Those holding Longfor Group Holdings Limited (HKG:960) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 46% in the last twelve months.

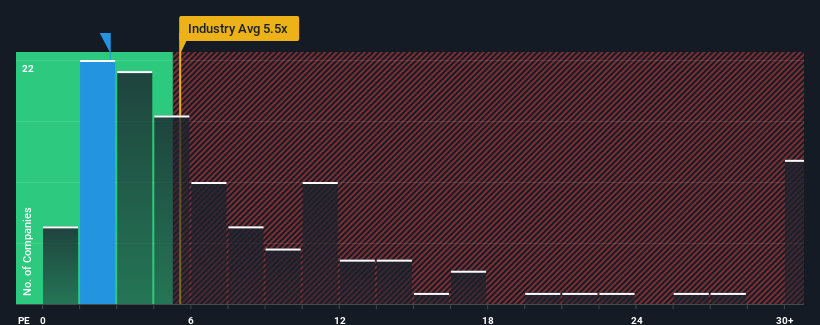

In spite of the firm bounce in price, Longfor Group Holdings' price-to-earnings (or "P/E") ratio of 2.7x might still make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 9x and even P/E's above 18x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Longfor Group Holdings has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Longfor Group Holdings' to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Regardless, EPS has managed to lift by a handy 18% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings growth is heading into negative territory, declining 7.3% per annum over the next three years. That's not great when the rest of the market is expected to grow by 15% each year.

In light of this, it's understandable that Longfor Group Holdings' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Longfor Group Holdings' P/E?

Shares in Longfor Group Holdings are going to need a lot more upward momentum to get the company's P/E out of its slump. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Longfor Group Holdings maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Longfor Group Holdings (2 are significant) you should be aware of.

If you're unsure about the strength of Longfor Group Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.