The automobile industry has the characteristics of high output value and long industrial chain. As the largest pillar industry other than real estate infrastructure, it is a key force that cannot be ignored in China's economic recovery. More importantly, under the global automobile industry's major trend from fuel to electrification to future intelligent competition, whether China's automobile industry can overtake curves is critical to driving economic transformation and upgrading. Against this background, there is no doubt that the automobile industry will rise over a long period of time.

Currently, companies are issuing performance announcements one after another, which probably just gave us a window to observe the “leading” companies and find “dusty pearls” in many “glass balls.”

Yixin Group (2858.HK), whose annual report soared the next day, is quite remarkable. Just like in “Speeding Life II,” the character played by Shen Teng was able to finish the race at Bayingbrook in all kinds of unfavorable circumstances; at the end of the day, it was still hard power. As for Yi Xin, there is no coincidence behind the surge, which may prove that the company's fundamentals and future prospects are worth looking forward to.

1. Outperform the industry and achieve the highest net profit since listing

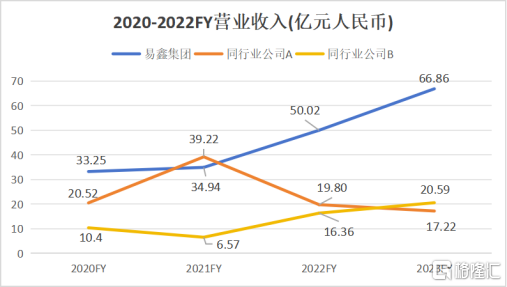

According to the latest performance announcement released by the company, Yi Xin achieved operating revenue of 6.686 billion yuan (RMB, same unit) in 2023, an increase of 29% over the previous year, the best annual revenue performance since listing. It is worth noting that this is the third year in a row that Yi Xin has maintained a rapid growth trend since 2020 was affected by the impact of the epidemic and the “double storm” of regulatory rectification.

If we further compare the financial data published by the other two leading listed companies on the auto finance service circuit, it is easy to find that Yi Xin's position ahead of his peers has been fully verified. Judging from the volume of revenue, Yi Xin is currently leading the development level of peer company B for more than 5 years. Although peer company A has yet to release annual report data, according to estimates of the company's performance data for the first three quarters and revenue guidelines for the fourth quarter, the annual revenue of company A, which is about the same size as Yi Xin in 2021, has been declining for two consecutive years, further widening the gap by Yi Xin.

Data source: Company financial report

Let's take another look at the volume of auto finance transactions. According to the data, the company completed 678,000 financing transactions during the reporting period, an increase of 22% over the previous year, and the volume of financing transactions reached 65.9 billion yuan, an increase of 24% over the previous year. From this perspective, the revenue growth rate is basically consistent with the growth rate of financing transactions, which proves that the increase in financing transactions is the main reason for revenue growth.

According to statistics from the China Association of Automobile Manufacturers and the China Automobile Dealers Association, the total trading volume of passenger cars (including new cars and used cars) in China increased by 12% year-on-year in 2023, and Yi Xin still maintained a stable performance exceeding the industry average.

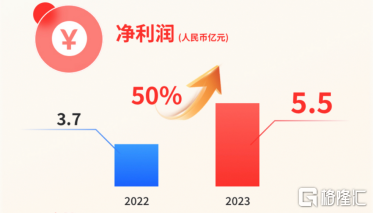

In addition, Yi Xin's profitability is also excellent. Net profit for the full year of 2023 also achieved simultaneous growth, reaching 550 million yuan, an increase of about 50% over the previous year. In comparison, interbank companies are struggling on the edge of profit and loss, and have yet to completely overcome the loss situation.

Data source: Company financial report

Behind the continued increase in profitability, it is inseparable from good risk control capabilities.

According to the data, as of December 31, 2023, the overdue rate of 90 days or more (including 180 days or more), which the industry is focusing on, fell to 1.89% from 1.92% in the same period last year; the overdue rate of 180 days or more also showed signs of simultaneous improvement, further declining from the end of 2022.

Based on the company's good financial performance and asset quality, Yi Xin was also favored by the market in the first-tier financing market, enabling the company to further expand financing channels.

