Despite an already strong run, Arcutis Biotherapeutics, Inc. (NASDAQ:ARQT) shares have been powering on, with a gain of 75% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 36% in the last twelve months.

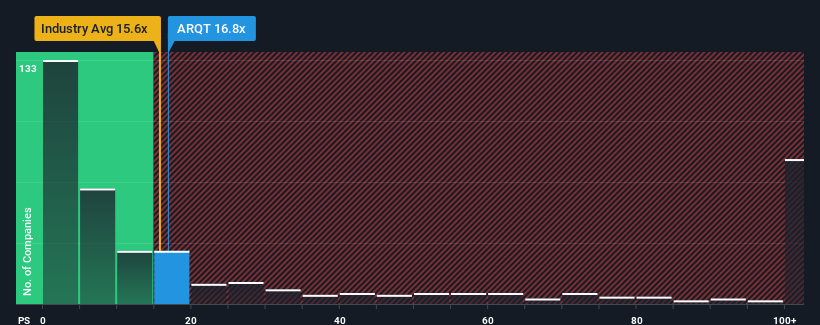

Even after such a large jump in price, there still wouldn't be many who think Arcutis Biotherapeutics' price-to-sales (or "P/S") ratio of 16.8x is worth a mention when the median P/S in the United States' Biotechs industry is similar at about 15.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Arcutis Biotherapeutics' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Arcutis Biotherapeutics has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Arcutis Biotherapeutics.Is There Some Revenue Growth Forecasted For Arcutis Biotherapeutics?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Arcutis Biotherapeutics' to be considered reasonable.

Retrospectively, the last year delivered an explosive gain to the company's top line. Although, its longer-term performance hasn't been anywhere near as strong with three-year revenue growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 84% each year over the next three years. That's shaping up to be materially lower than the 296% per year growth forecast for the broader industry.

In light of this, it's curious that Arcutis Biotherapeutics' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Arcutis Biotherapeutics' P/S Mean For Investors?

Its shares have lifted substantially and now Arcutis Biotherapeutics' P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Given that Arcutis Biotherapeutics' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Arcutis Biotherapeutics (at least 1 which is concerning), and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.