[Focus on hot topics]

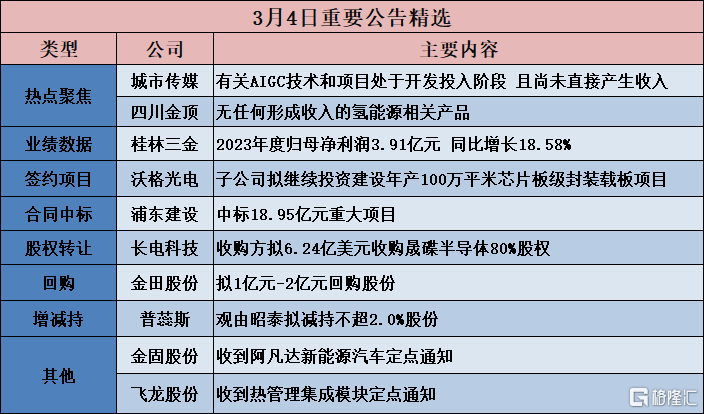

Urban Media (600229.SH): AIGC technology and projects are in the development phase and have not directly generated revenue

City Media (600229.SH) announced that the cumulative deviation value of the company's stock price increase exceeded 20% for three consecutive trading days on February 29, March 1, and March 4, 2024. According to the relevant provisions of the “Shanghai Stock Exchange Trading Rules”, this is an abnormal fluctuation in stock trading. The company recently noticed that some media and investors listed the company as an AIGC concept stock. The details are as follows: Currently, the company's AIGC technology and projects are in the development investment stage, the investment amount is small, and no direct revenue is generated. Investors are kindly requested to invest rationally and pay attention to investment risks.

Suzhou Keda (603660.SH): There is an essential difference between the KD-GPT big model released to the outside world and the Wensheng video model

Suzhou Keda (603660.SH) announced that the company's current main business mainly revolves around the collection, analysis and application of audio and video, as evidenced by software and hardware products and industry application solutions such as video conferencing, security monitoring, and integrated communication. It is a company that does not specialize in the development of large model algorithms. The KD-GPT model released by the company in 2023 is mainly used in the analysis and application of content such as images and videos, the construction of a knowledge base for specific industries, and natural language processing, which is fundamentally different from the Wensheng video model.

Sichuan Jinding (600678.SH): Hydrogen energy-related products without generating any revenue

Sichuan Jinding (600678.SH) announced that since February 27, 2024, the company's stock has been rising and falling for 5 consecutive trading days. Currently, the company's price-earnings ratio (TTM) is 16,481.68 and the net market ratio is 11.45, all significantly higher than the industry average. The stock trading price had a cumulative increase of 64.15% from February 26 to March 4, 2024 at the closing price. There is a risk that the stock price will rise significantly in the short term and then fall later. Up to now, the company has no hydrogen energy-related products that generate revenue.

[Investment projects]

Vogue Optoelectronics (603773.SH): The subsidiary plans to continue to invest in the construction of a chip board-level sealing board project with an annual output of 1 million square meters

Vogue Optoelectronics (603773.SH) announced that since the company has recently acquired 70% of Hubei Tonggewei's shares held by Hubei Tianmen Hi-Tech Investment and has completed matters relating to the share transfer and settlement, up to now, Hubei Tonggewei has changed from a participating company of the company to a wholly-owned subsidiary of the company, as the implementing entity of the “1 million square meter chip board grade sealing and loading board project”. The total investment amount of the project is estimated to be RMB 1215.64.23 million, including a construction investment of 86.0212,300 yuan and a working capital of 355.433 million yuan. Up to now, the project has invested 117.8455 million yuan. The subsequent investment amount required for the project is estimated to be RMB 109,779.68 million. The investment in this project is based on TGV technology independently developed by the company. The technology focuses on mass production applications of glass-based advanced packaging boards and next-generation semiconductor displays by superimposing the company's technical capabilities in the development of processes and materials such as glass-based thinning, double-sided multi-layer copper plating line stacking, insulating films, and massive through-holes. At present, in terms of glass-based semiconductor advanced packaging board products, several of the company's projects have been verified by customers, and mass production is feasible; in terms of next-generation semiconductor displays, with the company's breakthrough in TGV process technology capabilities, the company and well-known domestic companies jointly released the world's first glass-based TGVMicroLED display. This product uses a glass-based TGV carrier board launched by the company, which has promoted the commercialization of microLED displays. At present, the product has entered the mass production promotion and application stage.

[Contract won the bid]

Pudong Construction (600284.SH): won the bid for a major project worth 1,895 billion yuan

Pudong Construction (600284.SH) announced that recently, the company's subsidiaries Shanghai Pudong New Area Construction (Group) Co., Ltd., Shanghai Pudong Road and Bridge (Group) Co., Ltd. and Shanghai Nanhui Construction (Group) Co., Ltd. won bids for a total of RMB 1,895 billion.

