Aspen Aerogels, Inc. (NYSE:ASPN) shareholders would be excited to see that the share price has had a great month, posting a 53% gain and recovering from prior weakness. The annual gain comes to 123% following the latest surge, making investors sit up and take notice.

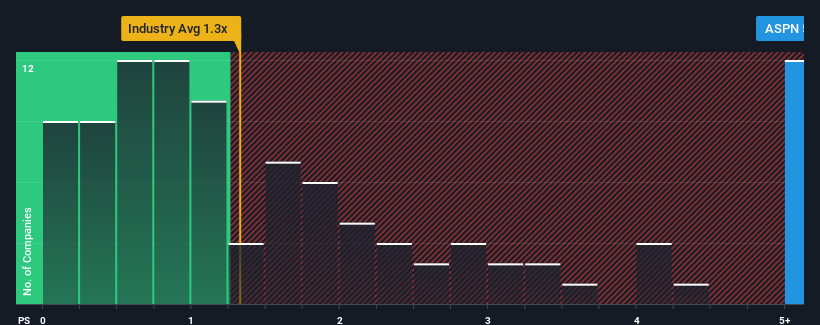

Since its price has surged higher, you could be forgiven for thinking Aspen Aerogels is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.5x, considering almost half the companies in the United States' Chemicals industry have P/S ratios below 1.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Aspen Aerogels' Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Aspen Aerogels has been doing quite well of late. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Aspen Aerogels will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Aspen Aerogels would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 32%. The strong recent performance means it was also able to grow revenue by 138% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 52% per annum during the coming three years according to the ten analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 8.0% per annum, which is noticeably less attractive.

With this in mind, it's not hard to understand why Aspen Aerogels' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Aspen Aerogels have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Aspen Aerogels maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Chemicals industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Aspen Aerogels that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.