Track the latest developments in north-south funding

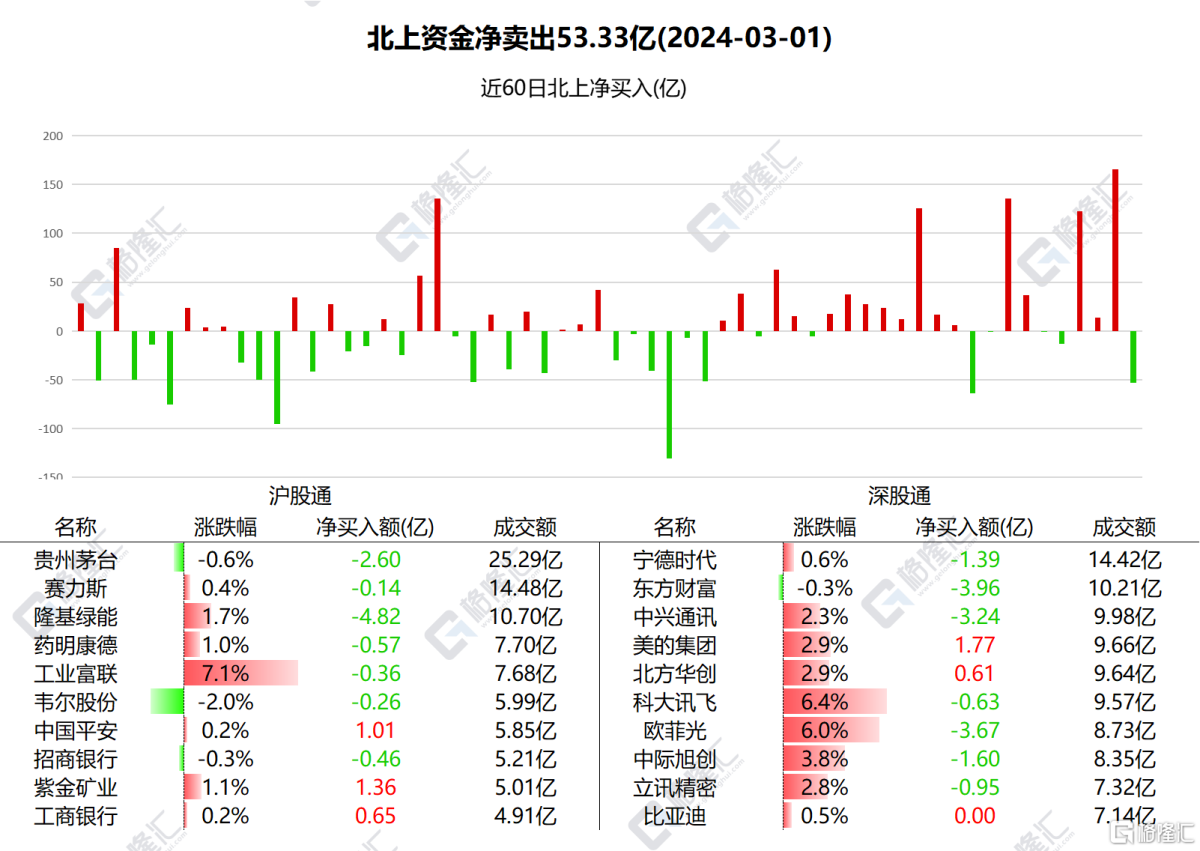

Beishang Capital made a sharp net sale of 5.333 billion yuan of A-shares today, ending the previous net buying trend for 3 consecutive days. Among them, Shanghai Stock Connect had net sales of 1,710 billion yuan and Shenzhen Stock Connect had net sales of 3.623 billion yuan.

Among the top ten traded stocks, the top three were Longji Green Energy, Oriental Wealth, and Ofiliguang, which had net sales of 482 million yuan, 396 million yuan, and 367 million yuan respectively.

Midea Group, Zijin Mining, and Ping An of China received net purchases of 177 million yuan, 136 million yuan, and 101 million yuan respectively.