[[Share acquisition]

Changdian Technology (600584.SH): The acquirer plans to acquire 80% of Shengdi Semiconductor's shares for US$624 million

Changdian Technology (600584.SH) announced that on March 4, 2024, Changdian Management Company and SANDISK CHINA LIMITED (hereinafter referred to as the “Seller”) signed a legally binding “Share Acquisition Agreement”. Changdian Management Company plans to purchase 80% of the shares of Shengdi Semiconductor held by the seller in cash. The transaction consideration is based on the “Asian Review Report (2024) No. 45” evaluation report issued by Beijing Asia Pacific Lianhua Asset Evaluation Co., Ltd., and determined by negotiations between the parties. After full communication and negotiation between the parties to the transaction, the transaction price is approximately US$624 million (the final price will be adjusted according to the usual delivery adjustments based on cash, liabilities, and net working capital before and after delivery). After the transaction was completed, the buyer held 80% of the shares in the target company, and the seller held 20% of the shares in the target company.

The target company was founded in 2006 and is located in Minhang District, Shanghai. It is mainly engaged in packaging and testing of advanced flash memory storage products. The product types mainly include iNAND flash memory modules, SD, microSD memories, etc. Products are widely used in mobile communications, industrial and Internet of Things, automobiles, smart homes and consumer terminals. Its factory is highly automated and has high production efficiency. It is a “lighthouse factory” that has received many awards for quality, operation, and sustainable development.

Xiamen Tungsten Industry (600549.SH): CHIXIA Laos plans to acquire 90% of the shares of China Investment (Laos) Mining Wholly Owned Co., Ltd. for US$18.963 million

Xiamen Tungsten Industry (600549.SH) announced that on March 4, 2024, the company's shareholding company Shanghai Chijinxia Tungsten Metal Resources Co., Ltd. (hereinafter referred to as “Chijinxia Tungsten”) and its wholly-owned subsidiary CHIXIA Laos Holdings Limited (Chinese name: Chixia Laos Holdings Co., Ltd., hereinafter referred to as “CHIXIA Laos”) and China Investment (Real Estate) Co., Ltd. (hereinafter referred to as “China Investment Real Estate”) and its wholly-owned subsidiary China Investment (Mining) Laos) Sole Co., Ltd. (Chinese name: China Investment (Laos) Mining Wholly Owned Co., Ltd., hereinafter referred to as the “Target Company”) signed the “Equity Transfer Agreement”. CHIXIA Laos plans to acquire 90% of the shares of the target company held by China Investment Real Estate in cash and debt, with a total transaction consideration of US$18.963 million (hereinafter referred to as the “transaction”), of which it will pay a share transfer of US$6.2765 million and repay the target company's related party loans of US$12.6865 million. Zhi Jinxia Tungsten provides an irrevocable joint and several liability guarantee for ChiXiAlaOS to fully fulfill its obligations and responsibilities under the “Equity Transfer Agreement” of this transaction.

[Performance data]

Huitong Energy (600605.SH): Net profit of 56.454 million yuan in 2023, a year-on-year increase of 509.13%, and plans to distribute 10 to 6 yuan

Huitong Energy (600605.SH) released its 2023 annual report. During the reporting period, it achieved operating income of 130 million yuan, an increase of 19.82%; net profit attributable to shareholders of listed companies of 56.454 million yuan, an increase of 509.13% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 11.5119 million yuan, an increase of 36.01% year on year; and basic earnings per share of 0.274 yuan. It is proposed to distribute a cash dividend of 6.00 yuan (tax included) for every 10 shares based on the company's total share capital.

Guilin Sanjin (002275.SZ) performance report: 2023 net profit of 391 million yuan increased 18.58% year-on-year

Guilin Sanjin (002275.SZ) announced its 2023 annual results report. During the reporting period, the company achieved operating income of 2.112 billion yuan, an increase of 10.82% over the same period of the previous year; realized total profit of 516 million yuan, an increase of 15.69% over the same period of the previous year; and realized net profit attributable to shareholders of listed companies of 391 million yuan, an increase of 18.58% over the same period last year. Net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 353 million yuan, an increase of 58.60% over the same period last year.

Zhangjiang Hi-Tech (600895.SH) performance report: 2023 net profit of 940 million yuan increased 14.27% year-on-year

Zhangjiang Hi-Tech (600895.SH) announced the 2023 annual results report. In 2023, the company achieved total operating revenue of 2,026 billion yuan, an increase of 6.24% over the same period of the previous year; realized net profit attributable to shareholders of listed companies of 940 million yuan, an increase of 14.27% over the same period of the previous year; realized net profit attributable to shareholders of listed companies after deducting non-recurring profits and losses of 945 million yuan, an increase of 13.23% over the same period last year.

