FiscalNote Holdings, Inc. (NYSE:NOTE) shares have continued their recent momentum with a 36% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 5.3% isn't as impressive.

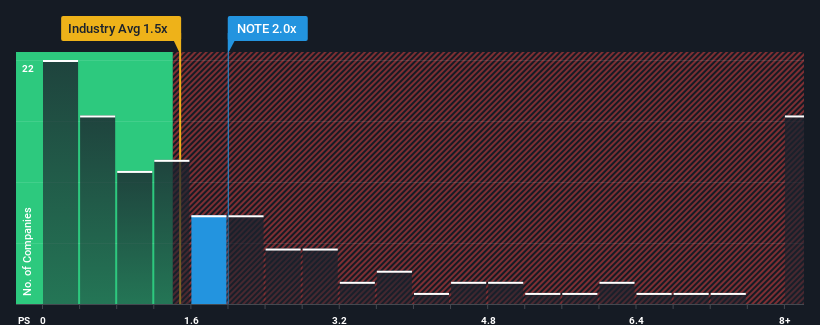

After such a large jump in price, you could be forgiven for thinking FiscalNote Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2x, considering almost half the companies in the United States' Professional Services industry have P/S ratios below 1.5x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does FiscalNote Holdings' Recent Performance Look Like?

Recent times have been advantageous for FiscalNote Holdings as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on FiscalNote Holdings will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

FiscalNote Holdings' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The strong recent performance means it was also able to grow revenue by 99% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 9.6% during the coming year according to the six analysts following the company. With the industry only predicted to deliver 6.5%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why FiscalNote Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From FiscalNote Holdings' P/S?

FiscalNote Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of FiscalNote Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - FiscalNote Holdings has 2 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.