Jinwu Financial News | CCB International Development Research reports that in addition to expecting interest to peak during the year, hoping that the inflow of talents will surpass the population outflow and further increase rents to support housing prices, various structural factors will still drag down the Hong Kong real estate market. These include the negative wealth effects of the stock market and property market, the aging population, a surge in the supply of public and private housing, and a decline in the carrying capacity of buyers and developers. The bank expects residential housing prices in Hong Kong to fall by 10-15% in 2024-25 until several bottoming signs: (1) the Hong Kong Government cancels all demand management measures (removal); (2) the cost of carrying (cost of carry) falls to zero or negative levels; (3) inventories fall back as housing supply peaks; and (4) household financial conditions improve as the economy recovers.

According to the bank, even without much government intervention, the Hong Kong commercial real estate market is on a structural downward trajectory. Office rents are expected to drop further by 10% and 5% in 2024 and 2025. Until (1) the vacancy rate and new supply are absorbed by the market; (2) occupancy costs (occupancy costs) fall back to a reasonable level; and (3) the trend of enterprise downsizing abates as the economy recovers.

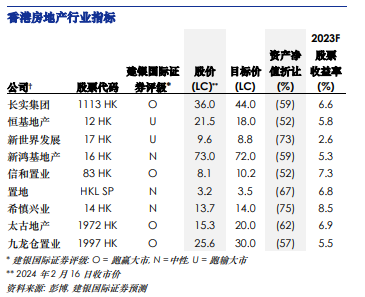

The bank favors asset-light real estate companies. The stock price performance of Hong Kong real estate developers and leaseholders is highly correlated with the Hang Seng Index. Investors tend to avoid real estate companies with more land storage, more office assets, and more assets in mainland China. The bank's stock selection ranking also favors asset-light real estate companies, preferring Changshi (01113) and Sino (00083), with leased shares including Lingzhan (00823), Swire Properties (01972), Land Land and Hessen (00014), followed by SHKP (00016) and Henderson (00012), which have the highest land reserves, and finally Shinsekai (00017), which has the highest debt ratio.