[Repurchase]

Jintian Co., Ltd. (601609.SH): Plans to repurchase shares for 100 million yuan to 200 million yuan

Jintian Co., Ltd. (601609.SH) announced that the total capital to be repurchased is not less than RMB 10,000 million and not more than RMB 20 million, and that the repurchase price will not exceed RMB 8.64 per share.

Guojin Securities (600109.SH): Plans to spend 50 million yuan to repurchase shares

Guojin Securities (600109.SH) announced that the company plans to use its own funds to repurchase the company's shares through centralized bidding transactions to reduce the company's registered capital. The total repurchase capital shall not be less than RMB 50 million (inclusive) and not more than RMB 100 million (inclusive). The repurchase price does not exceed RMB 12 per share (inclusive).

Kejie Intelligence (688455.SH): plans to spend 30 million yuan to 60 million yuan to buy back shares

Kejie Intelligence (688455.SH) announced that the company is using centralized bidding transactions to repurchase the company's shares at an appropriate time in the future to use the repurchase of shares for equity incentives. The total repurchase capital is not less than RMB 30 million (inclusive) and no more than RMB 60 million (inclusive). The repurchase price is no more than 14.58 yuan/share.

Huahai Qingke (688120.SH): Plans to spend 50 million yuan to repurchase shares

Huahai Qingke (688120.SH) announced that the company plans to repurchase some of the company's shares through centralized bidding transactions. The shares repurchased will be used for equity incentives or employee stock ownership plans; the total repurchase capital shall not be less than RMB 50 million (inclusive) and not more than RMB 10,000 million (inclusive); and the repurchase price shall not exceed RMB 260 per share.

Jianke Co., Ltd. (301115.SZ): Plans to spend 30 million yuan to 60 million yuan to repurchase the company's shares

Jianke Co., Ltd. (301115.SZ) announced that the company plans to use part of the overraised capital to repurchase the company's shares through centralized bidding transactions. The repurchased shares will be used to implement share incentives or employee stock ownership plans. The total repurchase capital shall not be less than RMB 30 million (inclusive) and not more than RMB 60 million (inclusive). The repurchase price of shares shall not exceed RMB 22 per share (inclusive). The repurchase period of shares shall be within 12 months from the date the board of directors of the company reviews and approves the share repurchase plan.

Alter (300825.SZ): Plans to repurchase 50 million yuan to 100 million yuan of company shares

Alter (300825.SZ) announced that the proposed repurchase amount is not less than RMB 50 million and no more than RMB 10,000 million of the company's shares, and the repurchase price of the shares is no more than RMB 15.28 per share.

[Increase or decrease holdings]

Prius (301257.SZ): It is estimated that Zhaotai plans to reduce its holdings by no more than 2.0%

Prius (301257.SZ) announced that the shareholder Shanghai Guanyou Investment and Development Co., Ltd. - Guanyou Zhaotai (Jiaxing) Venture Capital Partnership (Limited Partnership) (hereinafter referred to as “Guanyu Zhaotai”), which holds 4,822,400 shares of the company's shares (accounting for 7.8849% of the company's total share capital), plans to reduce the company's shares by no more than 1,223,200 shares within 3 months after 3 trading days from the date of publication of the announcement and/or 15 trading days from the date of publication of the announcement proportion 2.0000%)

Sanfeng Environment (601827.SH): Indirect controlling shareholders have increased their holdings of the company by a total of 7.1264 million shares

Sanfeng Environment (601827.SH) announced that on March 4, 2024, the company received a notification letter from the indirect controlling shareholder Water Environment: By the close of trading on March 4, Water Environment had increased its holdings of the company's shares by 7.1264 million shares through centralized bidding, accounting for about 0.42% of the company's total share capital.

[Other]

Jingu Co., Ltd. (002488.SZ): Received Avatar's NEV designation notice

Jingu Co., Ltd. (002488.SZ) announced that the company recently received a fixed notice from a well-known new energy vehicle manufacturer (limited to confidentiality requirements, unable to disclose its name, hereinafter referred to as the “customer”). The company will act as the customer's parts supplier to provide Avatar low-carbon wheel products for their new energy light truck models.

Feilong Co., Ltd. (002536.SZ): Received a fixed notice for the integrated thermal management module

Feilong Co., Ltd. (002536.SZ) announced that the company recently received a fixed notice from a domestic autonomous car brand company (it is not convenient to disclose the customer's specific name based on a confidentiality agreement between the two parties). According to the relevant agreement, the company became the supplier of the integrated thermal management module for the customer's project. The estimated sales revenue will exceed 400 million yuan during the life cycle.