[Focus on hot topics]

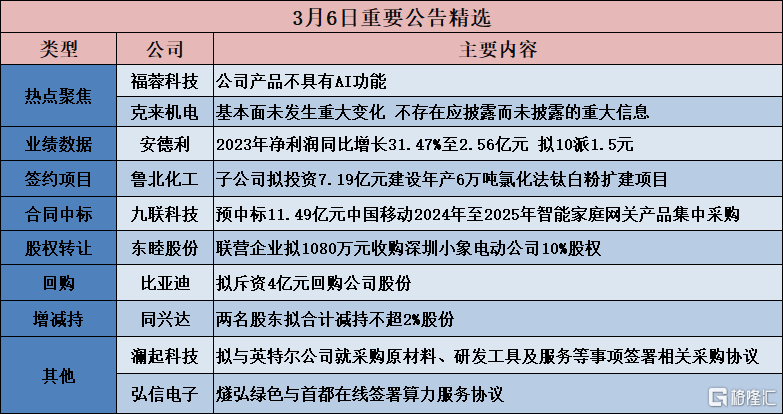

Furong Technology (603327.SH): The company's products do not have AI functions

Furong Technology (603327.SH) announced abnormal stock trading fluctuations and risk alerts. The company's main business is R&D, production and sales of aluminum structural materials for consumer electronics products. The company's main products are aluminum structural materials for consumer electronics products, which are further processed and used in smartphones, tablets, laptops, etc. The company's products do not have AI features.

Krei Electromechanical (603960.SH): There have been no major changes in fundamentals, no significant information that should be disclosed but not disclosed

Klei Mechatronics (603960.SH) announced a risk warning notice for stock trading. Since January 31, 2024, the company's stock has closed 14 times in 19 trading days, with a cumulative turnover rate of 241.85%. On March 6, 2024, the company's stock once again hit a rise and stop. The turnover rate reached 29.07%, and the turnover reached 3,078 billion yuan. Since the company's stock price has risen and stopped many times in a short period of time, the company's fundamentals have not changed significantly.

The company recently paid attention to rumors that the company is listed as a new quality productivity concept stock. The concept of new quality productivity is broad and covers many fields. The company's current main business is still intelligent equipment and auto parts. It is still in the traditional manufacturing sector. The company's related products have not changed. The company's R&D investment in 2023 is basically the same as that of 2022, and there is no significant difference with comparable listed companies in the same industry. It is not ruled out that some investors may use related concepts to speculate on the company's stock. After the company's self-inspection, as of the disclosure date of this announcement, there was no significant information that should be disclosed but not disclosed.

[Investment projects]

Lubei Chemical (600727.SH): The subsidiary plans to invest 719 million yuan to build an expansion project with an annual output of 60,000 tons of chlorinated titanium dioxide

Lubei Chemical (600727.SH) announced that in order to increase the company's titanium dioxide production capacity, increase the company's titanium dioxide market share, enhance product competitiveness and profitability, and improve the company's strategic layout, the company's wholly-owned subsidiary Shandong Xianghai Titanium Resources Technology Co., Ltd. plans to invest 719 million yuan to build a chlorinated titanium dioxide expansion project with an annual output of 60,000 tons.

Huaheng Biology (688639.SH): The subsidiary plans to build a project with an alternating annual output of 60,000 tons of three-chain amino acids, tryptophan, and 10,000 tons of refined amino acids per year

Huaheng Biotech (688639.SH) announced that in order to improve the industrial chain, further expand its business scope, and raise revenue levels, it plans to use its wholly-owned subsidiary Bayannur Huaheng Biotechnology Co., Ltd. (“Bayannur Huaheng”) as the implementing entity to invest no more than 700 million yuan to build a “project with an alternating annual output of 60,000 tons of triple-chain amino acids, tryptophan and 10,000 tons of refined amino acids” (“Project”). The main source of funding for this investment project is self-financing. The estimated construction period is 24 months. The project construction site is located in Shanba Town Industrial Park, Hangjin Houqi, Bayannaoer City.

[Contract won the bid]

Zhonglan Environmental Protection (300854.SZ): The consortium plans to win the bid for the Suichang County Domestic Waste Landfill Ecological Comprehensive Treatment Project - Comprehensive Landfill Management

Zhonglan Environmental Protection (300854.SZ) announced. Recently, the Zhejiang Government Service Network announced the “Suichang County Domestic Waste Landfill Ecological Comprehensive Treatment Project - Landfill Comprehensive Treatment Results Notice”. A consortium formed by Zhonglan Environmental Protection Technology Co., Ltd. and Zhejiang Robang Construction Co., Ltd. was the winning candidate for the project. The total price of the project is about 119.9 million yuan.

