Sprouts Farmers Market, Inc. (NASDAQ:SFM) shares have continued their recent momentum with a 27% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 92%.

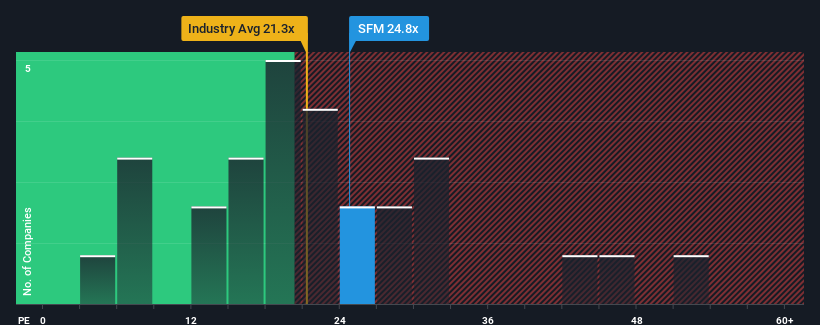

Since its price has surged higher, given around half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may consider Sprouts Farmers Market as a stock to potentially avoid with its 24.8x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Sprouts Farmers Market has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Sprouts Farmers Market's to be considered reasonable.

Retrospectively, the last year delivered a decent 4.7% gain to the company's bottom line. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 10% per year over the next three years. With the market predicted to deliver 11% growth each year, the company is positioned for a comparable earnings result.

With this information, we find it interesting that Sprouts Farmers Market is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On Sprouts Farmers Market's P/E

The large bounce in Sprouts Farmers Market's shares has lifted the company's P/E to a fairly high level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Sprouts Farmers Market currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Sprouts Farmers Market with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Sprouts Farmers Market, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.