Despite an already strong run, Arcturus Therapeutics Holdings Inc. (NASDAQ:ARCT) shares have been powering on, with a gain of 28% in the last thirty days. The last month tops off a massive increase of 164% in the last year.

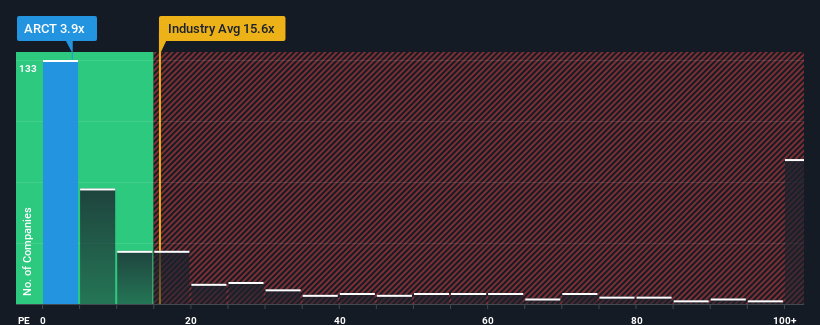

In spite of the firm bounce in price, Arcturus Therapeutics Holdings may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.9x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 15.6x and even P/S higher than 73x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

How Has Arcturus Therapeutics Holdings Performed Recently?

With revenue growth that's superior to most other companies of late, Arcturus Therapeutics Holdings has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Arcturus Therapeutics Holdings.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Arcturus Therapeutics Holdings' to be considered reasonable.

Retrospectively, the last year delivered an explosive gain to the company's top line. The amazing performance means it was also able to deliver huge revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 16% per annum as estimated by the ten analysts watching the company. That's shaping up to be materially lower than the 296% per year growth forecast for the broader industry.

With this in consideration, its clear as to why Arcturus Therapeutics Holdings' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Shares in Arcturus Therapeutics Holdings have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Arcturus Therapeutics Holdings' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for Arcturus Therapeutics Holdings that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.