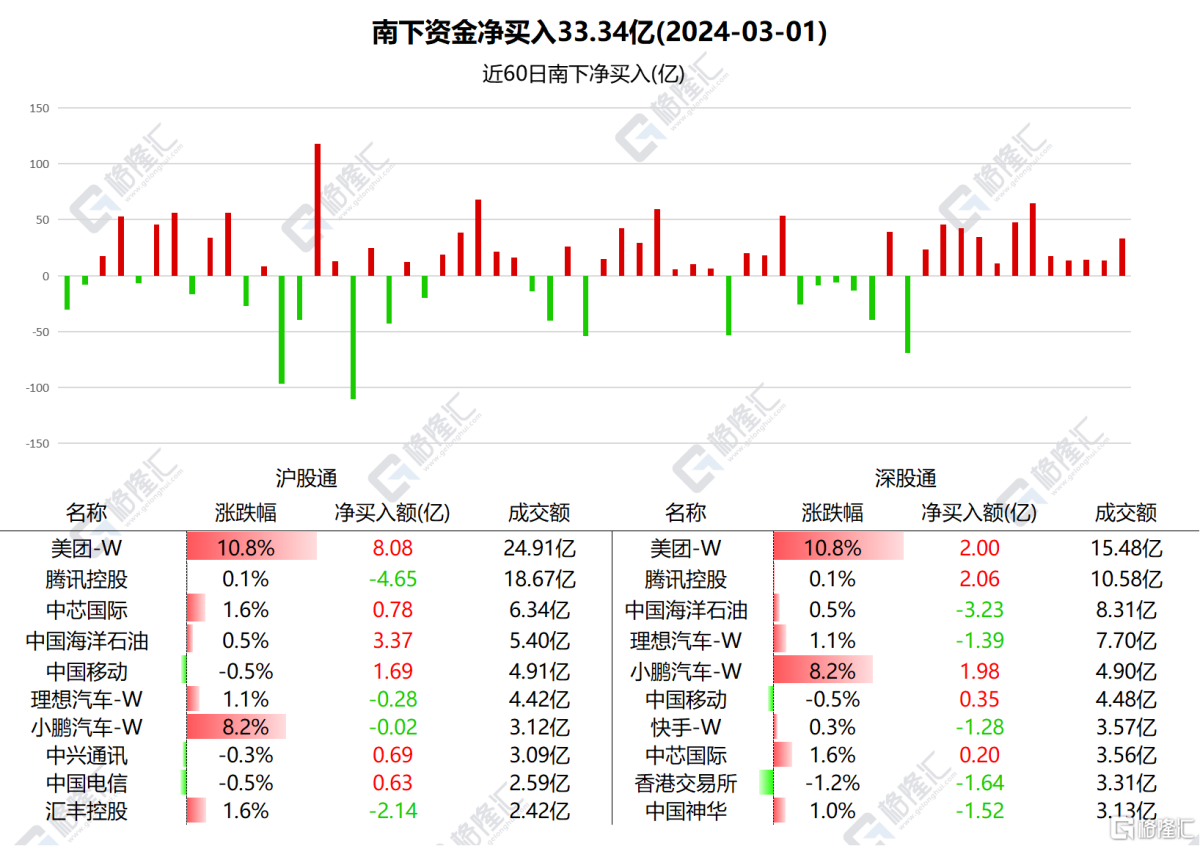

Southwest Capital made a net purchase of HK$3.334 billion in Hong Kong stocks today. Among them, Hong Kong Stock Connect (Shanghai) made net purchases of HK$2,337 million, and Hong Kong Stock Connect (Shenzhen) made net purchases of HK$997 million.

Among them, net purchases of Meituan were HK$1,08 million, China Mobile was HK$203 million, and Xiaopeng Motor was HK$195 million; net sales were Tencent HK$258 million, HSBC Holdings HK$213 million, Ideal Auto HK$166 million, Hong Kong Stock Exchange HK$163 million, China Shenhua HK$152 million, and Kuaishou HK$127 million.

According to statistics, Southbound has increased CNOOC's holdings for 14 consecutive days, totaling HK$5.318.4 billion; reduced Tencent's holdings for 6 consecutive days, totaling HK$2,1586.9 billion.

Nanshui focuses on individual stocks

Longji Green Energy:Yesterday, Longji Green Energy announced that it plans to repurchase shares for 300 million yuan to 600 million yuan. The repurchase price will not exceed RMB 3,154 per share. Longji Green Energy said in the latest investor relations questionnaire that due to changes in PV market demand and the company's order situation, the company moderately raised the module production schedule for March 2024

Oriental Wealth:According to the news, Dongfang Wealth announced that since August 24, 2023, it has repurchased 0.45% of its shares, used 1.01 billion yuan in capital, and adjusted the use of repurchased shares from employee stock ownership plans or equity incentive plans to cancellation and reduction of registered capital.

Zijin Mining:A previous research report by Ping An Securities pointed out that in the medium term, the direction of interest rate cuts for the whole year will not change under the downward trend in US inflation. Furthermore, overseas geopolitical uncertainty is expected to be another important factor driving gold in 2024, which is optimistic about the long-term rise in the gold price center.

Beishui focuses on individual stocks

Meituan:According to the news, Dongwu Securities released a research report saying that since November '23, Douyin and Meituan have successively adjusted the organizational structure and core leaders of the local lifestyle business, and the Meituan Home+Store business group has jointly reported to Wang Puzhong, which is conducive to better collaboration between the two major businesses in terms of merchant operations, live streaming products, membership systems, etc.; KeeTA is gaining experience and creating a new growth curve for the company. It is worth noting that there are rumors in today's intraday market that Meituan may stop the community group buying business.

China Mobile:Yang Jie, Chairman of China Mobile, attended Mobile World Congress 2024 and delivered a keynote speech entitled “From “5G+” to “AI+”, Jointly Create the Future of Digital Intelligence”. Yang Jie said that in the past five years, thanks to the full cooperation and joint efforts of all parties in the industry, next-generation information technology led by 5G has been widely applied. China Mobile has fully implemented the “5G+” plan, opened more than 1.9 million 5G base stations, nearly 800 million 5G package users, more than 25 million customers in the service industry, built more than 30,000 5G commercial cases such as smart factories, smart mines, and smart ports, and achieved large-scale applications.

Xiaopeng Motors:According to the news, Xiaopeng Motor and Volkswagen Group signed a strategic technical cooperation joint development agreement. This move is a milestone in strategic cooperation between the two sides and will accelerate joint research and development of two B-class pure electric vehicles. In addition, the two sides have also entered into a joint procurement plan for common parts for models and platforms. This means that in the subsequent joint development process, Xiaopeng Motor will fully benefit from the Volkswagen Group's global supply chain system, thereby further reducing the cost of the car building platform.