The Hong Kong stock market has been sluggish recently. As listed companies announce their results one after another, investors might as well use low valuations to find high-quality companies. On March 7, a medical device company that has been on the market for more than a year announced its results. Not only did its revenue grow by double digits for the third year in a row, but it also doubled its profits. The company gave back to shareholders with excellent performance and announced dividends for the first time. It can be seen that management has confidence in the company's future development potential. Furthermore, the company completed three acquisitions in just over a year after listing, increasing the size of the enterprise and fully demonstrating the execution ability of management. This company was listed in December 2022. It is mainly engaged in the medical treatment of coronary and peripheral interventional medical devices.

1. Revenue has maintained double-digit growth for three consecutive years, and overseas revenue has continued to rise

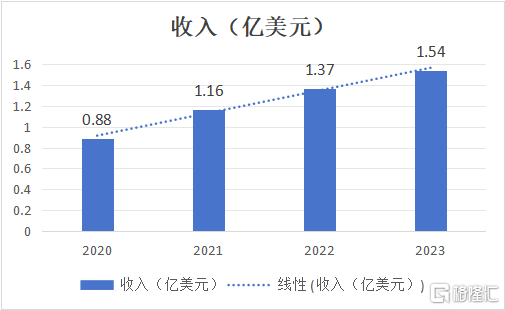

Looking intuitively at financial data, the outstanding performance of revenue and profit fully demonstrates the potential for continuous growth in the field of innovative medical devices.

Financial reports show that in 2023, Yieju Healthcare's revenue reached a new high of US$154 million, an increase of 12.5% over the previous year, and maintained double-digit growth for three consecutive years. This was mainly due to the increase in sales of the company's various products. Among them, PCI balloon and PTA balloon revenue increased by 12.1% and 29.0% year-on-year, respectively, to US$115 million and US$14.715 million.

Data source: financial report

On the profit side, Yeju Medical's profitability is also continuously being unleashed. In 2023, it achieved gross profit of US$106 million, an increase of 15.2% over the previous year, and gross margin of 69.2%, showing strong product renewal and iteration capabilities. Profit attributable to company owners reached a new high of US$45.73 million during the year, an increase of 143.8% over the previous year. The net interest rate soared 15.8 percentage points to 29.3%. Basic earnings per share increased to 5.45 US cents.

The author believes that the reason why Yeju Medical has achieved such results is its forward-looking global layout.

In an environment of domestic procurement and anti-corruption turmoil, many domestic manufacturers are actively setting up overseas, yet it is not easy to become an international brand recognized by overseas doctors. Judging from objective figures, only overseas Chinese companies that can contribute more than 85% of revenue on coronary and peripheral circuits are Yieju Healthcare.

Currently, Yeju Healthcare has focused on overseas markets since 2000, and its sales network now covers more than 70 countries and regions around the world. Among them, markets with mature healthcare systems, such as the US and Japan, will continue to grow rapidly in 2023. Financial reports show that in 2023, its sales revenue in Japan in yen surged 26.3% year on year; while the US market, which the company only entered in 2017, surged 27.9% year over year. As for the European, Middle Eastern and African markets, as well as the Asia-Pacific region, the market also maintained double-digit growth.

In overseas markets, in addition to leveraging its early first-mover advantage, Yeju Medical continues to develop innovative products, such as the best-selling Scoreflex Trio notch balloon in Japan, driving the company's continued endogenous growth momentum. Overseas, Yeju Medical can compete with leading medical device companies in the world and achieve continuous growth, fully demonstrating its excellent global commercialization capabilities, while also demonstrating the company's broad product acceptance. As for the domestic market, despite the impact of anti-corruption activities on the overall number of surgeries, Yeju Medical's revenue in the Chinese market in RMB remained flat, reflecting the confirmed clinical value of its products.

