Polestar Automotive Holding UK PLC (NASDAQ:PSNY) shareholders that were waiting for something to happen have been dealt a blow with a 40% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 75% loss during that time.

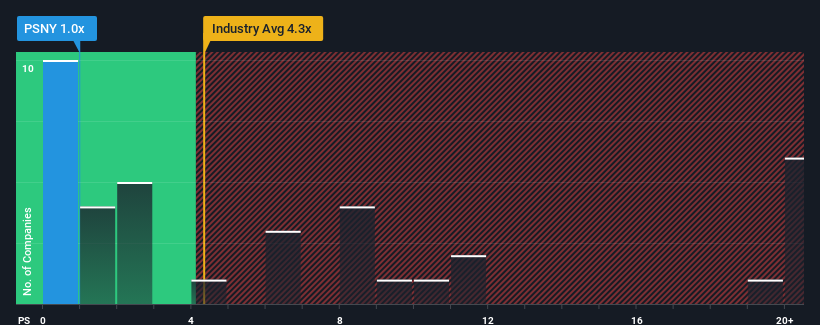

Following the heavy fall in price, Polestar Automotive Holding UK may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1x, considering almost half of all companies in the Auto industry in the United States have P/S ratios greater than 4.3x and even P/S higher than 11x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

How Polestar Automotive Holding UK Has Been Performing

Polestar Automotive Holding UK could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Polestar Automotive Holding UK's future stacks up against the industry? In that case, our free report is a great place to start.How Is Polestar Automotive Holding UK's Revenue Growth Trending?

In order to justify its P/S ratio, Polestar Automotive Holding UK would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 37% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 65% per annum as estimated by the seven analysts watching the company. With the industry only predicted to deliver 28% each year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Polestar Automotive Holding UK's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Polestar Automotive Holding UK's P/S

Shares in Polestar Automotive Holding UK have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems Polestar Automotive Holding UK currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Having said that, be aware Polestar Automotive Holding UK is showing 4 warning signs in our investment analysis, and 2 of those don't sit too well with us.

If these risks are making you reconsider your opinion on Polestar Automotive Holding UK, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.