[Focus on hot topics]

Shanggong Shenbei (600843.SH): I am concerned about recent rumors about the company being involved in the “low altitude economy” in the market, and the company is not engaged in related business

Shanggong Shenbei (600843.SH) announced abnormal fluctuations in stock trading. The company's main business is to engage in R&D, production and sales of industrial sewing machines. The company is concerned about recent rumors about the company's involvement in the “low altitude economy” in the market, and the company is not engaged in related business. The company holds 35.29% of Shanghai Feiren Technology Co., Ltd., which is not included in the scope of the company's consolidated statements. The company is unable to dominate or control the investment decisions, production and operation activities of Shanghai Feiren Technology Co., Ltd., and the investment income generated by it has little impact on the company's business performance. The investment decisions of Shanghai Feiren Technology Co., Ltd. will not have any impact on the company's main business.

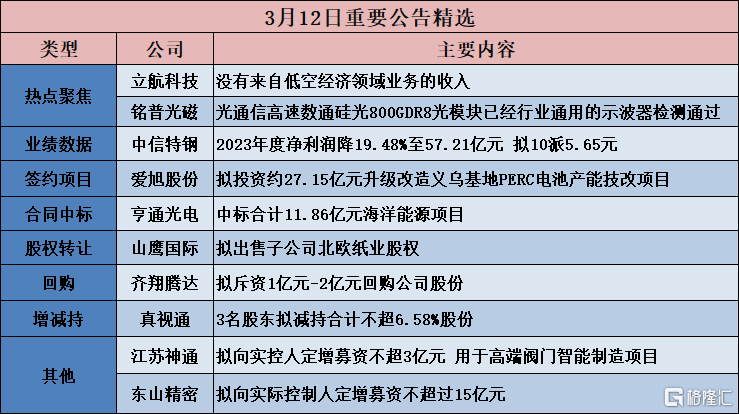

Lihang Technology (603261.SH): No revenue from businesses in the low-altitude economy sector

Lihang Technology (603261.SH) announced abnormal stock trading fluctuations. The company's main business is aircraft ground support equipment, aircraft testing and testing equipment, aircraft process equipment, aircraft parts processing, and aircraft parts assembly. The company's business has not changed since listing. The company currently has no revenue from the low-altitude economy business. Investors are invited to pay attention to the risk of conceptual hype.

Mingpu OptoMagnetic (002902.SZ): The optical communication high-speed digital silicon 800GDR8 optical module has been tested by industry-common oscilloscopes

Mingpu OptoMagnetic (002902.SZ) announced abnormal stock trading fluctuations. In response to the company's self-developed optical communication high-speed digital silicon 800GDR8 optical module that has been tested by industry-common oscilloscopes and the ODM/JDM supply method for digital optical modules, the company specifically reminds investors to rationally analyze, make careful decisions, and pay attention to investment risks. The risks are as follows: (1) If there is a shortage of the core raw material chip for the company's optical communication high-speed digital silicon optical 800GDR8 optical module, and the company is unable to obtain sufficient chip supply, it may adversely affect the company's performance. (2) Future market demand, market expansion and competition are uncertain, and the extent of the company's impact on future performance cannot be accurately predicted. (3) In the digital optical module industry, if the market's acceptance of the ODM/JDM supply model is low and the company does not adjust its development strategy in a timely manner, it will miss out on development opportunities in this industry, which will adversely affect the long-term development of the company.

[Investment projects]

Aixu Co., Ltd. (600732.SH): Plans to invest about 2,715 billion yuan to upgrade the PERC battery production capacity technical improvement project at the Yiwu base

Aixu Co., Ltd. (600732.SH) announced that according to industry trends and the company's strategic plan, in order to further optimize the production capacity structure, meet the growing demand of downstream customers for N-type high-efficiency crystalline silicon solar cell products, and continue to enhance the company's core competitiveness, the wholly-owned subsidiary Zhejiang Aixu Solar Technology Co., Ltd. (“Zhejiang Aixu”) plans to invest about 2,715 billion yuan to upgrade the current 25GW PERC battery production capacity at the Yiwu base to TopCon battery production capacity.

