34 years later, finally unbundled

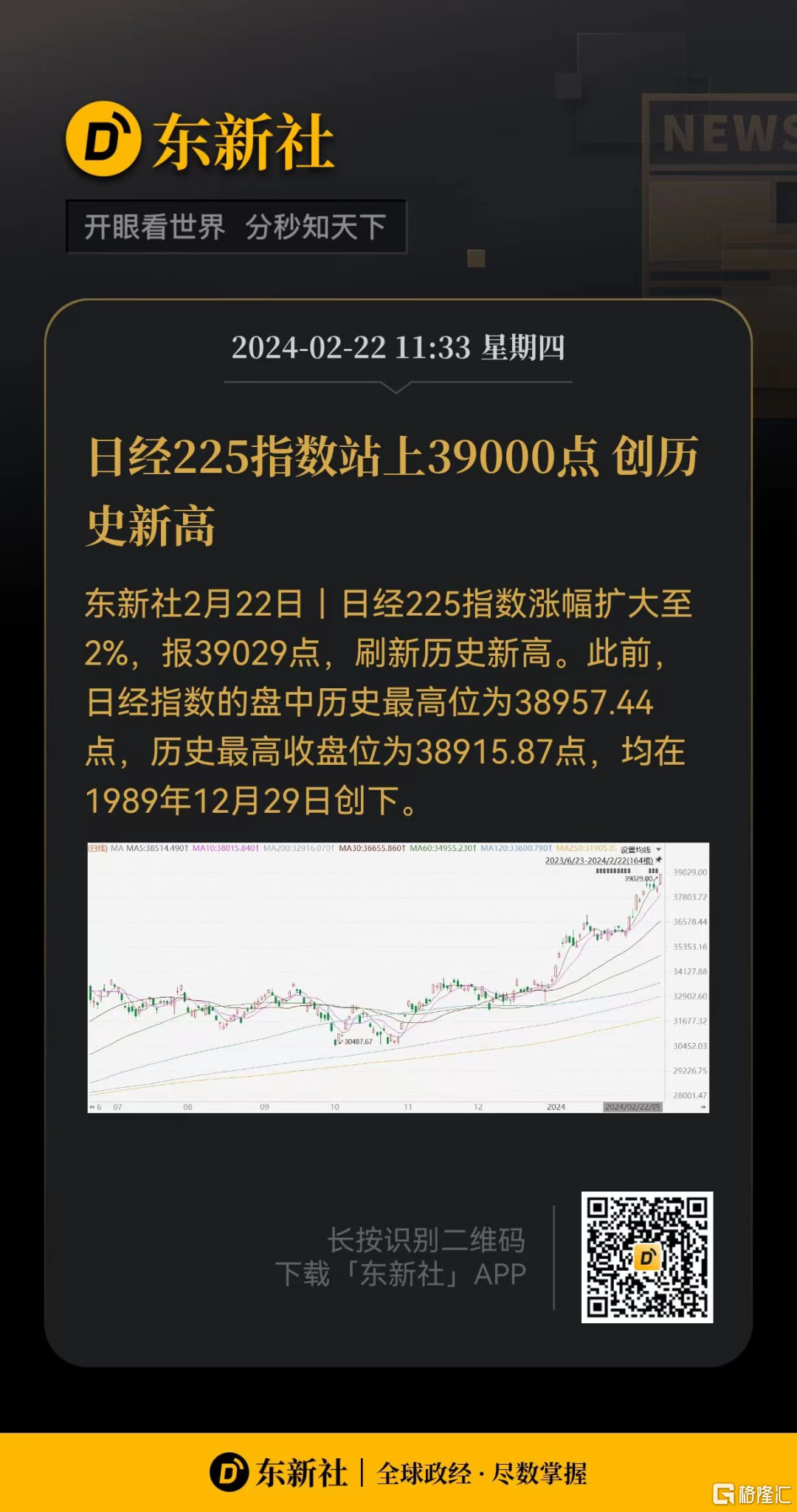

As the computer continues to pop up news of the record high of Japanese stocks: The Nikkei 225 Index climbed to 39,000 points, finally breaking through the all-time high of 38,915 points set during the bubble economy at the end of 1989.

For some reason, I had goosebumps all over my body. Yes, it's been 34 years. For those who bought it on December 29, 1989, the deal finally came on February 22, 2024. Time flies, and it's been a full 34 years since I went back.

I just don't know if that wave of people can wait until today?

There's no reason. Remembering Shi Tiesheng, the day people made a choice, standing at a fork in the road, you still thought it was just the most dull day in your life, yet you couldn't imagine that this choice was in the future, right in your eyes.

People mess around in the stock market; how can anyone not get stabbed. I'm afraid this goosebumps just resonate with people who have fallen from Tianya (I want to go ashore too).

1

Japanese stocks hit a record high

On February 22, 2024, witness the history of other people's stock markets!

Today, the Nikkei 225 Index closed up 2.19% to 3,9098 points, breaking the record high of 38,957 points during the bubble economy period at the end of 1989, breaking a new record high.

After the collapse of the bubble economy in 1989, the Japanese stock market began an adjustment that lasted nearly 20 years.

In 2009, the Nikkei 225 Index slowly rebounded from 6994.9 points. The market broke through important hurdles in 2015, 2018, and 2020. The index rose more than 28% for the full year of 2023, and was even more intense at the beginning of 2024, with a cumulative increase of more than 17% since the beginning of the year.

