Key Insights

- ESSA Bancorp to hold its Annual General Meeting on 7th of March

- CEO Gary Olson's total compensation includes salary of US$560.8k

- Total compensation is similar to the industry average

- Over the past three years, ESSA Bancorp's EPS grew by 8.7% and over the past three years, the total shareholder return was 8.4%

CEO Gary Olson has done a decent job of delivering relatively good performance at ESSA Bancorp, Inc. (NASDAQ:ESSA) recently. As shareholders go into the upcoming AGM on 7th of March, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

How Does Total Compensation For Gary Olson Compare With Other Companies In The Industry?

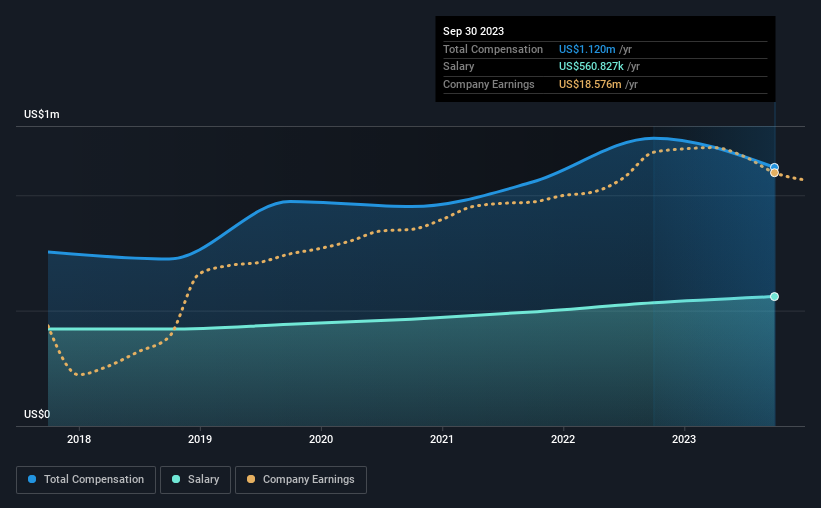

According to our data, ESSA Bancorp, Inc. has a market capitalization of US$163m, and paid its CEO total annual compensation worth US$1.1m over the year to September 2023. That's a notable decrease of 10% on last year. Notably, the salary which is US$560.8k, represents a considerable chunk of the total compensation being paid.

On examining similar-sized companies in the American Banks industry with market capitalizations between US$100m and US$400m, we discovered that the median CEO total compensation of that group was US$992k. So it looks like ESSA Bancorp compensates Gary Olson in line with the median for the industry. Moreover, Gary Olson also holds US$2.3m worth of ESSA Bancorp stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$561k | US$534k | 50% |

| Other | US$560k | US$713k | 50% |

| Total Compensation | US$1.1m | US$1.2m | 100% |

On an industry level, roughly 43% of total compensation represents salary and 57% is other remuneration. ESSA Bancorp pays out 50% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at ESSA Bancorp, Inc.'s Growth Numbers

ESSA Bancorp, Inc.'s earnings per share (EPS) grew 8.7% per year over the last three years. It saw its revenue drop 1.8% over the last year.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest EPS growth gives us some relief. It's hard to reach a conclusion about business performance right now. This may be one to watch. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has ESSA Bancorp, Inc. Been A Good Investment?

ESSA Bancorp, Inc. has not done too badly by shareholders, with a total return of 8.4%, over three years. It would be nice to see that metric improve in the future. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

So you may want to check if insiders are buying ESSA Bancorp shares with their own money (free access).

Switching gears from ESSA Bancorp, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.