Track the latest developments in north-south funding

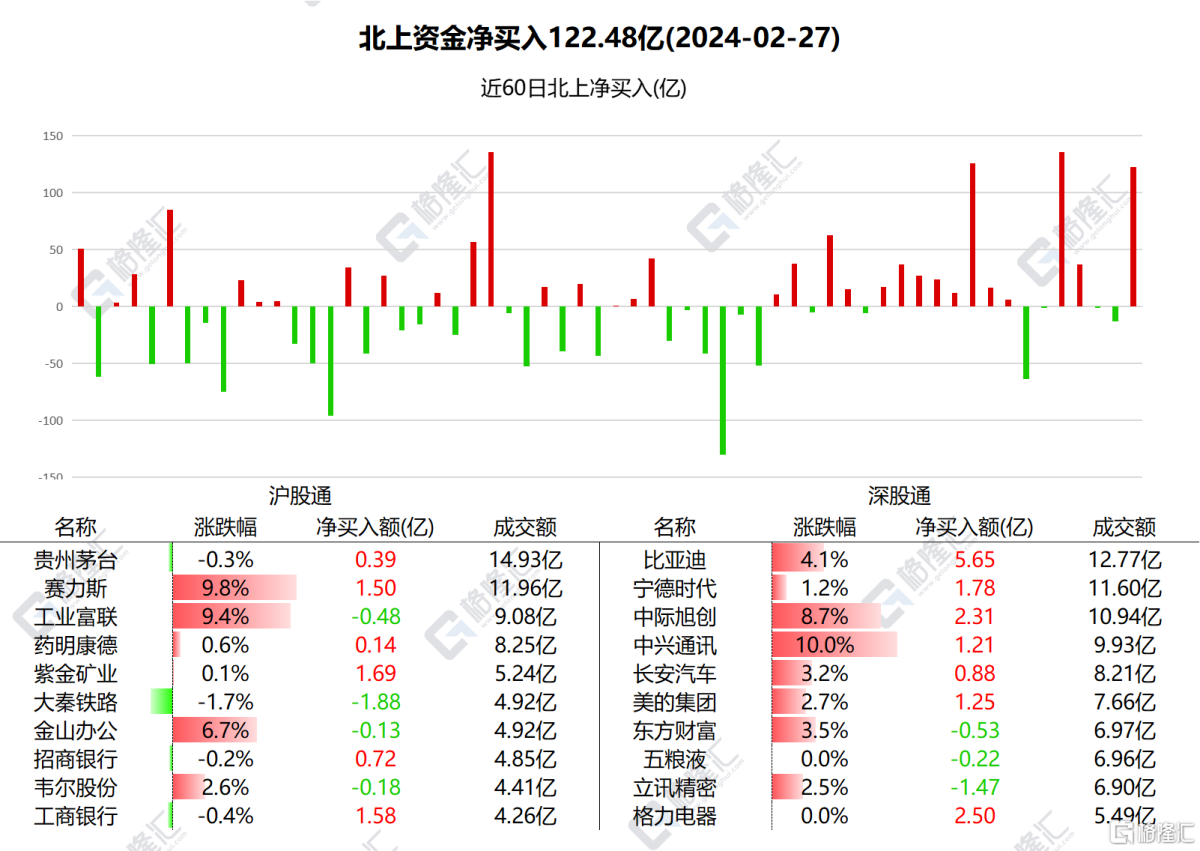

On February 27, Beishang Capital made a significant net purchase of 12.248 billion yuan of A-shares, the third time since February that the net purchase amount in a single day exceeded 12 billion yuan. Among them, Shanghai Stock Connect had net purchases of 6.214 billion yuan and Shenzhen Stock Connect had net purchases of 6.035 billion yuan.

Among the top ten traded stocks, the top three were BYD, Gree Electric, and Zhongji Xuchuang, which received net purchases of 565 million yuan, 250 million yuan, and 231 million yuan respectively.

