Gold prices are supported

Since February 28, international gold prices have continued to rise and have broken through the high of 2,100 US dollars/ounce, reaching a record high.

(Source: Tono Flush)

Domestic gold prices have also risen. The price of pure gold jewelry from many gold and jewelry brands has surpassed 636 yuan/gram, reaching a record high. Take Chow Tai ?$#@$ as an example. The price of gold has risen 18 yuan/gram from a month ago, an increase of about 2.9%, and a 19% increase compared to the same period last year.

Domestic and foreign futures prices have resonated, and the Shanghai Gold Main Link has risen sharply for the fourth day, rising 3.79%. Boosted by gold prices, related individual stocks such as Zijin Mining, Chifeng Gold, and Shandong Gold have risen one after another.

Not only is there a resonance, but the peak period of domestic gold consumption has just passed with the Spring Festival. Leaving aside the relationship between supply and demand and the central bank's gold purchase behavior, the price of gold is still related to actual interest rates and economic expectations. A series of economic data recently released by the US has become the most direct trigger for a rocket-like rise in the price of gold.

On March 1, the latest data from the American Institute for Supply Management (ISM) showed that the US ISM manufacturing PMI index for February fell far below mainstream market expectations. The manufacturing index fell to 47.8, or 49.1 in January. The market's previous general forecast improved slightly to 49.5; the employment index fell to 45.9 from 47.1 in January.

These data show that economic activity in the US manufacturing industry has not recovered as smoothly as expected. The market doubts whether it will lead to signs of economic recession, and is not very optimistic about non-farm payrolls in February.

Furthermore, there was a bank storm on the same day. The New York Community Bank announced that losses for the fourth quarter of last year had increased by more than 10 times compared to what was previously disclosed. The reason was that there was a problem with the loan review process, which caused the bank to write off 2.4 billion US dollars in goodwill.

For investors, once the economy has a hard landing, the timing of the Federal Reserve's interest rate cut will be forced to advance. As a result, the US dollar index will fall, and the price of gold denominated in US dollars will rise accordingly. Furthermore, the market's interpretation of recent Federal Reserve Governor Waller's statement was biased towards “pigeons,” causing the trend of trade easing expectations once again.

Interest rate cuts can reduce borrowing costs, thereby increasing investors' demand for risky assets, which may drive up precious metals prices. In particular, in the context of the Federal Reserve leading developed country central banks to cut interest rates, central banks around the world may form a new policy resonance, further driving up the price of gold.

Federal Reserve Chairman Powell said in an interview in early February that the Federal Reserve is expected to cut interest rates 3 times this year, about 25 basis points each time, and is expected to start cutting interest rates as early as May. At the same time, he stressed that Federal Reserve officials still need to see further evidence that inflation is under control in order to have more confidence in cutting interest rates. If they act too fast, they will once again stimulate inflation. Previously, the market had been betting that the Federal Reserve would cut interest rates 6 times starting in March.

The Federal Reserve and the market are different from judging the future trend of the US economy, especially the rate of decline in US inflation. Verification of economic data is the biggest cause of current fluctuations in gold prices. On February 13, the US CPI data for January did not cool down as expected. As a result, the price of gold in New York fell below 2003 from 2,047 US dollars on that day.

However, although the exact window and extent of the Fed's interest rate cut is still unclear, many countries around the world have plans to cut interest rates to stimulate the economy, helping the price of gold, a precious metal, to basically remain above the key level of 2,000 US dollars per ounce since mid-December.

Major central banks around the world, including the Federal Reserve, the European Central Bank, the Bank of England, and the Bank of Japan, may adopt interest rate cuts in 2024 to stimulate economic growth. China will also adopt a steady and loose monetary policy this year to maintain the 5% economic growth target. Common expectations of interest rate cuts by central banks around the world may have a positive impact on gold prices, especially when the market is cautious about future economic prospects.

Judging from gold trading, the willingness of central banks around the world to buy gold is still increasing, which also provides long-term upward momentum for gold. According to data released by the State Administration of Foreign Exchange, as of the end of January 2024, the central bank of China reported 72.19 million ounces of gold reserves, an increase of 320,000 ounces over the previous month. It is worth mentioning that this is the 15th consecutive month of increase, and the cumulative increase in holdings has reached 9.55 million ounces (about 271 tons).

According to data from the World Gold Council, the annual net gold purchase volume of central banks of various economies in 2023 was 1,037 tons, of which the Central Bank of China's net gold purchase volume was 225 tons, ranking first among all countries. The central banks of Poland and Turkey are in second and third place.

Judging from safe-haven demand, demand for gold as a safe-haven asset continues due to uncertainty about economic recovery and heightened geopolitical conflicts.

At least 65 countries (regions) of the world will hold elections this year, affecting 49% of the world's population. The US election, on the other hand, is the focus of attention. In the 2012, 2016, and 2020 US election years, global central bank gold reserves increased by an average of 519 tons, which is 124 tons higher than the average of non-election years from 2009 to 2021.

Against the backdrop of turbulent world conditions, weak economic growth, and increased global governance challenges, this year's election will have a profound impact on the global landscape in the next few years. The ensuing uncertainty and changes in the dollar system may accelerate.

On the other hand, domestic gold jewelry prices are also constantly breaking records. Today, many gold jewelry brands such as Chow Tai Fu, Zhou Liufu, and Lao Feng Xiang have all reached 645 yuan/gram, reaching an all-time high.

Physical gold is a type of commodity asset that Chinese people are particularly fond of allocating. It is not only stable in price over a long period of time, but also beautiful, and has heritage significance. Even during the period of continuous adjustment of international gold prices in February, domestic gold prices remained high, mainly due to the boom in consumer demand around the Spring Festival.

During the Spring Festival, sales of key retail and catering companies across the country increased 8.5% year on year. Among them, sales of gold and silver jewelry increased by about 20% year on year, far exceeding the overall level of the market.

According to data from the China Gold Association, the country's gold consumption last year was 1089.06 tons, up 8.78% year on year. Among them, gold jewelry consumption was 706.48 tons, up 7.97% year on year; gold bars and coins were consumed 299.6 tons, up 15.70% year on year. The “Global Gold Demand Trend Report” released by the World Gold Association also shows that in 2023, China's domestic jewellery consumption reached 282 billion yuan, a record high.

Judging from historical rules, there is a clear correlation between gold price trends and the beginning of the Fed's interest rate cut cycle.

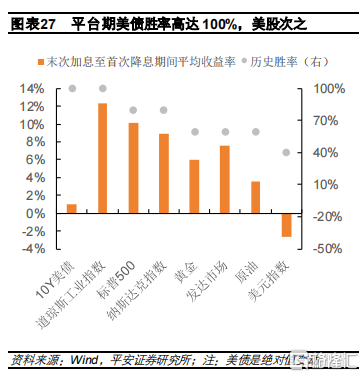

From the last rate hike until the first rate cut, the gold and US dollar indices showed a strong negative correlation in the short term. Most of the time, the gold price rose and the US dollar fell. The decline in the US dollar is related to changes in the strength and weakness of the US economic trend. If the US economy shows signs of recession after interest rate hikes are suspended, the dollar's pricing capacity will decrease, while the performance of gold will be even stronger. Moreover, the peaking and falling of US bonds also supported the price of gold.

However, after the first rate cut began, gold usually rose within 20 trading days. Within 6 months after the start of the Fed's interest rate cut cycle, the average yield of gold was significantly higher than that of other assets, and the win rate was 100%, showing an absolute advantage in the interest rate cut cycle.