Vistra Corp. (NYSE:VST) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 135% in the last year.

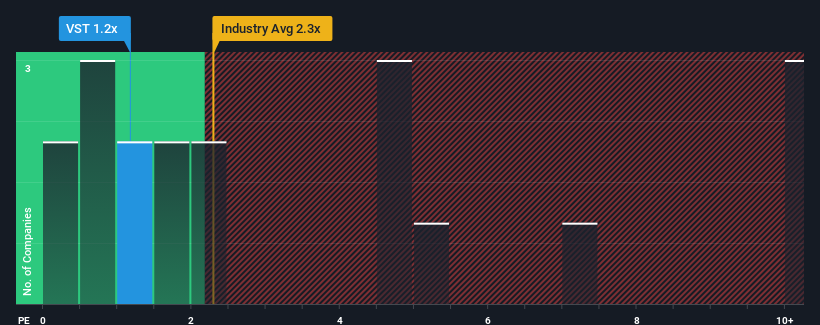

Even after such a large jump in price, Vistra may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.2x, considering almost half of all companies in the Renewable Energy industry in the United States have P/S ratios greater than 1.9x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Vistra's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Vistra has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Vistra.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Vistra's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. Pleasingly, revenue has also lifted 32% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 6.5% per year during the coming three years according to the five analysts following the company. Meanwhile, the broader industry is forecast to expand by 7.3% per year, which paints a poor picture.

With this in consideration, we find it intriguing that Vistra's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Vistra's P/S

The latest share price surge wasn't enough to lift Vistra's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Vistra's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Vistra's poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Vistra (1 is concerning) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.