The Daqin Railway had the highest net sales volume, amounting to 188 million yuan.

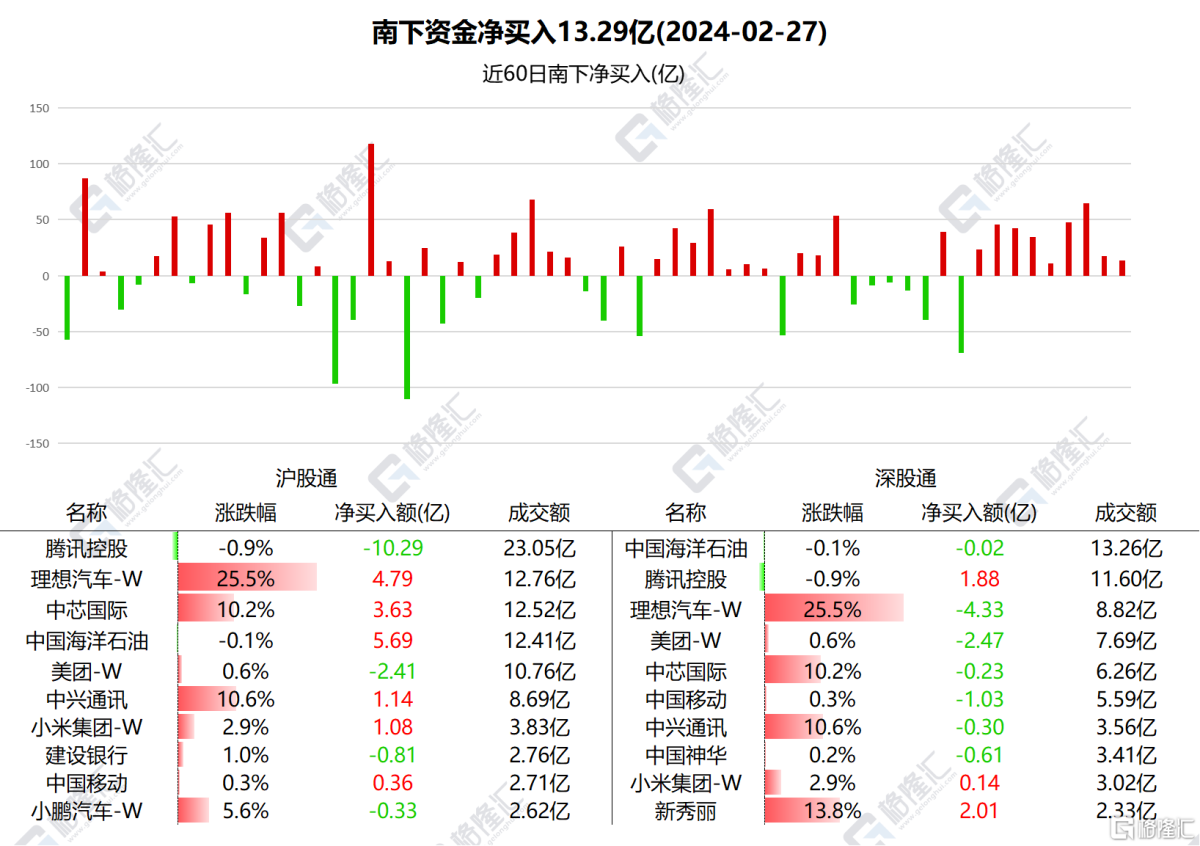

Today, Southwest Capital made a net purchase of HK$1,329 billion in Hong Kong stocks. Among them, Hong Kong Stock Connect (Shanghai) made a net purchase of HK$1,182 million, and Hong Kong Stock Connect (Shenzhen) made a net purchase of HK$148 million.

Net purchases of CNOOC HK$566 million, SMIC HK$339 million, Samsonite HK$200 million, Xiaomi HK$122 million; net sales of Tencent HK$841 million and Meituan HK$487 million.