Last year, the company achieved many breakthroughs in standardized products distributed on the domestic open market. Among them, in terms of credit bonds, Yi Xin issued the fourth ultra-short-term financing note (SCP) project in the second half of last year, and the subscription ratio reached a record high. In terms of structured products, the Asset-Backed Note (ABN) project has received numerous international AAA ratings. In addition to this, the company has also further developed overseas financing channels and reached cooperation with many foreign financial institutions such as Macau's Dafeng Bank. By the end of last year, the company's historical cumulative financing scale in the open market was over 50 billion yuan.

Overall, many of Yi Xin's key business indicators have shown a steady upward trend and are ahead of the industry. On the basis of achieving steady development, Yi Xin will be further strengthened in terms of financing channels and capabilities to promote the expansion of the core business scale, thus forming a flywheel effect and entering a virtuous cycle of development.

At present, Yi Xin is the absolute “leader” in domestic auto finance trading platforms. Along with the continuous improvement of the economic environment, the industry has completed a new round of clean-up, which is expected to further consolidate its leading position in the industry and form a differentiated advantage over rivals in the same industry.

2. The business is fully blossoming: steady auto trading, rapid release of new energy sources, and fintech has become a new growth point for performance

The reason for the steady improvement in Yixin's performance is largely due to Yixin's forward-looking layout. Currently, Yi Xin, with auto financing services as the core, is gradually deepening into the fields of new energy vehicles, fintech, etc. on the basis of growth in the new car and used car business, forming a diversified layout and jointly promoting the company's growth.

1) Auto finance transactions: The new car business is eye-catching, and the used car business is strategically tightened.

Financial reports show that in 2023, Yi Xin's new car financing transaction volume increased 51% year on year to 399,000, and the corresponding financing amount reached 40.2 billion yuan, an increase of 57% year on year, accounting for 59% of the total current transaction volume. In contrast, the number of used car financing transactions declined slightly by 4% year over year.

Data source: Company financial report

Does this mean that Yi Xin's used car business is not working?

The opposite is true. The coin still has both positive and negative sides, and the same is true when looking at the development of the company's business. According to data from the Automobile Dealers Association, in 2023, the cumulative volume of used car transactions across the country increased by 14.88% year-on-year. However, what needs to be clarified here is that since last year, nearly 50 mainstream car companies in the market have set off a “price war” for new cars, and the resulting fluctuation in vehicle prices quickly spread to the used car market. Therefore, this growth rate is the result of the “price for volume” in the used car market, and the profits of used car dealers have actually generally declined.

From this perspective, Yi Xin was able to keenly sense short-term market cycle fluctuations, and in the face of the overall macroeconomic downturn, considering the relatively weak risk resilience of used car customers, strategically reducing the risk exposure of the used car business and achieving profit growth is a correct tactical adjustment.

Moreover, from a long-term perspective, Yi Xin's used car business still has room to lift the growth curve once again.

On the one hand, China's used car industry is on the rise, and the market size is as high as trillion dollars. Second, the policy is also beneficial to the large-scale development of the used car market. In 2023, the implementation of offsite upgrades for used cars will significantly improve transaction efficiency. Most importantly, the current used car market is still quite scattered, but increased competition is forcing the supply side to clear. Comprehensive construction such as brand building, after-sales service, and honest management has raised supply-side costs, compounded the trend of standardized development and digital transformation, and market share is concentrated in the direction of large platforms and large dealers. This is a long-term benefit for the development of Yixin Group's used car business.

2) New energy vehicle business: The compound annual growth rate over three years exceeds 200%, and the industrial chain layout is perfect.

The NEV business is one of the key drivers of Yixin's rapid growth. Financial reports show that the company has now reached cooperation with more than 10 new car builders and 25 traditional joint venture OEMs in the new energy business, and achieved a 200% year-on-year increase in NEV financing transactions to 12.4 billion yuan during this period. Since the company entered the new energy circuit, Yixin's NEV financing volume has grown at a compound annual rate of over 216% over three years, and is in the rapid expansion stage.

