Jia Yao Holdings Limited (HKG:1626) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 90% in the last year.

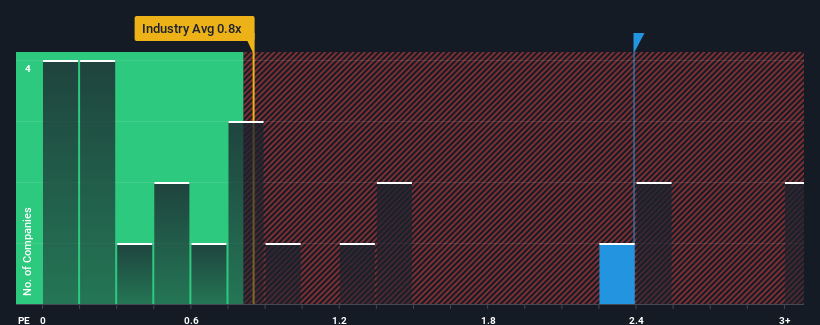

Since its price has surged higher, when almost half of the companies in Hong Kong's Packaging industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider Jia Yao Holdings as a stock probably not worth researching with its 2.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

How Jia Yao Holdings Has Been Performing

With revenue growth that's exceedingly strong of late, Jia Yao Holdings has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Jia Yao Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Jia Yao Holdings' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 40% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 85% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 19% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we can see why Jia Yao Holdings is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Jia Yao Holdings' P/S

Jia Yao Holdings' P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's no surprise that Jia Yao Holdings can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Jia Yao Holdings that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.