Jiulian Technology (688609.SH): Pre-bid of 1,149 million yuan for China Mobile's centralized procurement of smart home gateway products from 2024 to 2025

Jiulian Technology (688609.SH) announced that recently, China Mobile Procurement and Bidding Network announced the selected candidates for the “China Mobile 2024-2025 Centralized Procurement of Smart Home Gateway Products (Open Procurement Section)”. The company is the selected candidate for the above projects. Selected items and shares: Purchase Package 1: gPON - Dual Band WiFi6 (including GPON - Dual Band WiFi 5), winning share 15.94%; Purchase Package 2:10G GPON-WiFi 6, winning share 15.22%; Package 3: GPON without WiFi, winning share 15.94%; Purchase Package 4:10G GPON - no WiFi, 14.49%; total 11.6838 million units. The estimated total bid amount is 1,149 million yuan (tax included).

*ST Weihai (002586.SZ): Pre-bid for the Wenling Jiulong Remittance and Storage Project Construction Project

*ST Weihai (002586.SZ) announced that on March 6, 2024, the company inquired on the Zhejiang Public Resources Exchange Center's electronic bidding and trading platform and learned that the company was the winning candidate for the “Wenling Jiulong Remittance and Savings Project Construction 2 Bids” project. The project bid price was 222 million yuan (the specific contract amount is subject to the contract finally signed by the two parties). The publicity period is from March 6, 2024 to March 11, 2024. The pre-bid amount for the “Wenling Jiulong Remittance and Savings Project Construction 2 Bids” accounted for 8.64% of the company's total audited operating revenue in 2022.

[[Share acquisition]

Wangbian Electric (603191.SH): Plans to bid for a total of 79.97% of Yunbian Electric's shares from Shanghai Changwei and Nanfang Asset through the Beijing Equity Exchange

Wangbian Electric (603191.SH) announced that on February 6, 2024, Shanghai Chang2Wei and Nanfang Asset will list and trade 54.97% and 25% of Yunbian Electric's shares respectively on the Beijing Equity Exchange; the company plans to bid for Shanghai Changwei and Nanfang Asset to hold a total of 79.97% of Yunbian Electric's shares through the Beijing Equity Exchange. According to the relevant regulations on state-owned equity transfers, the reserve price of 79.97% of Yunbian Electric shares held by Shanghai Changwei and China Southern Asset in total is 55,98168.69 million yuan. If a bid is formed during the transfer process, the actual transaction price will be higher than this value.

Dongmu Co., Ltd. (600114.SH): The joint venture plans to acquire 10% of Shenzhen Xiaoxiang Electric Company's shares for 10.8 million yuan

Dongmu Co., Ltd. (600114.SH) announced that it received a notice from the joint venture Ningbo Dongmu Guangtai Enterprise Management Partnership (“Ningbo Dongmu Guangtai”). On March 6, 2024, Ningbo Dongmu Guangtai signed “Equity Transfer Agreements” with Liu Xiao, Tian Xiaofeng, and Tang Qi respectively. Ningbo Dongmu Guangtai purchased 10.00% of the shares of Shenzhen Xiaoxiang Electric Technology Co., Ltd. (“Shenzhen Xiaoxiang Electric Company”) in cash of RMB 10.08 million. If the acquisition is successful and the relevant legal formalities are completed, Ningbo Dongmu Guangtai will hold 22.00% of Shenzhen Xiaoxiang Electric Company's shares.

Shenzhen Xiaoxiang Electric Company has core technologies such as self-developed concentrated magnetic axial magnetic flux motors and control algorithms. Compared with traditional radial magnetic field motors, the axial magnetic field motors developed and produced have remarkable characteristics of small size, light weight and high efficiency. They are particularly suitable for applications with special requirements for volume and weight, such as new energy vehicles, electric motorcycles, robots, drones, electric ships, and electric aircraft, to provide customers with energy-efficient, efficient and weight-size electric drive solutions.

[Performance data]

Andley (605198.SH): Net profit in 2023 increased 31.47% year-on-year to 256 million yuan, and plans to distribute 10 to 1.5 billion yuan

Andley (605198.SH) released its 2023 annual report. During the reporting period, it achieved operating income of 876 million yuan, a year-on-year decrease of 17.77%; net profit attributable to shareholders of listed companies of 256 million yuan, an increase of 31.47% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 231 million yuan, an increase of 40.00% year on year; and basic earnings per share of 0.71 yuan. In addition, the company uses a cash dividend method to distribute a cash dividend of RMB 1.50 (tax included) to all shareholders for every 10 shares based on 349,000,000 shares.

Shanghai Electric Power (600021.SH): Net profit increased 376.56% year-on-year in 2023

Shanghai Electric Power (600021.SH) announced its 2023 annual results report. Total operating revenue was 4240,1757 million yuan, up 8.03% year on year, and net profit attributable to shareholders of listed companies was 1592.664 million yuan, up 376.56% year on year. In 2023, the main reasons for the increase in the company's performance: first, marginal revenue from coal and electricity continued to improve, and the efficiency of holding and participating coal power companies increased; second, the increase in the installed capacity of new energy sources and the development of overseas projects, and the increase in profits.

