Today, Northside Capital made a net purchase of 4.244 billion yuan of A-shares, while Southbound made a net purchase of HK$195 million in Hong Kong shares.

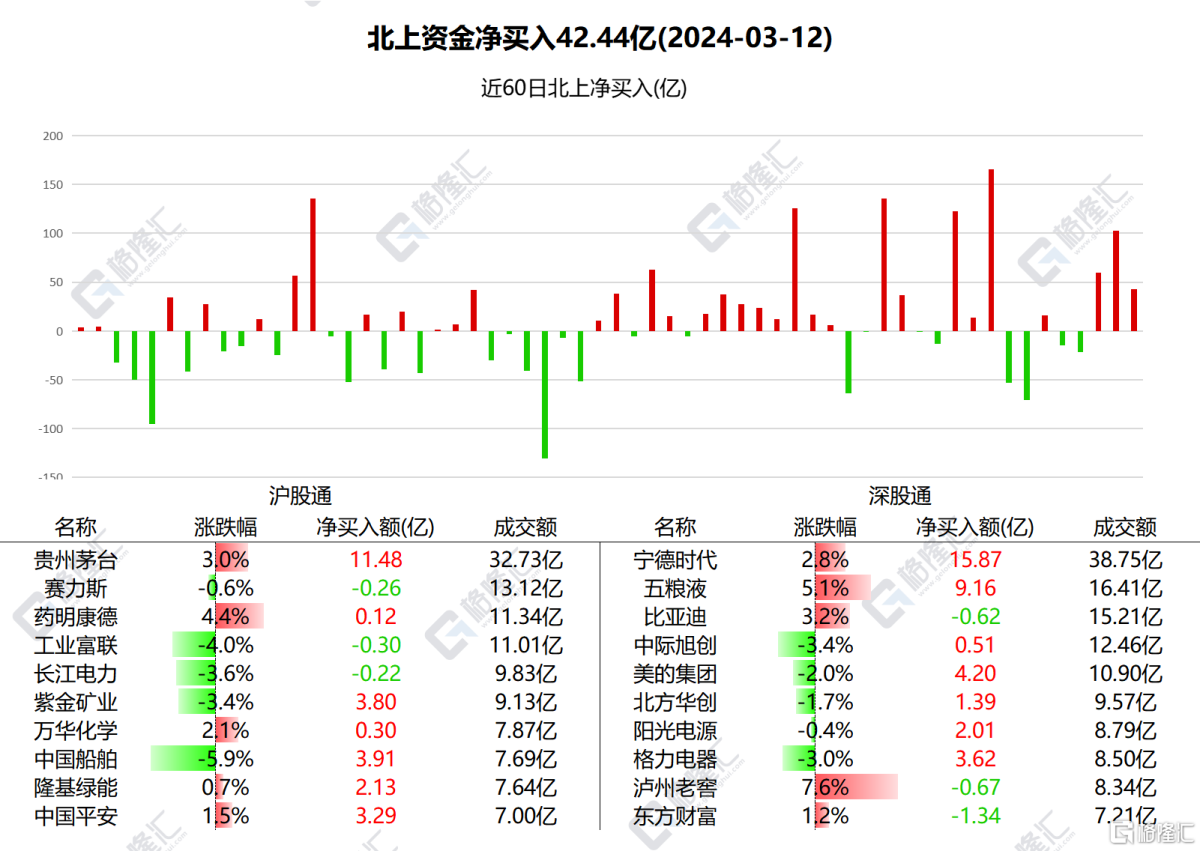

Today,Northbound CapitalToday's net purchase of A-shares was 4.244 billion yuan, the third consecutive day of net purchases.

Among them, net purchases were 1,587 million yuan for Ningde Era, 1,148 million yuan for Kweichow Moutai, 916 million yuan for Wuliangye, 420 million yuan for Midea Group, 391 million yuan for China Shipping, 380 million yuan for Zijin Mining, and 329 million yuan for Ping An of China;

Net sales were Dongfang Wealth 134 million yuan, Luzhou Laojiao 67 million yuan, and BYD 62 million yuan.