Data source: Company financial report

With policy support and technological progress, new energy vehicles are gradually moving towards smaller cities and towns. Cities below the third tier have great potential for development. Chen Shihua, Deputy Secretary General of the China Association of Automobile Manufacturers, also said that China's automobile consumer market is expected to peak at around 40 million vehicles, and future automobile consumption growth points should be in third-tier cities. The company believes that since Yi Xin has offline channels all over the country and is experienced in sinking the market, it has obvious advantages and great potential in expanding the NEV business.

In addition to cooperating with mainstream brands, Yi Xin is also extending its business to the NEV industry chain through industrial investment and strategic cooperation, such as innovative vehicle and electric leasing products, autonomous driving, fleet management, etc., to further improve the company's layout in the new energy vehicle industry and seek higher growth.

3) Fintech business: A year-on-year increase of nearly 600%, and long-term potential can be expected.

The fintech business seems to have become Yi Xin's second growth curve. According to financial reports, the amount of financing transactions facilitated by Yi Xin through the financial technology model reached 10.18 billion yuan in 2023, a year-on-year increase of 563% over the same period last year, achieving explosive growth. The business's revenue share also rapidly grew from 2% in 2022 to 7%, further demonstrating the business's long-term potential.

Under the fintech business data table, the optimization of Yi Xin's business structure is also hidden. Financial services based on technology can help Yi Xin break through capital constraints and shift to an asset-light path. The optimization of the business structure can help continuously reduce the restrictions and associated risks of future capital on business growth, and enhance the resilience of business growth, thereby providing the necessary internal conditions for the healthy growth of the company's performance.

In addition to this, actively laying out overseas markets, surrounded by a large wave of Chinese companies going overseas, can bring new development opportunities and growth to the company. In particular, in Southeast Asia, fintech in this region has shown a rapid development trend over the past few years, attracting intense attention from global capital. Take Indonesia as an example. In 2022, the Indonesian fintech industry saw a 39% year-on-year increase in transaction volume, leading the growth rate among G20 countries.

Yi Xin is targeting this market with broad opportunities, focusing on overseas regions with great potential for growth, such as Southeast Asia and East Asia. What can be expected is that Yi Xin promotes its leading domestic development experience and technical advantages overseas. Once its scientific and technological capabilities are recognized by the local market, it is expected that the domestic growth path will be replicated in a broad market space, and the long-term potential for the future is imaginable.

Conclusion:

In short, Yi Xin actively lays out emerging businesses and establishes a diversified business pattern while the basic market for auto finance transactions is stable. Currently, emerging businesses represented by new energy+fintech have grown into the second growth curve. While promoting high-quality growth in performance, they can still bring unlimited room for imagination to the market, reflecting the accuracy of the company's strategic layout and efficiency in execution.

It is worth noting that Yi Xin changed the logo on the occasion of its 10th anniversary, changing from the original “car” element to an “X” symbol with “Y” as the core, indicating that the company will adhere to a professional and exploratory attitude and continue to use the power of technology to bring users a better experience.

What is behind this is Yi Xin's timely grasp of the AI craze trend. According to reports, the Titan cloud platform developed by the company already has functions such as intelligent outbound calling, intelligent customer service, remote interview, and intelligent quality inspection, which empowers various business aspects such as marketing, risk control, and customer service. With the support of a self-developed cloud platform, the company can not only effectively improve its operational efficiency, optimize its risk control system, and further enhance its profitability. More importantly, through this platform, Yi Xin can effectively improve the user experience and successfully attract a large number of users, thereby continuously enhancing user stickiness.

Overall, there is still room for improvement in China's passenger car penetration rate. In particular, driven by the global energy transition in recent years, there is great room for improvement in NEV market share. Whether it is external market space or endogenous growth potential, it has clearly amplified the appeal of Yixin Group.

Also not to be overlooked is that the company announced that it will pay a final dividend of HK3 cents per share, accounting for about 30% of net profit per share during the reporting period. Giving back the trust of shareholders and investors with effective cash dividends not only reflects the importance the company attaches to shareholder returns, but also reflects the shareholders' confidence in the company's future development prospects and recognition of its growth value. This leading company in the auto finance sector is worth further tracking.