Rackspace Technology, Inc. (NASDAQ:RXT) shareholders have had their patience rewarded with a 28% share price jump in the last month. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.7% in the last twelve months.

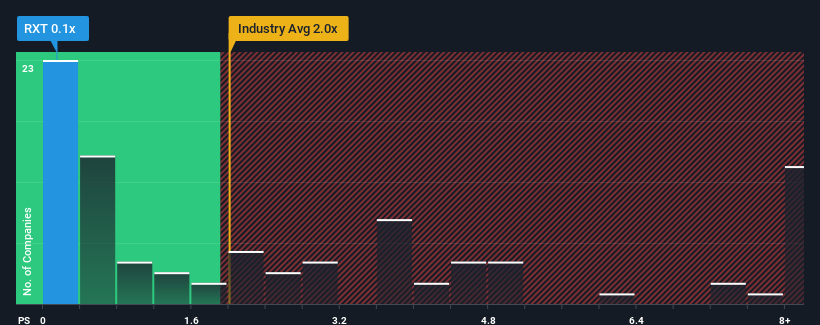

Although its price has surged higher, it would still be understandable if you think Rackspace Technology is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in the United States' IT industry have P/S ratios above 2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Has Rackspace Technology Performed Recently?

Rackspace Technology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Rackspace Technology.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Rackspace Technology's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 2.8% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 16% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 4.5% as estimated by the five analysts watching the company. Meanwhile, the broader industry is forecast to expand by 9.1%, which paints a poor picture.

With this in consideration, we find it intriguing that Rackspace Technology's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Rackspace Technology's P/S?

Rackspace Technology's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Rackspace Technology's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You should always think about risks. Case in point, we've spotted 3 warning signs for Rackspace Technology you should be aware of, and 1 of them doesn't sit too well with us.

If these risks are making you reconsider your opinion on Rackspace Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.