Foreword:Looking ahead to 2024, against the backdrop of the beginning of the cryptocurrency bull market, the performance of companies in the industrial chain will inevitably resume high growth. For ICG, once the revenue scale and revenue growth rate rise again, its investment value will be reflected. The target market capitalization of 1 billion dollars is a shockable threshold, which is quite worth looking forward to.

After the US stock market on February 28, ICG.US (ICG.US) announced the fourth quarter and full year results of 2023.

Revenue in Q4 of 2023 increased compared to the same period in 2022, while profits resumed in Q4. Overall, the data performance was quite optimistic.Judging from the reaction of the capital market, it also gave an affirmationThe stock price rose 8.81% after the market.

Congchain Group (ICG) began recovering the market in Q4 last year before the US stock market. The cumulative increase in Q4 was over 100%, and only then gradually entered a volatile adjustment trend in Q1 of this year. Behind this, ICG's performance is closely related to the cryptocurrency market.

How will ICG evolve along with the market in 2023? In 2024, what catalytic factors are worth looking forward to in the market that may push ICG to surprise its performance?

The flatbread market continues to be bullish, and ICG's performance is recovering

In the first three quarters of last year, the cryptocurrency market was poor. The highest price of flatbread was less than 32,000 US dollars, and mining profit margins for miners and mining companies became more and more meager. Downstream is thinking about how to balance electricity spending to control costs and eventually overcome the bear market. This directly affects upstream mining machines and ASIC chip sales. It is easy to see this from the stock price performance of ICG and Canaan Technology at this stage.

