The Wai Yuen Tong Medicine Holdings Limited (HKG:897) share price has fared very poorly over the last month, falling by a substantial 46%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 34% share price drop.

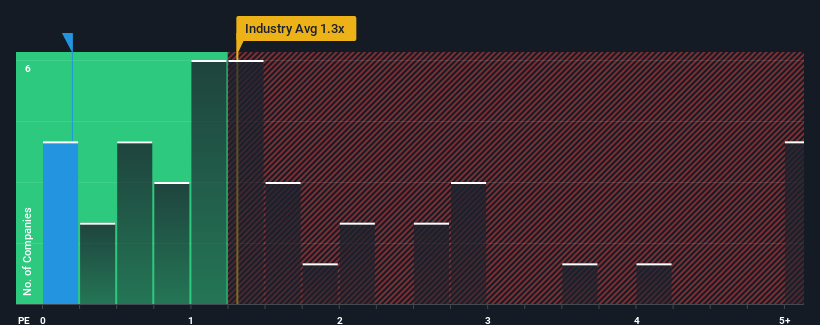

In spite of the heavy fall in price, given about half the companies operating in Hong Kong's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Wai Yuen Tong Medicine Holdings as an attractive investment with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has Wai Yuen Tong Medicine Holdings Performed Recently?

We'd have to say that with no tangible growth over the last year, Wai Yuen Tong Medicine Holdings' revenue has been unimpressive. Perhaps the market believes the recent lacklustre revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Wai Yuen Tong Medicine Holdings' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Wai Yuen Tong Medicine Holdings?

The only time you'd be truly comfortable seeing a P/S as low as Wai Yuen Tong Medicine Holdings' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 60% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

This is in contrast to the rest of the industry, which is expected to grow by 14% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Wai Yuen Tong Medicine Holdings' P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Wai Yuen Tong Medicine Holdings' recently weak share price has pulled its P/S back below other Pharmaceuticals companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Wai Yuen Tong Medicine Holdings revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you take the next step, you should know about the 3 warning signs for Wai Yuen Tong Medicine Holdings (1 doesn't sit too well with us!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.