Shanghai Orient-Chip Technology Co.,LTD. (SHSE:688061) shareholders are no doubt pleased to see that the share price has bounced 32% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 48% in the last twelve months.

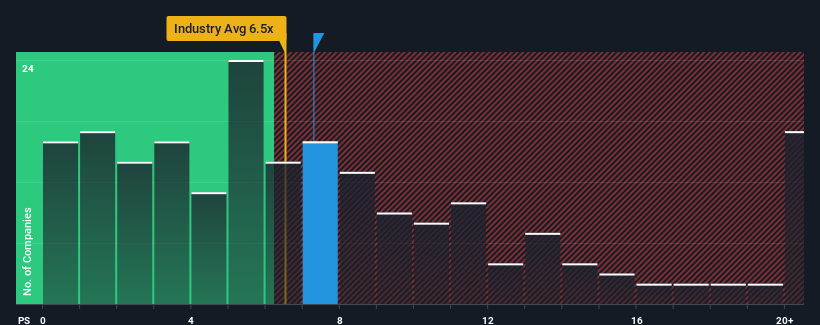

Although its price has surged higher, there still wouldn't be many who think Shanghai Orient-Chip TechnologyLTD's price-to-sales (or "P/S") ratio of 7.3x is worth a mention when the median P/S in China's Semiconductor industry is similar at about 6.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Shanghai Orient-Chip TechnologyLTD's P/S Mean For Shareholders?

Shanghai Orient-Chip TechnologyLTD hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Shanghai Orient-Chip TechnologyLTD will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Shanghai Orient-Chip TechnologyLTD?

The only time you'd be comfortable seeing a P/S like Shanghai Orient-Chip TechnologyLTD's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's top line. Still, the latest three year period has seen an excellent 57% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 58% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 37%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Shanghai Orient-Chip TechnologyLTD's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Shanghai Orient-Chip TechnologyLTD appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at Shanghai Orient-Chip TechnologyLTD's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware Shanghai Orient-Chip TechnologyLTD is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.