Those holding Transwarp Technology (Shanghai) Co.,Ltd. (SHSE:688031) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 30% over that time.

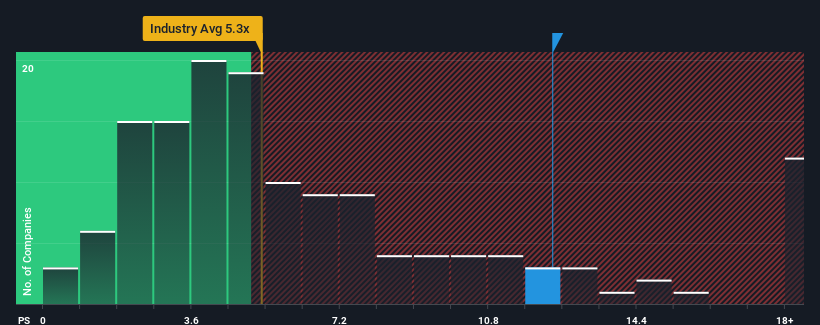

Following the firm bounce in price, when almost half of the companies in China's Software industry have price-to-sales ratios (or "P/S") below 5.3x, you may consider Transwarp Technology (Shanghai)Ltd as a stock not worth researching with its 12.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Transwarp Technology (Shanghai)Ltd's Recent Performance Look Like?

Transwarp Technology (Shanghai)Ltd certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Transwarp Technology (Shanghai)Ltd will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Transwarp Technology (Shanghai)Ltd's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 44%. The latest three year period has also seen an excellent 107% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 38% during the coming year according to the three analysts following the company. With the industry only predicted to deliver 33%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Transwarp Technology (Shanghai)Ltd's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Transwarp Technology (Shanghai)Ltd's P/S

The strong share price surge has lead to Transwarp Technology (Shanghai)Ltd's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Transwarp Technology (Shanghai)Ltd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Transwarp Technology (Shanghai)Ltd that you should be aware of.

If these risks are making you reconsider your opinion on Transwarp Technology (Shanghai)Ltd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.