Despite an already strong run, MacroGenics, Inc. (NASDAQ:MGNX) shares have been powering on, with a gain of 34% in the last thirty days. The annual gain comes to 253% following the latest surge, making investors sit up and take notice.

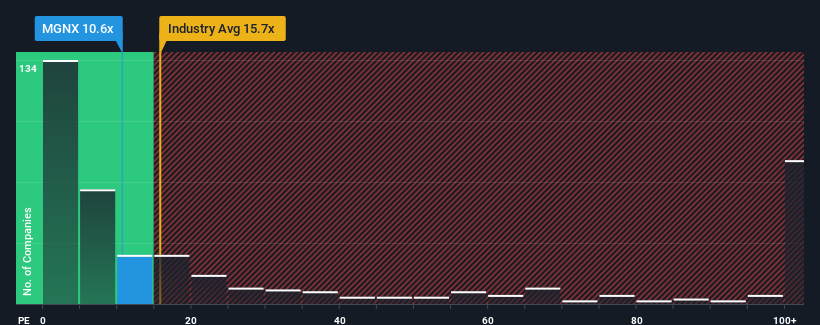

Although its price has surged higher, MacroGenics may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 10.6x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 15.7x and even P/S higher than 76x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has MacroGenics Performed Recently?

MacroGenics could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MacroGenics.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, MacroGenics would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 30%. Pleasingly, revenue has also lifted 57% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 8.9% per year during the coming three years according to the nine analysts following the company. Meanwhile, the broader industry is forecast to expand by 265% per year, which paints a poor picture.

With this information, we are not surprised that MacroGenics is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On MacroGenics' P/S

MacroGenics' stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that MacroGenics' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, MacroGenics' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You should always think about risks. Case in point, we've spotted 1 warning sign for MacroGenics you should be aware of.

If you're unsure about the strength of MacroGenics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.