Repare Therapeutics Inc. (NASDAQ:RPTX) shares have had a horrible month, losing 30% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 47% in that time.

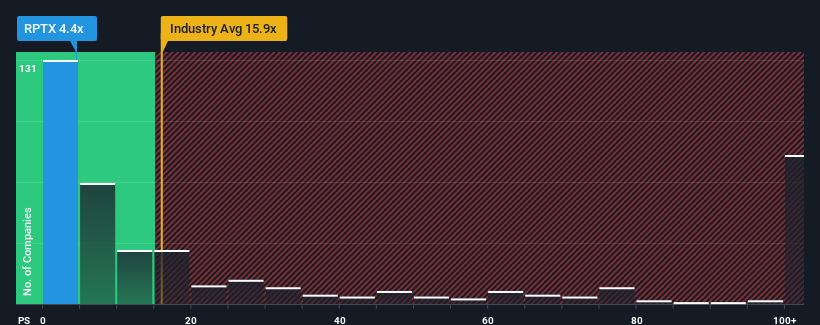

After such a large drop in price, Repare Therapeutics may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 4.4x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 15.9x and even P/S higher than 76x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

What Does Repare Therapeutics' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Repare Therapeutics' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Repare Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Repare Therapeutics would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 61%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue growth is heading into negative territory, declining 10% per annum over the next three years. With the industry predicted to deliver 262% growth per year, that's a disappointing outcome.

With this information, we are not surprised that Repare Therapeutics is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Repare Therapeutics' P/S?

Shares in Repare Therapeutics have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's clear to see that Repare Therapeutics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Repare Therapeutics' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Repare Therapeutics (at least 1 which is significant), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.