Wanma Co., Ltd. (002276.SZ): Wanma Polymer plans to invest in an environmentally friendly polymer material industrialization project with an annual output of 80,000 tons

Wanma Co., Ltd. (002276.SZ) announced that its subsidiary Zhejiang Wanma Polymer Materials Group Co., Ltd. (“Wanma Polymer”) plans to invest in the construction of an “environmentally friendly polymer material industrialization project with an annual output of 80,000 tons” and the relocation project of Sichuan Wanma Polymer Materials Co., Ltd. (“Sichuan Company”). The project plans to purchase new land, build a new plant, and add some additional production lines. The total investment of the project is estimated to be 99.37 million yuan. The funding source is Wanma Polymer's own capital or its own funding.

[Contract won the bid]

China Western Power (601179.SH): 10 subsidiaries won the bid for 1,133 billion yuan for the first batch of procurement projects for the State Grid in 2024

China Western Power (601179.SH) announced that on March 12, 2024, the State Grid Corporation e-commerce platform (issued the “State Grid Co., Ltd. first batch procurement notice for 2024 (first substation equipment (including cable) tender for transmission and transformation projects)”. The 10 subsidiaries under the company were relevant winners, with a total bid amount of 1,1333.9 billion yuan. The company's revenue for 2022 was 18.0.064.9 billion yuan.

Jinli Huadian (300069.SZ): The subsidiary won a bid of about 126 million yuan for the national grid project

Jinlihua Electric (300069.SZ) announced that on March 12, 2024, State Grid Co., Ltd. issued the “State Grid Co., Ltd. 2024 Third Batch Procurement (First Circuit Installation Material Tender Procurement for Transmission and Transformation Projects)” (tender number: 0711-240TL00621001). Zhejiang Jinlihua Electric Equipment Co., Ltd., a wholly-owned subsidiary of the company Jinlihua Electric Co., Ltd., was one of the winning suppliers. The winning bid amount was approximately 1255623 million yuan. It accounts for approximately 104.28% of the company's audited revenue in 2022.

Hengtong Optoelectronics (600487.SH): won the bid for a total of 1,186 billion yuan marine energy projects

Hengtong Optoelectronics (600487.SH) announced that its holding subsidiaries Jiangsu Hengtong High Voltage Submarine Cable Co., Ltd. and Hengtong Offshore Engineering Co., Ltd. have successively won bids for marine energy projects. The holding subsidiary of the company received the “Notice of Winning Bid” for the project, confirming that it won the bid for the “Shenneng Hainan CZ2 Offshore Wind Power Demonstration Project 35kV Submarine Cable, 220kV Submarine Cable Procurement and Installation Construction (Section I)” and “Yinghe Sea Wind Farm 2023-2025 35kV Submarine Cable Emergency Repair and Construction”; signed the “Shandong Energy Bozhong Offshore Wind Power G Site Project (Southern District) EPC General Contracting Project 66kV Submarine Cable Procurement and Laying Project” and “China Power Investment Guangdong Zhanjiang Xuwen Offshore Wind Farm 300MW Offshore Wind Farm Project C general contracting project 220kV submarine cable The total bid amount for marine energy project contracts such as the “Landing Section Directional Drilling Project” was 1,186 billion yuan.

Changgao Dianxin (002452.SZ): won a total of 266 million yuan in bids for national grid-related projects

Changgao Electric (002452.SZ) announced that the e-commerce platform of China Grid Co., Ltd. issued the “State Grid Co., Ltd. 2024 First Batch Procurement (First Substation Equipment (Including Cable) Bidding and Procurement for Transmission and Transformation Projects)” and the “State Grid Co., Ltd. 2024 Second Batch Procurement (First Single Source Procurement of Substation Equipment for Transmission and Transformation Projects)”. Hunan Changgao Electric Co., Ltd., Hunan Changgao Electric Co., Ltd., Hunan Changgao High Voltage Switch Co., Ltd., Hunan Changgao Senyuan Electric Equipment Co., Ltd., and Hunan Changgao Complete Electric Appliance Co., Ltd., which are wholly-owned subsidiaries of Changgao Electronics Technology Co., Ltd., won bids for three types of products: combined appliances, isolators, and switch cabinets. In the above tender project, the four wholly-owned subsidiaries won a total bid of 265.573.5 million yuan. The total bid amount for the four wholly-owned subsidiaries was RMB 265.573,500, accounting for 21.72% of the company's consolidated audited revenue in 2022.