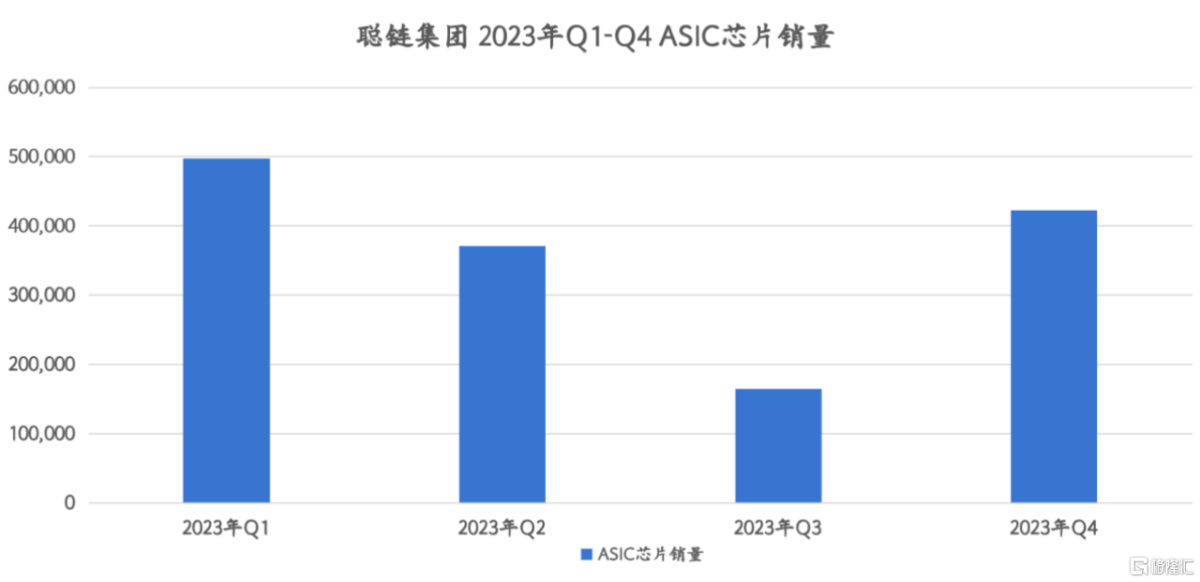

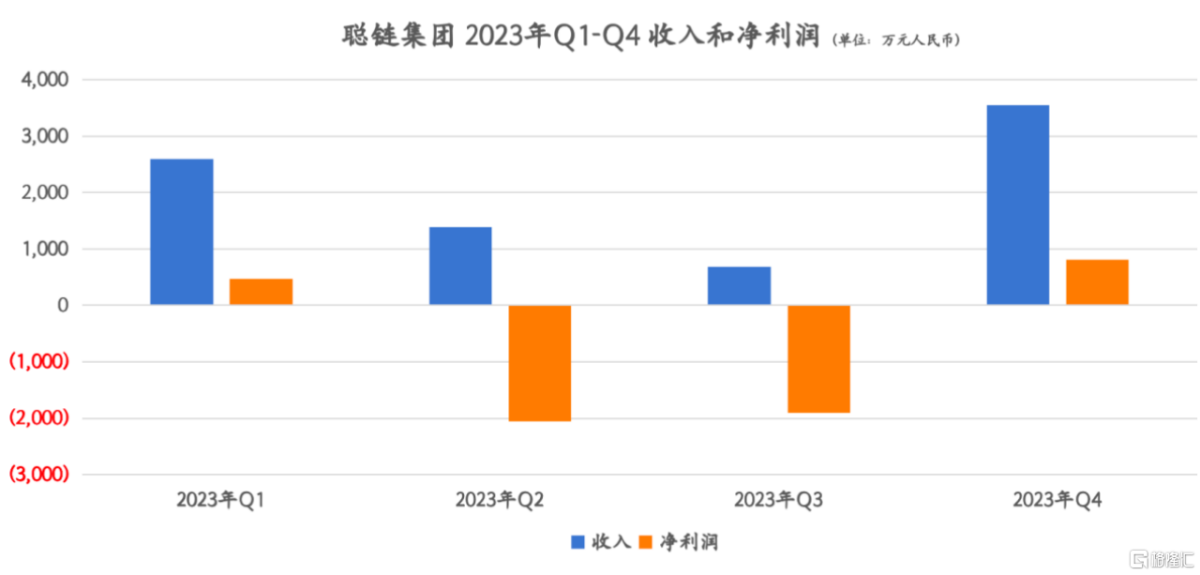

Beginning in the fourth quarter, the Flatcake Spot ETF approved expectations combined with the Fed's interest rate cut expectations. The market was bullish and led to a recovery in ICG's performance.As can be seen, ICG sold 423,040 ASIC chips in the fourth quarter of last year, compared to only 165,056 units in the third quarter, which is a significant increase in sales. Meanwhile, ICG began selling mining equipment with ASIC chips embedded in the fourth quarter, achieving sales volume of 135,168 units.

Because of this, management notes that revenue for the fourth quarter of 2023 increased by 418.2% compared to the third quarter. Meanwhile, ICG recovered quarterly profits, achieving net profit of 8.1 million yuan, while a net loss of 19.1 million yuan was recorded in the third quarter.

Although it has yet to fully recover, judging from the cryptocurrency market situation, ICG's performance in the first quarter of this year and beyond is expected to continue growing.

Before the “halving” incident in April, the price of flatbread had already exceeded 60,000 US dollars, which will greatly stimulate miners' demand for mining machines and ASIC chips. Take the big cake mining company Mara as an example. It is already planning to increase its hash rate to between 35 and 37 EH/s in 2024. Investment bank Jefferies analysts are also concerned that Mara has plans to buy more mining machines.

soFor upstream mining machine chip manufacturers such as ICG, chip sales and operating performance will be “carried away” by miners who “mine” mainstream mining coins and non-mainstream mining coins under the POW mechanismUnder the bull market, miners need to expand production, procure ahead of time, and reserve high computing power.

Looking at it in the long run,The impact from spot ETF approval will continue to be catalyzed, including the possibility that an ETH spot ETF will be approved in May, which will provide more stable support for cryptocurrency value growth and stimulate miners' demand for mining machines and ASIC chips over the long term.

Grayscale mentioned in the report that after the approval of the Big Cake Spot ETF, the net inflow of these new launches reached about 1.5 billion US dollars within 15 trading days, which is almost equivalent to selling pressure after three months of potential “halving”. In other words, capital inflows into mainstream ETFs will offset the original selling pressure on cryptocurrencies and support the price.

So,As cryptocurrency becomes more and more a mainstream asset allocation for a wide range of investors over time, it is a “stable happiness” for both the value of the currency and all parties in the industry chain.In this case, mining machine chip manufacturers such as ICG will usher in steady growth in performance. As you can see,ICG has been achievedThe “reversal of the predicament” is a clear sign of profit in a single quarter.

Cryptocurrency forms a “consensus”, and mining machine chips are more definitive

Think about it, what kind of long-term value opportunities do cryptocurrency and related industry chains have? At least from an investment perspective, we may only be able to truly hold firm and reap benefits if we can clearly see these essentials.

Actually,The sharp rise in the price of flatbread and the recent surge in chip stocks represented by Nvidia are all powerful upward (or downward) momentum for the market to trade their future and form a so-called “consensus”.However, the market capitalization size only reflects a facet of the process, or the result of a bet.

In the AI era, computing power is widely needed, and AI chips are the core of the core. As an upstream “seller”, Nvidia's performance took off as a result and became the most definitive investment target.

Cryptocurrency is gradually entering an era of large-scale asset allocation and is accepted by the public in the form of spot ETFs. This means that cryptocurrencies may still have a lot of value room to catch up with precious metals and various other ways to store value.This also means that cryptocurrencies are needed, and everyone will have more stable demand for upstream mining machines and ASIC chips.

Following this logic, it seems possible to rank “certainty.” The author believes,Mining Machine ASIC Chip>MSTR>Coin>Flatbread. As an exchange, Coin makes money from transaction fees; MSTR holds flatbread, such as leveraged flatbread investments; mining machines and ASIC chips are “shovels” and have a high degree of growth certainty.

Currently, the market value of flatbread is about 1.233 trillion US dollars, which is about to surpass the market value of silver. The market value of gold is close to 14 trillion US dollars, and the market value of the S&P 500 index is about 43 trillion US dollars. Some agencies have given a target price of 175,000 US dollars for flatbread. This seems very far out of reach, but it must be acknowledged that if some of the market values of other assets are transferred, then it is not difficult to double the market value.

So overall, investors and all parties in the industry chain can also explore huge value space in it, and ICG is no exception.In a bull market, the growth of mining machines and ASIC chips is more than certain.

At present, ICG has gradually expanded downstream, starting with ASIC chips, and completed the acquisition of Goodshell in the latest quarter. As a result, ICG can empower mining rigs with its ASIC chip customization capabilities and provide existing customers with ASIC chips and new mining machine products. This means,ICG can reap new growth opportunities, which is expected to open up more room for growth.