It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Johnson Electric Holdings (HKG:179). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Johnson Electric Holdings with the means to add long-term value to shareholders.

Johnson Electric Holdings' Improving Profits

Over the last three years, Johnson Electric Holdings has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, Johnson Electric Holdings' EPS grew from US$0.12 to US$0.24, over the previous 12 months. It's not often a company can achieve year-on-year growth of 97%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Johnson Electric Holdings shareholders can take confidence from the fact that EBIT margins are up from 2.0% to 7.9%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

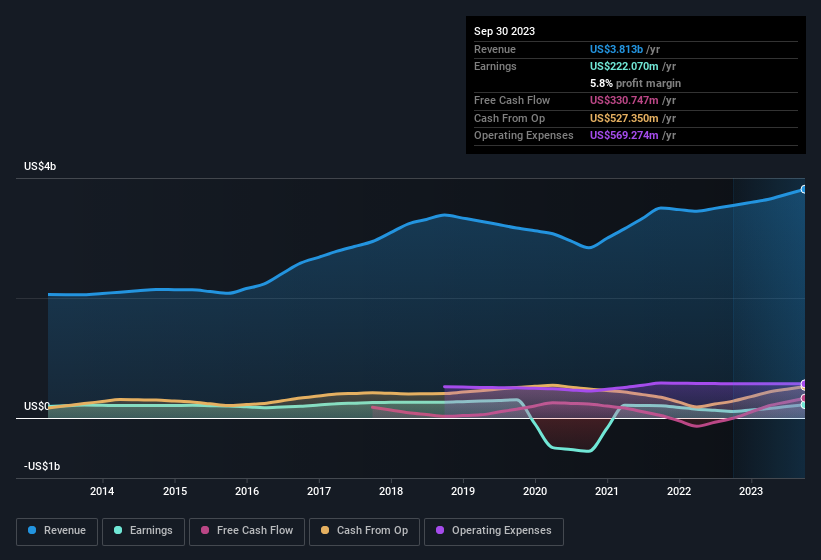

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Johnson Electric Holdings' balance sheet strength, before getting too excited.

Are Johnson Electric Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One shining light for Johnson Electric Holdings is the serious outlay one insider has made to buy shares, in the last year. Specifically, the Honorary Chairman, Yik-Chun Wang Koo, accumulated US$18m worth of shares at a price of US$11.46. Seeing such high conviction in the company is a huge positive for shareholders and should instil confidence in their mission.

On top of the insider buying, we can also see that Johnson Electric Holdings insiders own a large chunk of the company. Indeed, with a collective holding of 68%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. And their holding is extremely valuable at the current share price, totalling US$6.7b. That means they have plenty of their own capital riding on the performance of the business!

Should You Add Johnson Electric Holdings To Your Watchlist?

Johnson Electric Holdings' earnings per share have been soaring, with growth rates sky high. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Johnson Electric Holdings deserves timely attention. We should say that we've discovered 1 warning sign for Johnson Electric Holdings that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Johnson Electric Holdings, you'll probably love this curated collection of companies in HK that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.