Debon Lighting (603303.SH): Net profit in 2023 increased 10.31% year-on-year, and plans to pay 10 to 3.33 yuan

Debon Lighting (603303.SH) released its 2023 annual report, with operating revenue of 4.697 billion yuan, up 0.86% year on year, net profit of 376 million yuan, up 10.31% year on year, after deducting non-net profit of 297 million yuan, down 2.79% year on year, with basic earnings per share of 0.7875 yuan. It is proposed to distribute a cash dividend of $3.33 for every 10 shares.

[Repurchase]

Jingzhida (688627.SH): Plans to repurchase 30 million yuan to 50 million yuan of company shares

Jingzhida (688627.SH) announced that the total amount of capital to be repurchased is not less than RMB 30 million, not more than RMB 50 million of the company's shares, and the maximum repurchase price will not exceed RMB 83.57 per share.

BYD (002594.SZ): Plans to spend 400 million yuan to buy back the company's shares

BYD (002594.SZ) announced that the company plans to use its own funds to repurchase RMB common shares (A shares) issued by the company. The repurchased shares will be used for cancellation to reduce the registered capital. The proposed repurchase amount is RMB 400 million, and the repurchase price shall not exceed RMB 270 per share. Under the condition that the repurchase price of shares does not exceed RMB 270 per share, the estimated number of shares to be repurchased is not less than 1,481,481 shares, accounting for about 0.05% of the company's total issued share capital. The specific number of shares repurchased is based on the actual number of shares repurchased at the end of the repurchase period. The repurchase period shall not exceed 12 months from the date the company's shareholders' meeting reviews and approves the repurchase plan.

[Increase or decrease holdings]

Tongxingda (002845.SZ): The two shareholders plan to reduce their total holdings by no more than 2%

Tongxingda (002845.SZ) announced that the shareholder Shanghai Guosheng Capital Management Co., Ltd. (representing “Shanghai Guosheng Capital Management Co., Ltd. - Shanghai Guosheng Haitong Private Enterprise High Quality Development Private Equity Investment Fund Partnership (limited partnership)” (“Guosheng Capital”) plans to reduce the company's shares by no more than 3,275,517 shares (i.e. no more than 1% of the company's current total share capital) within three months after 15 trading days from the date of disclosure of this announcement. Shareholder Mr. Liu Qingke plans to reduce his holdings of the Company's shares by no more than 3,275,517 shares (that is, no more than 1% of the company's current total share capital) through centralized bidding transactions or bulk transactions within three months after 15 trading days from the date of disclosure of this announcement.

Poly Development (600048.SH): The actual controller has increased its A-share holdings by 250 million yuan

Poly Development (600048.SH) announced that as of March 6, 2024, the actual controller of the company, China Poly Group Co., Ltd. (referred to as “Poly Group”), has increased its holdings of the Company's A shares by a total of 267.801 million shares, accounting for 0.22% of the company's total share capital. The cumulative increase amount is RMB 250 million, which has reached the lower limit of the amount of the plan to increase its holdings.

[Other]

Hongxin Electronics (300657.SZ): Suihong Green signs computing power service agreement with Capital Online

Hongxin Electronics (300657.SZ) announced that the company's holding company, Gansu Suihong Green Computing Power Co., Ltd. (“Suihong Green” for short), continues to promote the computing power investment of AI computing power platforms in Qingyang, Gansu, while the company's management team is actively and rapidly promoting the implementation of computing power resource services. Based on the principles of equality and mutual benefit, mutual trust, paid use, and common development, Suihong Green and Beijing Capital Online Technology Co., Ltd. (“Capital Online” for short) went through friendly negotiations, and the two sides jointly signed the “Computing Power Service Agreement” on March 5, 2024. The signing of this computing power service agreement marks that following the lighting of the nearly 3,000P computing power equipment in Qingyang on December 20, 2023, Qingyang Big Computing Power Dock officially began providing a full range of computing power resource services to customers in need of computing power based on stock and incremental computing power equipment.

Capital Online will purchase computing power resource services and other related products from Suihong Green in accordance with its own business development needs. The two parties plan that within 3 years after signing this agreement, Capital Online will purchase a total computing power resource service fee of about RMB 300 million from Suihong. The specific purchase amount and service period are based on the PO order signed by the two parties. At the same time, the initial computing power service order amount will not be less than RMB 20 million.

Lanqi Technology (688008.SH): Intends to sign relevant procurement agreements with Intel on matters such as procurement of raw materials, R&D tools and services

Lanqi Technology (688008.SH) announced that due to business development needs, the company intends to sign relevant agreements with Intel Corporation and companies directly or indirectly controlled by Intel Corporation (“Intel Corporation” or “Affiliates”) on matters such as procurement of raw materials, R&D tools and services, and requests the board of directors to authorize management to sign relevant procurement agreements within a quota not exceeding RMB 106 million. The Jinjue CPU project was developed by the company in cooperation with Intel. The company procures products from Intel to meet the objective needs of the company's business development.