XJ Electric Co., Ltd. (SZSE:000400) shares have had a really impressive month, gaining 36% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 5.4% isn't as impressive.

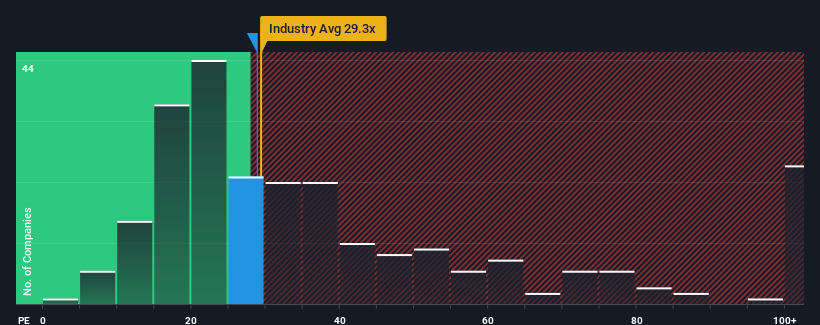

Even after such a large jump in price, you could still be forgiven for feeling indifferent about XJ Electric's P/E ratio of 28.8x, since the median price-to-earnings (or "P/E") ratio in China is also close to 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With its earnings growth in positive territory compared to the declining earnings of most other companies, XJ Electric has been doing quite well of late. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like XJ Electric's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a worthy increase of 11%. The latest three year period has also seen a 29% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Turning to the outlook, the next year should generate growth of 23% as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 41%, which is noticeably more attractive.

With this information, we find it interesting that XJ Electric is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From XJ Electric's P/E?

Its shares have lifted substantially and now XJ Electric's P/E is also back up to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that XJ Electric currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for XJ Electric with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.