2. All aspects of the upgrade in three dimensions demonstrate efficient execution ability

In terms of products, Yieju Medical has accumulated R&D experience over the past 20 years and successfully created more than 40 approved products. The diversified product portfolio comprehensively covers all PCI and PTA surgical treatment processes. These include 27 products approved by Japan's PMDA, 26 CE marked products, 14 products approved or approved by the FDA, and 20 products approved by the National Drug Administration.

After listing in November of last year, the company also used sufficient financial resources to acquire German company Eucatech AG for 2.4 million euros, further enriching its product portfolio. eucatech AG has a number of CE marked products, including coronary sirolimus elution stents, peripheral self-inflating stents, and coronary and paclitaxel coated balloons, which help the industry keep up with the trend of “no intervention without implantation” in PCI and PTA surgeries, enhance the ability to treat lesions in PCI and PTA surgeries, and will also quickly bring new revenue growth points to the company.

In terms of market development, in the Asia Pacific region, the Group acquired 84% of Indonesian distributor PT Revass Utama Medika (“Revass”). According to reports, Revass has a significant market share in Indonesia. Indonesia is a populous country with a population of 280 million, and the number of cardiac catheterization laboratories has continued to grow in recent years.

This acquisition will enable Yeju Medical to have more direct access to the Indonesian market, shift from a distribution model to a direct sales model, and “grab the beach” in the Indonesian healthcare industry. According to Yeju Medical's results announcement, the company also acquired South Korean distributor SJ Medicare Co. last year. Ltd.'s full shareholding is expected to significantly increase local revenue, while strengthening the Group's sales channel management, diversifying product portfolio, and promoting doctor education.

In terms of production capacity, the company currently has an annual production capacity of about 1.9 million balloons and 60,000 stents in Shenzhen, China and Hofler in the Netherlands. In order to plan future production capacity requirements, Yeju Medical decided to establish the Group's largest R&D and production base in Fuyang, Hangzhou. It is expected that when production starts in 2027, the annual production capacity will be increased by an additional 2.4 million pieces. From one year of listing, rapid expansion has brought the company to a new level, demonstrated management's ability to make efficient decisions, and is also an important pillar of the company's future development.

3. Summary

In the past year, due to multiple factors such as the global economy, the overall performance of the Hong Kong stock market was weak, and many indicators were at historically low levels. Volatility in the financial market not only increased the uncertainty of the economic environment, but also made investors more cautious. The innovative medical device sector, in particular, has been in the plight of multiple bottoms superimposed in recent years, and both valuation and market sentiment continue to face pressure.

However, with the release of a series of positive signals, the market has shown signs of a reversal at the bottom. For example, expectations of US interest rate cuts increase, which is expected to inject new liquidity into the market, broaden financing channels for biotech companies, and provide new market opportunities for leading companies in the field of interventional cardiovascular treatment such as Yeju Medical.

In response, a number of institutions have also expressed optimism about the development prospects of the innovative medical device industry. For example, Caixin Securities pointed out that it is optimistic about medical device R&D platform-based manufacturers with independent innovation capabilities and the ability to go overseas; Haitong Securities pointed out that innovative medical devices will gradually enhance their global and local competitiveness. The organization's optimism has also added strong support to the value potential of Yeju Healthcare.

Focusing on the corporate level, Yeju Medical can be said to have both short-term performance growth logic and long-term value growth logic.

In the short term, the report card, which continues to reach record highs in revenue and profit, is a strong proof of the strong growth in the company's performance, and this trend will continue. In the long term, its current cash and bank balance is US$256 million. Abundant cash flow has laid a solid foundation for Yeju Medical's product development and business development, helping the company continue to launch more competitive products. Based on this, the author judges that Yeju Medical may be able to maintain a dividend payout ratio of around 20%-30% in the future and continue to return shareholders by paying dividends. In terms of profit in 2023, its current price-earnings ratio is less than 10 times, and it is a high-quality medical device industry company.

Overall, the continued growth of Yieju Medical's performance trend, the reversal trend at the bottom of the valuation, and the rising optimistic expectations of the market have formed a positive feedback cycle, which has accelerated the resonance effect between the company's fundamentals and valuation, and the market should pay more attention to it.