By buying an index fund, investors can approximate the average market return. But if you pick the right individual stocks, you could make more than that. For example, Guanghui Logistics Co.Ltd (SHSE:600603) shareholders have seen the share price rise 60% over three years, well in excess of the market decline (20%, not including dividends).

Although Guanghui LogisticsLtd has shed CN¥409m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years of share price growth, Guanghui LogisticsLtd actually saw its earnings per share (EPS) drop 11% per year.

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Given this situation, it makes sense to look at other metrics too.

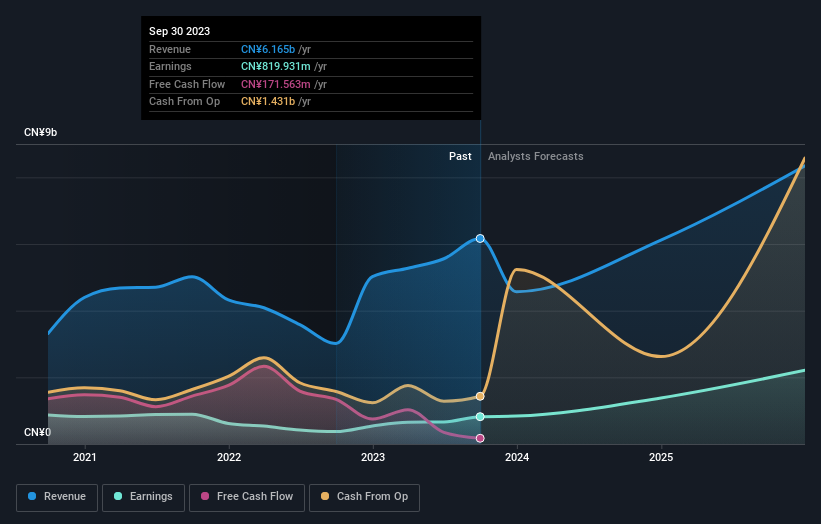

It could be that the revenue growth of 10% per year is viewed as evidence that Guanghui LogisticsLtd is growing. If the company is being managed for the long term good, today's shareholders might be right to hold on.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Guanghui LogisticsLtd has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Guanghui LogisticsLtd

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Guanghui LogisticsLtd's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Guanghui LogisticsLtd shareholders, and that cash payout contributed to why its TSR of 71%, over the last 3 years, is better than the share price return.

A Different Perspective

While it's never nice to take a loss, Guanghui LogisticsLtd shareholders can take comfort that their trailing twelve month loss of 6.1% wasn't as bad as the market loss of around 13%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 12% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Guanghui LogisticsLtd that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.