According to statistics, Southbound has increased CNOOC's holdings for 11 consecutive days, totaling HK$5.124.3 billion; adding Ideal Auto for 9 consecutive days, for a total of HK$1,1609.5 billion.

Nanshui focuses on individual stocks

BYD:According to the Qunyi Securities (Hong Kong) research report, BYD recently released a variety of products and continues to gain strength in mainstream and high-end markets. The Qin PLUS Honor Edition achieves “lower electricity than fuel” pricing, which is expected to seize the fuel vehicle market faster.

Gree Electric:Tianfeng Securities released a research report saying that the emphasis on policies mentions “trade-in” to facilitate the release of demand for home appliance stock renewal. Compared with the previous round of trade-in policies, the current domestic home appliance market has a larger stock, and there is room for renewal demand. With subsequent national and local capital investment, demand for industry upgrading is expected to be better released. At the same time, the increase in the concentration of the domestic home appliance industry is expected to enable leading enterprises to fully benefit from favorable policies and seize greater growth. The bank believes that at a time when growth and stock coexist in the domestic home appliance industry, along with the implementation of this round of home appliance trade-in policies, it is expected to bring greater demand and potential for upgrading.

Zhongji Asahikawa:According to an analysis by Tianfeng Securities, in the context of the computing power era, data centers have become major energy consumers. Upgrading optical module technology not only simply doubles the rate, but also needs to solve the problems of high power consumption and high cost caused by the increase in speed. CPO, LPO, silicon light, and thin-film lithium niobate solutions are expected to be breakthroughs in solving this series of problems.

Beishui focuses on individual stocks

SMIC:According to the news, the State Assets Administration Commission recently held a special promotion conference on artificial intelligence for central enterprises on “AI Empowering Industry Renewal” to speed up the construction of a number of intelligent computing power centers. It triggered a rapid rise in market sentiment towards the semiconductor industry. In addition, the 2024 Mobile World Congress kicks off in Barcelona, Spain this week. Many advanced technology concepts such as AI communication, autonomous driving, and robotics have also catalyzed market expectations for the semiconductor industry.

ZTE:Recently, at the MWC2024 conference, ZTE unveiled the top ten innovative products and solutions for 5G-A to help accelerate 5G-A from industrial consensus to commercial application. According to reports, ZTE's top ten innovative products and solutions cover green infrastructure, multi-dimensional technological innovation and application expansion for TOC, TOB, and TOX application scenarios, and the integration of 5G-A with AI.

Meituan:According to the news, Meituan automatic delivery vehicles appeared at the MWC2024 conference. According to reports, Meituan began unmanned delivery in 2016. Three years later, Meituan's first self-developed unmanned delivery vehicle passed the test and became the first “certified” service-type low-speed unmanned vehicle in the mainland. Currently, Meituan automatic delivery vehicles have started pilot projects in parts of Beijing and Shenzhen.

CNOOC:According to the news, CNOOC said that the test capacity of the new drilling well in the Bozhong 26-6 oilfield of the 100 million ton oil field reached a record high, adding more than 40 million cubic meters of proven oil and gas reserves, which means that the total proven reserves of the oil field have exceeded 200 million cubic meters, making it the largest metamorphic rock oil field in the world. Furthermore, according to reports, ExxonMobil and CNOOC are considering exercising their rights to acquire Hess's shares in a large-scale offshore oil development project in Guyana, which may disrupt Chevron's transaction to acquire Hess for 53 billion US dollars.

THE IDEAL CAR:On February 26, Ideal Auto released financial reports showing that in the fourth quarter of 2023, the company achieved revenue of 41.73 billion yuan, a sharp increase of 136.4% over the previous year; net profit of 5.75 billion yuan, an increase of 2068.2% over the previous year. In 2023, the company achieved revenue of 123.85 billion yuan, an increase of 173.5% over the previous year. This also made Ideal the first new power car company in China to exceed 100 billion yuan in revenue.