The flames of the NEV price war have already burned into the power battery market. In February of this year, some second- and third-tier power battery manufacturers, such as Gateway Power, were still in a state of shutdown and production. Combined with holiday disturbances, the recovery of the power battery market was slightly slow.

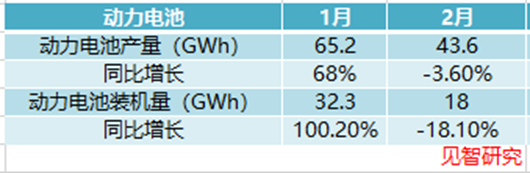

In February, power battery production reached 43.6 GWh, down 33.1% from month to month, down 3.6% year on year; sales volume was 37.4 GWh, down 10.1% year on year, down 34.6% month on month; installed capacity reached 18 GWh, down 18.1% year on year and 44.4% month on month. Overall, the power battery market did not perform well in February.

1. Ternary lithium batteries regain their dominant position in overseas exports

In January of this year, a wave of price increases for ternary lithium batteries bucked the trend, leading to a wave of distancing sales of ternary lithium batteries, which were already in a disadvantageous position.

Ternary lithium batteries lag behind lithium iron phosphate batteries across the board in terms of production, sales, installed capacity, and export volume.

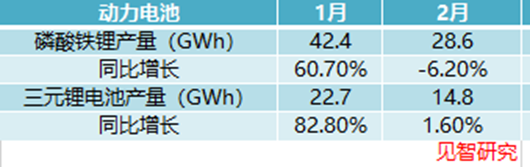

Fortunately, the price of ternary lithium batteries returned to a downward trend in February. The price of square ternary lithium cells (power type) fell to 0.47 yuan/Wh, while the price of lithium iron phosphate cells changed little during the same period. Cost changes in the two types of power batteries have led to a recovery in ternary lithium battery sales. At a time when lithium iron phosphate battery production and installed capacity both showed negative growth, ternary lithium batteries continued to grow positively.

In February of this year, the production and loading volume of lithium iron phosphate batteries reached 28.6 GWh and 11 GWh respectively, a year-on-year decrease of 6.2% and 27.5%, accounting for 65.7% and 61.3%. The output and loading volume of ternary lithium batteries reached 14.8 GWh and 6.9 GWh respectively, up 1.6% and 3.3% year-on-year, accounting for 34% and 38.7%.

It is worth noting that in the field of overseas exports of power batteries, ternary lithium batteries account for more than lithium iron phosphate batteries, returning to a dominant position.

In February of this year, total power battery exports reached 8.1 GWh, a year-on-year decrease of 10.9% and a month-on-month decrease of 0.7%. Among them, the export volume of lithium iron phosphate batteries was 3.3 GWh, up 25.5% year on year, down 22.9% month on month, accounting for only 39.5%; on the other hand, the export volume of ternary lithium batteries reached 4.7 GWh, down 27.1% year on year, up 20.7% month on month, and the share of export volume also increased sharply from less than 50% to 57.5%.

2. Some second- and third-tier power battery manufacturers have not yet resumed work, and the competitive pressure is still strong

After the Spring Festival, a new round of reshuffle in the power battery market has begun. The main cleaning targets this time have changed from tail power battery manufacturers to second- and third-tier power battery manufacturers.

According to data from February 2023, a total of 36 power battery companies in China's NEV market have achieved loading facilities. Among them, the market share of second- and third-tier power battery manufacturers has changed quite a bit. Compared with the same period last year, apart from the top ten power battery manufacturers, which have basically remained on the list, the ranking of 10-15 has undergone a major reshuffle.

Take the established power battery manufacturers Jiewei Power and Rishen, which have been established for nearly 15 years. Jetway Power once aimed to “hit 100 GWh power battery production capacity by 2025” and “become the top three installed capacity in the national power battery market.” However, it has now completely withdrawn from the power battery market, and due to the pressure of the price war, it is still in a state of shutdown.

Specifically, in February of last year, with an installed capacity of 0.09 GWh and a market share of 0.53%, Gateway still maintained the 11th place in the market for installed power batteries, which is only one step away from the top ten. However, in February of this year, the fierce price war caused Gateway Dynamics to completely drop out of the list.

Power battery manufacturers that have experienced the same situation also have Lishen. Previously, they wanted to obtain capital market financial support to promote the lithium battery project through backbone restructuring with Meiliyun, but the project was completely terminated in February of this year.

In February of last year, Lishen was still able to maintain the 13th place in the market for installed power batteries with an installed capacity of 0.07 GWh and 0.46% of the market share. However, in February of this year, Lishen completely dropped out of the list and was on the verge of elimination.

3. The Ningde era returned to a market share of 50% or more

At present, the position of leading power battery manufacturers remains stable, and there is an intention of starting a counterattack war with 50% domestic market share.

In February of this year, the installed capacity of domestic power batteries in the Ningde era reached 9.82 GWh, increasing its market share by 5.75 percentage points month-on-month and 11.4 percentage points year-on-year to 55.16%. After a long absence, it returned to a market share of more than 50%.

According to Wall Street News and Insight Research, the market share in the Ningde era was able to return to a 50% increase. The main reason was that the market share of its old rival, BYD, was drastically reduced.

BYD, which produces its own power batteries, did not sell enough new energy vehicles in February. Sales volume was only 120,000 units, down 37% year on year and 39% month on month. As a result, BYD's installed power battery capacity was only 3.16 GWH, and its market share fell below the 20% mark, down 0.93 percentage points from month to month, and 16.44 percentage points to 17.74% year on year.

It is worth noting that although BYD's NEV sales performance in February was poor, with the gradual fermentation of the BYD Dynasty DMI model series, which triggered a wave of price cuts after the Spring Festival, subsequent sales may usher in breakthrough growth. The 50% market share in the Ningde era will once again face the risk of falling out.

Now, it seems that as the power battery price war continues to heat up, apart from leading manufacturers being able to stabilize their positions, ranking changes and shuffling among second- and third-tier power battery manufacturers may usher in further acceleration.