Why are Japanese stocks so strong? Using Buffett's endorsement alone, it is difficult to fully explain the sudden rise in Japanese stock investment frenzy.

If we look at Japan's GDP performance in 2023, you'll be even more puzzled. The Japanese economy has experienced negative growth for two consecutive quarters, and the nominal GDP growth rate in 2023 fell to fourth place in the world, overtaken by Germany, which has a weak economy.

Why did Japanese stocks reach new highs?

2

The reason for the new high in Japanese stocks

In fact, the previous article on ETF Evolution “The Strongest After the Spring Festival Was Surprising!” It has already been mentioned:GDP has never been an absolute measure of a country's economy. Whether a country's economy is good or not is ultimately about profit. The same is true when it comes to settling in a listed company. Whether an enterprise is good or not, more importantly, how much money it earns.

There are two key factors behind the record high in Japanese stocks: improved profits of Japanese companies and improved governance of the Tokyo Stock Exchange.

The net profit forecast for Japanese listed companies for fiscal year 2023 is 43.5 trillion yen, up 13% year on year, 3.5 trillion yen higher than the forecast at the beginning of the fiscal year in May last year, and is expected to reach a record high for three consecutive years.

If we take a closer look at which Japanese listed companies are improving their profits, we will find that global companies are performing better.

Companies that have made new profits are well-known large companies, such as Toyota, Nintendo, Suzuki, and Fuji Mechatronics. Judging from the results for the fourth quarter of 2023, the share of Japanese listed companies with a high share of overseas sales raising profit expectations is rapidly expanding.

This is due to the resilience of the US economy providing external demand to the global market, and the maintenance of the Japan-US spread also exacerbated the weakening of the yen after the Bank of Japan's many interest rate hikes failed, all of which are beneficial to Japan's export economy.

For export-oriented listed companies, if the yen depreciates and export sales increase, book profits will increase, which in turn will drive up the stock market.

Japan's exports in 2023 were 100.88 trillion yen, a record high, and the trade deficit was 9.29 trillion yen, a decrease of 54.3% year over year.

Second, stock buybacks are also an important reason for the strength of the Japanese stock market.

The total amount of shares repurchased by Japanese listed companies in 2023 reached about 9.6 trillion yen, an increase of 135 billion yen over the previous year. The scale has increased for 3 consecutive years, and reached a record high for 2 consecutive years.

With the support of these two factors, it can be said that Japanese stocks are booming in the global market. The money-making effect has come out. Fearful capital has flowed into the Japanese stock market like crazy, further driving Japanese stocks to soar.

According to data released by the Japan Exchange Group, net stock purchases by overseas investors in the 2nd week of January reached 1.4 trillion yen, the largest since April 2023. According to institutional analysis, there are national wealth sovereign funds and hedge funds behind this.

From an ETF perspective, overseas Japanese stock ETFs had a total inflow of 3.1 billion US dollars in the 5 weeks beginning in early 2024, and the overall balance of Japanese stock ETFs listed overseas reached 77.7 billion US dollars, a new high since 2002.

A-share shareholders also used Nikkei ETFs to participate in the Japanese stock market. Nikkei ETFs were bombarded in January of this year, and major fund companies frequently warned of premium risks.

Currently, there are five A-share ETF products that track the Japanese stock market. Among them, the two largest products are Huaxia Fund Nikkei ETF and Huaan Fund Nikkei 225 ETF, respectively.

(The content of this article is a list of objective data and information and does not constitute any investment advice)

3

What do you think of Japanese stocks after reaching new highs?

Now everyone's biggest concern should be, can Japanese stocks continue to reach new highs?

Wall Street's answer to this is: they are all bullish. Some institutions are even shouting: What does breaking through the 34-year high count mean that Japanese stocks will continue to innovate their history. 40,000 points, or even 41,000 points, are nothing to be said about.

Global asset management giant BlackRock even bluntly stated that Japanese stocks would be the big winner of the Bank of Japan's interest rate hike. Yue Bamba, head of BlackRock's active equity investment department in Japan, predicts thatThe Bank of Japan will withdraw from the YCC policy as early as March, believing that this will clearly differentiate Japan from the monetary policies of Europe and the US, and make Japan a hotspot of interest for global investors.

In addition to BlackRock, J.P. Morgan Chase, Bank of America Securities, and BNP Paribas are also bullish on Japanese stocks.

Bank of America Securities raised the 2024 year-end target for Japanese stocks on February 19: The Nikkei Average reported 41,000 points at the end of the year, compared to the previous forecast of 38,500 points.

Bank of America Securities is optimistic about Japanese stocks for three major reasons: 1) steady performance in the third quarter; 2) real wages and manufacturing cycles will resume from April to June; 3) May will see more corporate reforms and repurchases, and announce full fiscal year results.

CICC Securities is also optimistic that the Nikkei Index will break through 40,000 points in 2024. The reason is that compared with the Japanese stock market of more than 38,000 points in 1989, the current valuation level of Japanese stocks is more reasonable, there are more companies with excellent profitability, more globally competitive companies, and better corporate governance.

With praise from all over the market, some of the shorted capital even used options to chase up Japanese stocks. Bullish option contracts (unsettled balance) with an exercise price of 40,000 yen and 41,000 yen increased rapidly in March.

Source: Nikkei Chinese.com

From sovereign wealth funds and hedge funds to overseas individual investors, emptying capital has been a blessing in this stock market that has been lost for 20 years.

I don't know when the bullet that was fired this time will hit who's eyebrows?