Tiantie Co., Ltd. (300587.SZ): Won the bid of 27.363,500 yuan for the Sichuan Road and Bridge Shengtong Construction Project for the Xichang Jiaojia Anning Urban and Rural Integrated Construction Project (East and West District)

Tiantie Co., Ltd. (300587.SZ) announced that the company recently received the “Notice of Winning Bid” from the Materials Branch of Sichuan Road and Bridge Construction Group Co., Ltd. The notice confirmed that the company was the winning bidder for the Sichuan Luqiao Shengtong Construction Engineering Co., Ltd. Xichang Jiaojia'anning Urban-Rural Integrated Construction Project (East and West District), with a bid amount of 27.363,500 yuan.

[[Share acquisition]

Mountain Eagle International (600567.SH): Proposed sale of shares in subsidiary Nordic Paper

Mountain Eagle International (600567.SH) announced that in order to adapt to the company's strategic plan adjustments, further optimize resource allocation, and focus on the development of the core industrial chain, the company plans to sell all or part of its shares in the Nordic Paper industry to foreign countries to reduce the share of the company's business in Europe. Nordic Paper is a company listed on Nasdaq OMX Exchange in Stockholm, Sweden, stock code NPAPER, international securities identification code SE0014808838. The company indirectly holds 32,220,312 shares of Nordic Paper through SutrivHolding AB, accounting for 48.16% of the total share capital of Nordic Paper.

[Performance data]

CITIC Special Steel (000708.SZ): Net profit for 2023 fell 19.48% to 5.721 billion yuan, and plans to distribute 10 to 5.65 yuan

CITIC Special Steel (000708.SZ) released its 2023 annual report. In 2023, the company achieved operating income of RMB 114,019 billion, up 15.94% year on year; net profit attributable to shareholders of listed companies was RMB 5.721 billion, down 19.48% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was RMB 5.263 billion, down 13.41% year on year; and basic earnings per share were RMB 1.13 yuan/share. It is proposed to distribute a cash dividend of 5.65 yuan (tax included) for every 10 shares to all shareholders.

Chengzhi Co., Ltd. (000990.SZ): 2023 net profit of 177 million yuan increased 248.36% year-on-year

Chengzhi Co., Ltd. (000990.SZ) announced its 2023 annual report, with operating income of 12.417 billion yuan, up 5.97% year on year, net profit of 177 million yuan, up 248.36% year on year, after deducting non-net profit of 152 million yuan, up 671.90% year on year, with basic earnings of 0.1,460 yuan per share.

Jiejie Microelectronics (300623.SZ): Net profit for 2023 decreased by 39.04% to 219 million yuan, plans to distribute 10 to 0.58 yuan

Jiejie Microelectronics (300623.SZ) announced its 2023 annual report. During the reporting period, it achieved operating income of 2.06 billion yuan, an increase of 15.51% over the same period of the previous year; realized net profit attributable to owners of the parent company of 219 million yuan, a decrease of 39.04% over the same period of the previous year; net profit attributable to shareholders of listed companies after deducting non-recurring gains and losses of 204 million yuan, a year-on-year decrease of 31.98%; basic earnings per share of 0.30 yuan; plans to distribute cash dividends of 0.58 yuan (tax included) to all shareholders for every 10 shares.

[Repurchase]

Xinpeng (688508.SH): Plans to spend 40 million yuan to 80 million yuan to buy back shares

Chippeng (688508.SH) announced that all of the shares repurchased by the company will be used to protect the company's value and shareholders' rights. The total repurchase capital shall not be less than RMB 40,000,000 (inclusive) and not more than RMB 80,000,000 (inclusive); the repurchase price shall not exceed RMB 53.24 per share (inclusive).

Qi Xiang Tengda (002408.SZ): Plans to spend 100 million yuan to 200 million yuan to buy back the company's shares

Qi Xiang Tengda (002408.SZ) announced that the company plans to buy back the company's shares through centralized bidding transactions, which are intended to be used to implement employee stock ownership plans or equity incentive plans. The total repurchase capital shall not be less than RMB 100 million (inclusive), and not more than RMB 200 million (inclusive), and the repurchase price of shares shall not exceed RMB 6.16 per share (inclusive). The repurchase period shall not exceed 12 months from the date the board of directors of the company reviewed and approved the repurchase plan.

Haitong Development (603162.SH): Plans to spend 20 million yuan to 40 million yuan to buy back shares

Haitong Development (603162.SH) announced that the company now plans to use its own funds to repurchase some of the company's A-share common shares through centralized bidding transactions. The total capital for the repurchase of shares shall not be less than RMB 20 million (inclusive), not more than RMB 40 million (inclusive), and the repurchase price shall not exceed RMB 20.00 yuan (inclusive) of shares (inclusive).

