Zhejiang Sunoren Solar Technology Co.,Ltd. (SHSE:603105) shareholders should be happy to see the share price up 11% in the last week. But that doesn't change the reality of under-performance over the last twelve months. After all, the share price is down 43% in the last year, significantly under-performing the market.

While the last year has been tough for Zhejiang Sunoren Solar TechnologyLtd shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the Zhejiang Sunoren Solar TechnologyLtd share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

The divergence between the EPS and the share price is quite notable, during the year. So it's well worth checking out some other metrics, too.

Given the yield is quite low, at 1.2%, we doubt the dividend can shed much light on the share price. Zhejiang Sunoren Solar TechnologyLtd managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

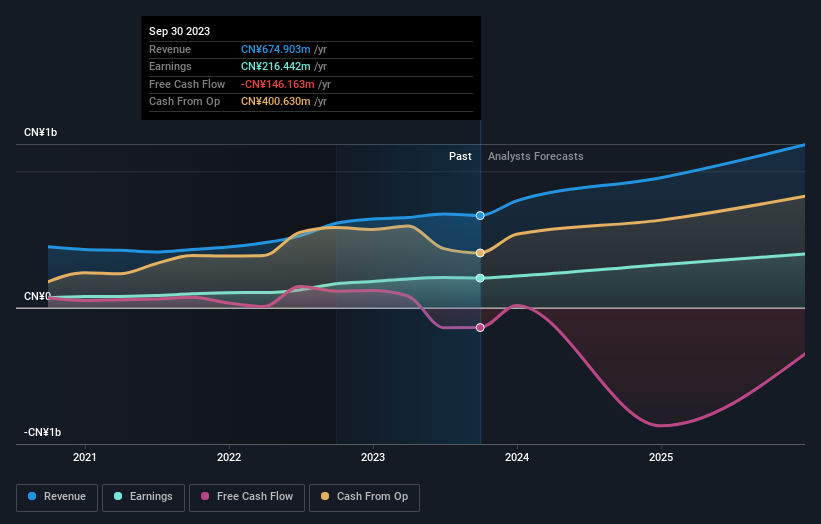

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Zhejiang Sunoren Solar TechnologyLtd has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Zhejiang Sunoren Solar TechnologyLtd's financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Zhejiang Sunoren Solar TechnologyLtd shareholders are down 43% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 17%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Zhejiang Sunoren Solar TechnologyLtd better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Zhejiang Sunoren Solar TechnologyLtd you should be aware of.

We will like Zhejiang Sunoren Solar TechnologyLtd better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.