The main aim of stock picking is to find the market-beating stocks. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term Shanghai Ganglian E-Commerce Holdings Co., Ltd. (SZSE:300226) shareholders for doubting their decision to hold, with the stock down 43% over a half decade. Shareholders have had an even rougher run lately, with the share price down 15% in the last 90 days. Of course, this share price action may well have been influenced by the 11% decline in the broader market, throughout the period.

The recent uptick of 6.6% could be a positive sign of things to come, so let's take a look at historical fundamentals.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate half decade during which the share price slipped, Shanghai Ganglian E-Commerce Holdings actually saw its earnings per share (EPS) improve by 16% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

Because of the sharp contrast between the EPS growth rate and the share price growth, we're inclined to look to other metrics to understand the changing market sentiment around the stock.

The modest 0.3% dividend yield is unlikely to be guiding the market view of the stock. Arguably, the revenue drop of 7.9% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

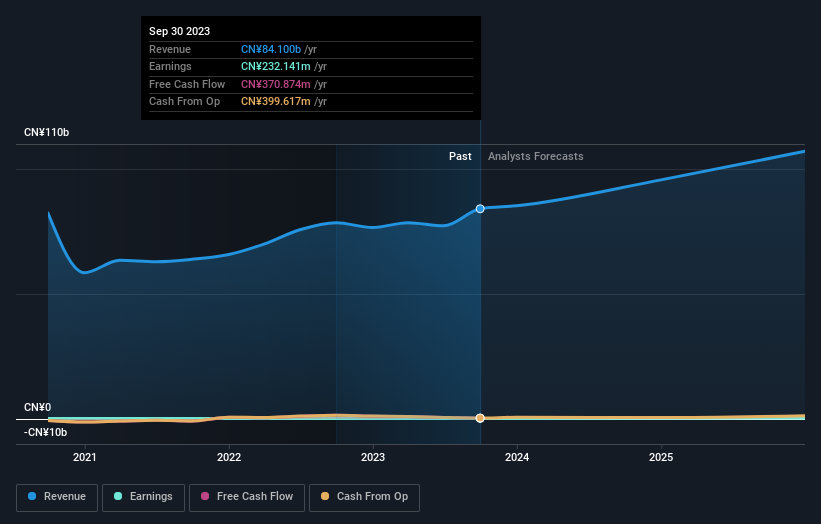

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Shanghai Ganglian E-Commerce Holdings has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Shanghai Ganglian E-Commerce Holdings stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While it's certainly disappointing to see that Shanghai Ganglian E-Commerce Holdings shares lost 16% throughout the year, that wasn't as bad as the market loss of 20%. Unfortunately, last year's performance may indicate unresolved challenges, given that it's worse than the annualised loss of 7% over the last half decade. Whilst Baron Rothschild does tell the investor "buy when there's blood in the streets, even if the blood is your own", buyers would need to examine the data carefully to be comfortable that the business itself is sound. Before deciding if you like the current share price, check how Shanghai Ganglian E-Commerce Holdings scores on these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.