Despite an already strong run, Spire Global, Inc. (NYSE:SPIR) shares have been powering on, with a gain of 71% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 53% in the last year.

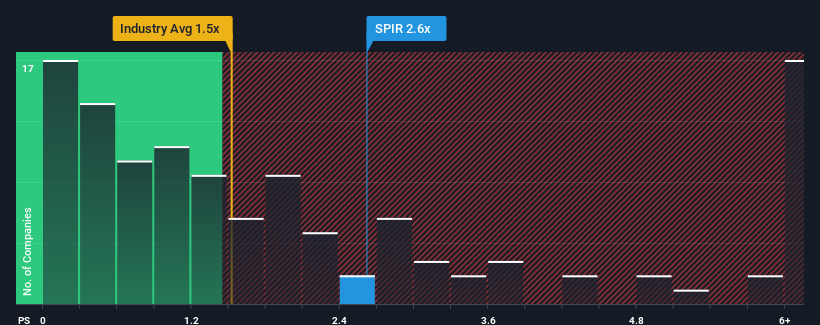

Following the firm bounce in price, you could be forgiven for thinking Spire Global is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.6x, considering almost half the companies in the United States' Professional Services industry have P/S ratios below 1.5x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Has Spire Global Performed Recently?

Recent times have been advantageous for Spire Global as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Spire Global.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Spire Global's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 38% last year. Pleasingly, revenue has also lifted 252% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 33% as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 6.5%, which is noticeably less attractive.

With this information, we can see why Spire Global is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The large bounce in Spire Global's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Spire Global's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - Spire Global has 3 warning signs we think you should be aware of.

If you're unsure about the strength of Spire Global's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.