[Increase or decrease holdings]

Beisman (300796.SZ): Hansheng Dingshi plans to reduce its holdings by no more than 3%

Beisman (300796.SZ) announced that it recently received a “Notice of the Shareholding Reduction Plan” issued by Shanghai Hansheng Dingshi Enterprise Management Consulting Partnership (Limited Partnership) (Hansheng Dingshi for short), the company's shareholder. Hansheng Dingshi plans to reduce its holdings by no more than 10,830,000 shares, that is, no more than 3% of the company's total share capital; it uses centralized bidding to reduce holdings by no more than 1% of the total number of shares in any 90 consecutive natural days; it uses bulk transactions to reduce holdings within 90 consecutive natural days The total number does not exceed the company 2% of the total number of shares.

Zhenshitong (002771.SZ): Three shareholders plan to reduce their total holdings by no more than 6.58%

Zhenshitong (002771.SZ) announced that Mr. Hu Xiaozhou, a shareholder holding 6,779,969 shares (3.23% of the company's total share capital), Mr. Chen Ruiliang, a shareholder holding 4,975,144 shares of the company (accounting for 2.37% of the company's total share capital), and Ms. Wu Lan, a shareholder holding 2,056,632 shares of the company (0.98% of the company's total share capital), plan to reduce the company's shares within six months from the date of the announcement by means of centralized bidding transactions, bulk transactions, or agreement transfers 13,811,745 shares (accounting for 6.58% of the company's total share capital). Among them, those who reduce their holdings through centralized bidding transactions do not exceed 1% of the total number of shares of the company within 90 consecutive calendar days; if their holdings are reduced through bulk transactions, the total number of shares each reduced does not exceed 2% of the total number of shares of the company within 90 consecutive natural days.

[Other]

Jiangsu Shentong (002438.SZ): Plans to raise no more than 300 million yuan in capital from actual controllers for high-end intelligent valve manufacturing projects

Jiangsu Shentong (002438.SZ) announced plans to issue A-shares to specific targets in 2024. The number of shares issued to specific targets this time is no more than 36,585,365 shares (including the number of shares), which is no more than 30% of the total share capital of the listed company before this issuance. The pricing reference date for this issue is the announcement date of the company's board resolution to review the issuance of shares to specific targets. The issue price is 8.20 yuan/share.

The current issuance of shares to specific targets is Han Li, the actual controller and chairman of the company. There are 1 issuer in total. Shares subscribed by the issuer of this issue cannot be transferred within 18 months from the end of the issuance. Where laws, regulations, or regulatory documents stipulate otherwise on the sales limit period, according to their provisions. The total capital raised by issuing shares to specific targets this time is no more than 300 million yuan (including the number of shares). The net amount of capital raised after deducting the relevant issuance fees is intended to be used for high-end valve intelligent manufacturing projects.

Dongshan Precision (002384.SZ): Plans to raise no more than 1.5 billion yuan in additional capital from the actual controller

Dongshan Precision (002384.SZ) announced that the current issuance of shares to specific targets is Yuan Yonggang and Yuan Yongfeng, the actual controllers of the company, and that the issuer subscribes to the shares issued by the company in RMB cash. The total amount of capital raised by issuing shares to specific targets this time does not exceed RMB 1,500,000. The net amount of capital raised after deducting the relevant issuance fees is to be used as “supplementary working capital”.

Beyond Technology (301049.SZ): Actual controller and chairman Gao Zhijiang was placed in lien and investigated

Transcendence Technology (301049.SZ) announced that the company recently received the “Notice of Detention” and “Notice of Case Filing” issued by the Hexian County Supervisory Commission. Mr. Gao Zhijiang, the actual controller and chairman of the company, was placed in lien and investigated.

With the exception of Mr. Gao Zhijiang, all other directors, supervisors, and senior management personnel of the company are currently performing their duties normally. As of the disclosure date of the announcement, the company had not received any investigation or documents cooperating with the investigation by the competent authorities, and the progress and conclusion of the withheld investigation are not yet known. The company will continue to monitor the progress of the above matters and promptly fulfill its information disclosure obligations in strict accordance with the provisions and requirements of relevant laws and regulations.