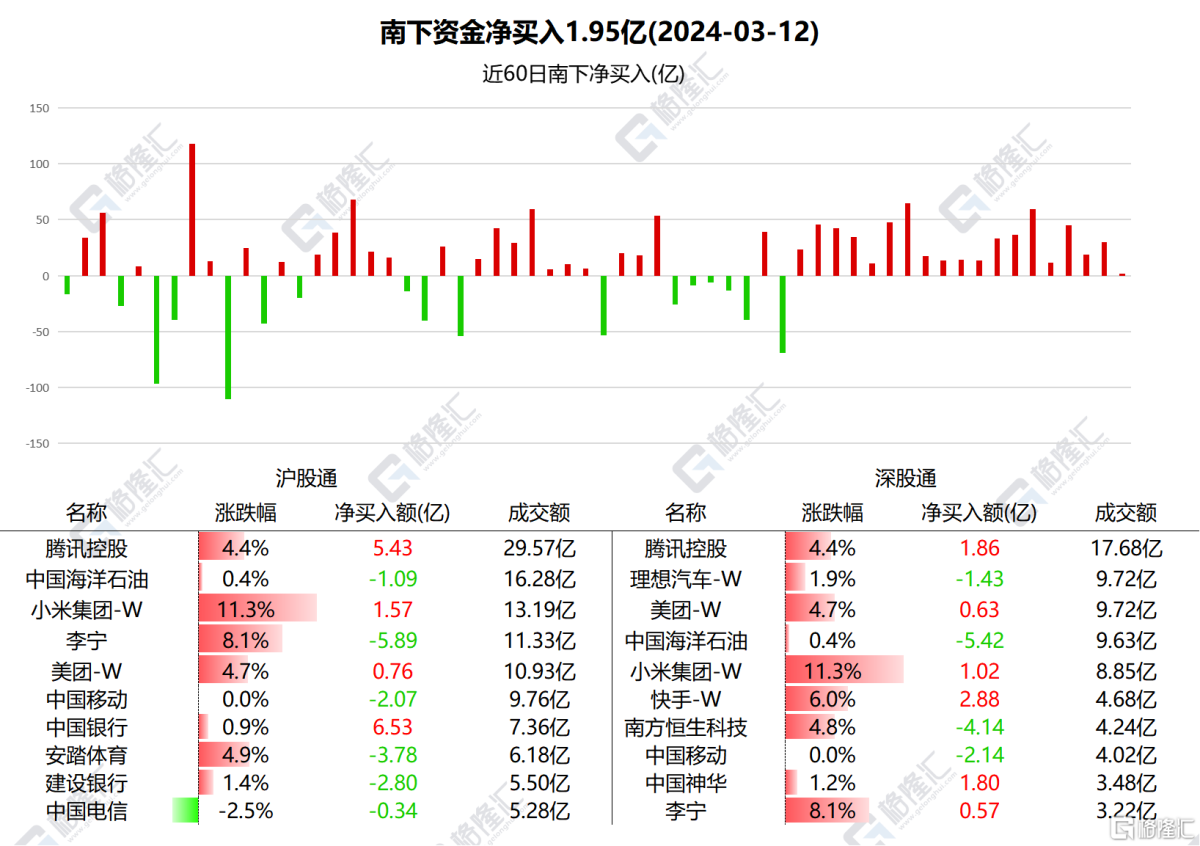

Southbound capitalThe net purchase of Hong Kong stocks was HK$195 million, the 19th consecutive net purchase.

Among them, net purchases of Tencent were HK$729 million, Bank of China HK$653 million, Kuaishou HK$287 million, Xiaomi HK$258 million, China Shenhua HK$179 million, and Meituan HK$138 million.

Net sales of CNOOC of HK$651 million ended the previous net buying trend for 20 consecutive days; net sales of Li Ning of HK$532 million, China Mobile HK$413 million, Southern Hang Seng Technology HK$413 million, Anta Sports HK$377 million, CCB HK$279 million, and Ideal Auto of HK$142 million.

Nanshui focuses on individual stocks

Ningde eraIt continued to rise 2.76% today. Data show that in February, China's power battery load was 18 GWh, a year-on-year decrease of 18.1% and a month-on-month decrease of 44.4%. From an enterprise perspective, Ningde Shidai's market share is over 55%, and BYD's share is nearly 18%. Ningde Times, BAIC Blue Valley, and Xiaomi plan to establish a joint venture to invest in the construction of an intelligent battery cell manufacturing plant in Beijing.

Kweichow MoutaiToday's rise is 2.98%. Consumer stocks are clearly moving today, and liquor stocks are trending better due to intensive price increases. Furthermore, the agency believes that the 2024 Chengdu Spring Sugar Fair is about to open, and attention to the liquor sector will continue to increase.

Beishui focuses on individual stocks

Tencentup 4.38%,Bank of ChinaA slight increase of 0.94%. Southbound Capital has increased Tencent's holdings for 6 consecutive days, totaling HK$2,594.29 billion; Bank of China increased its holdings for 4 consecutive days, totaling HK$2,385.38 billion.

China Offshore OilThere was a slight increase of 0.35%, and there was a decline in individual stocks with high dividends in the market. CNOOC will release the company's 2023 annual report after the market closes on March 21.