The next Holy Dragon?

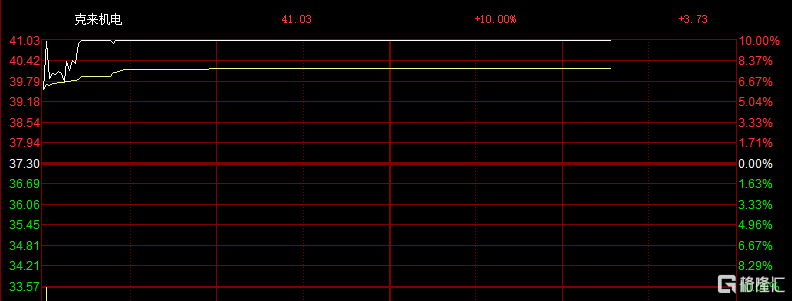

On February 27, Klay Mechatronics's stock price rose 5.92%. After opening, the company's stock price fluctuated upward. The intraday lockdown rose and stopped, and the company successfully won 13 consecutive markets. The latest price was 41.03 yuan, a new high since December 2021, with a market value of 10.8 billion yuan.

If I had to find a favorable explanation for this wave of financial speculation,It is still a fermentation of the concept of “new quality productivity” from the beginning of the year.Combined with the 15-word blessing of the weekend's top stories —“Large-scale equipment renewal and consumer goods trade-in”, the firepower directly exploded again.

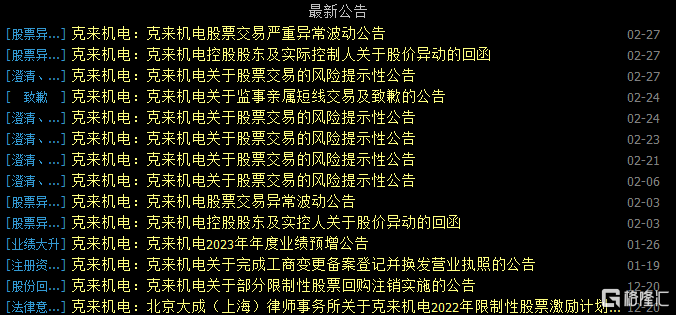

However, in recent years, Krei Mechatronics has continuously issued risk alerts. Recently, on the evening of February 26, Klei Mechatronics announced that due to the recent large fluctuations in the company's stock trading volume and turnover rate, there may be a risk of excessive market sentiment and irrational speculation. The company reminds investors to make rational decisions and invest prudently.

But how can you say that, as the old shareholder community knows, change announcements have always been the standard for continuously rising and stopping stocks. The “risk alert” is the issuance of monster stock passes, so how high can this wave be verified? (For entertainment only, not for investment reference)

Ignore the “referee” licensing warning

Obviously, the benchmark for the rebound in new quality productivity+A-shares, Klay Mechatronics became the pioneer in this round of the A-share rebound. This strong 13-board wave has already rewritten the 11-game record set by Shenzhen China A from January 9 to 23 this year, and has become the new “king of consecutive boards” for A-shares since this year.

In fact, after a successful 12-game streak yesterday, the market is already relishing this, and shareholders have begun to circulate images of the new version of “13 Subs Win” everywhere.

Looking back at this sharp trend, from February 1, there has been a cumulative sharp rise of 245% during the period. At the same time, as of press time, Shenzhen China A's stock price has risen by 184.37% since the beginning of the year, followed by a 175.92% increase over the same period.

However, historical experience has always proven that every time the market starts to blow like this, short-term monster stocks may peak! The dragon head probably won't die, but the boys in the back row should be careful. After all, the fish head market hasn't caught up. Just watch the fish market slap rotten thighs; just look at the fish tail market!

According to public information, Klei Mechatronics is mainly engaged in the business of intelligent equipment and auto parts. The company covers many popular topics, including CPO concepts, Huawei cars, robots, driverless cars, and new energy vehicles.

According to the 2023 annual performance advance announcement recently issued by Klei Electromechanical, the company expects to achieve net profit of 91.4799 million to 97.9221 million yuan in 2023, an increase of 42%-52% over the previous year. During the reporting period, the company's auto parts business benefited from the improvement in the automobile market, increased sales volume, and increased product revenue and gross margin.

Regarding the main reason for the pre-increase in performance, the announcement shows that in 2023, with changes in the macro environment and the concerted efforts of various policies, the overall operation of China's economy continued to improve. At the same time, the company continued to improve internal management, improve operating capacity, reduce costs and increase efficiency, and operating performance continued to improve. The auto parts business has benefited from the improvement in the automobile market, increased sales, and increased product revenue and gross margin.

Furthermore, in today's market, high-ranking stocks initially began to fall behind in the direction of some individual stocks. For example, Lanke Hi-Tech fell to a halt. 263, Anoch, and Zhongwei Electronics had the highest declines, then advanced to the 13th consecutive board, and market sentiment was quickly repaired.

Some market sources said that Krai Mechatronics advanced to the 13th consecutive board. Although Weyhead began adjustments today, yesterday's rise and fall also broke out of the 20cm 7-channel market, opening up a high level of space between 10CM and 20CM individual stocks, capital began large-scale imitation speculation, and technology stocks represented by new industrialization continued to fully blossom.Therefore, there is a clear trend of strengthening small-cap micro-cap stocks in the market, but we still need to pay attention to the risk of market fragmentation in the future.