Dada Nexus Limited (NASDAQ:DADA) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 73% share price decline over the last year.

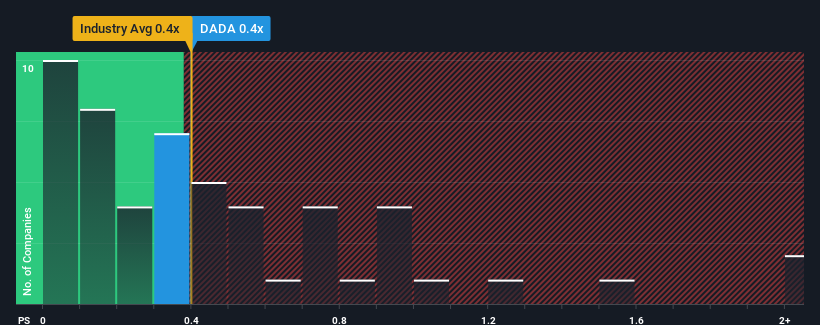

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Dada Nexus' P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Consumer Retailing industry in the United States is about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Dada Nexus' Recent Performance Look Like?

Recent times have been advantageous for Dada Nexus as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Dada Nexus will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Dada Nexus' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 25% gain to the company's top line. Pleasingly, revenue has also lifted 123% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 15% each year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 4.8% per annum growth forecast for the broader industry.

With this information, we find it interesting that Dada Nexus is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Dada Nexus' P/S Mean For Investors?

Its shares have lifted substantially and now Dada Nexus' P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Dada Nexus' P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Dada Nexus (at least 1 which is a bit unpleasant), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.