The sharp correction in small-cap stocks indicates a decline in risk appetite in the Indian market as a whole. Currently, the local stock market is losing ground in the Asia-Pacific market.

An Indian small-cap index lost more than $80 billion in market value in less than two weeks until Wednesday. Previously, regulators raised the risk of overheating and guided capital restrictions on purchases. The Bombay Stock Exchange's small-cap and mid-cap indices rebounded on Thursday. Both indices fell more than 4% in the first two trading days.

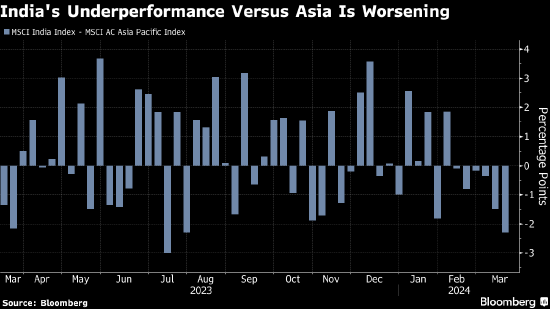

As popularity waned, investors also withdrew from higher-valued large-cap stocks. The performance of the MSCI India Index lags behind the MSCI Asia Pacific Index for the second month in a row. Markets such as South Korea are more favored because these markets are more exposed to the chip and artificial intelligence boom. Some investors expect the decline to deepen.

“Regulatory actions against small-cap stocks prove India's valuation bubble,” said industry research strategist Nitin Chanduka. “As the national election approaches and chip stocks rise in other markets in the region, the performance of the Indian stock market is likely to continue to lag behind other Asian markets.”

According to the data, the expected annual price-earnings ratio of the MSCI India Index is 22.7 times, a 58% premium over similar indicators for Asian stocks.

The Securities and Exchange Board of India (Securities and Exchange Board of India) has always been concerned about large capital flows to small to medium stocks. Over the past year, the riskiest sector of India's $4.3 trillion market saw a sharp rise. At the end of last month, the agency asked the fund to take measures to ease the inflow of funds into related plans and protect investors from sudden redemptions.

The S&P BSE small cap index fell more than 11% from the all-time high it hit earlier this year. Since market participants are still generally optimistic about the Indian stock market, some investors took advantage of the stock market decline to increase their stock holdings. Domestic institutional investors, including public funds and insurance companies, poured a record amount of $1.1 billion into the local stock market on Wednesday, according to exchange data.