Zhejiang Meorient Commerce Exhibition Inc. (SZSE:300795) shareholders would be excited to see that the share price has had a great month, posting a 37% gain and recovering from prior weakness. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

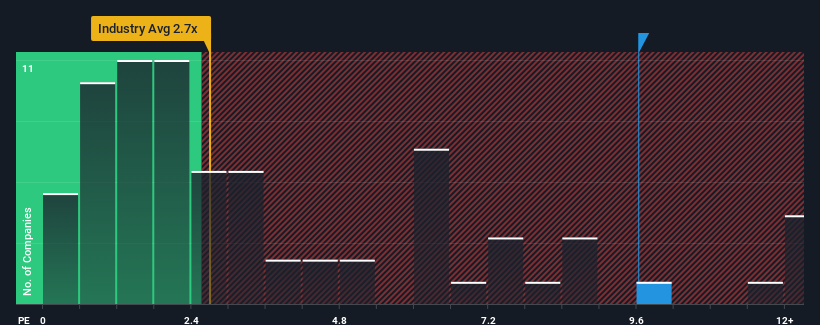

Following the firm bounce in price, given around half the companies in China's Media industry have price-to-sales ratios (or "P/S") below 2.7x, you may consider Zhejiang Meorient Commerce Exhibition as a stock to avoid entirely with its 9.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Has Zhejiang Meorient Commerce Exhibition Performed Recently?

Zhejiang Meorient Commerce Exhibition certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Zhejiang Meorient Commerce Exhibition's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Zhejiang Meorient Commerce Exhibition would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 201% last year. The latest three year period has also seen an excellent 196% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 46% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 20%, which is noticeably less attractive.

With this information, we can see why Zhejiang Meorient Commerce Exhibition is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Zhejiang Meorient Commerce Exhibition's P/S Mean For Investors?

Shares in Zhejiang Meorient Commerce Exhibition have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Zhejiang Meorient Commerce Exhibition's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Zhejiang Meorient Commerce Exhibition with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.