Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. For example, EyePoint Pharmaceuticals, Inc. (NASDAQ:EYPT) has generated a beautiful 700% return in just a single year. Also pleasing for shareholders was the 372% gain in the last three months. It is also impressive that the stock is up 141% over three years, adding to the sense that it is a real winner. We love happy stories like this one. The company should be really proud of that performance!

Since the long term performance has been good but there's been a recent pullback of 4.5%, let's check if the fundamentals match the share price.

Because EyePoint Pharmaceuticals made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

EyePoint Pharmaceuticals grew its revenue by 0.3% last year. That's not great considering the company is losing money. So it's truly surprising that the share price rocketed 700% in a single year. We're happy that investors have made money, but we can't help questioning whether the rise is sustainable. It just goes to show that big money can be made if you buy the right stock early.

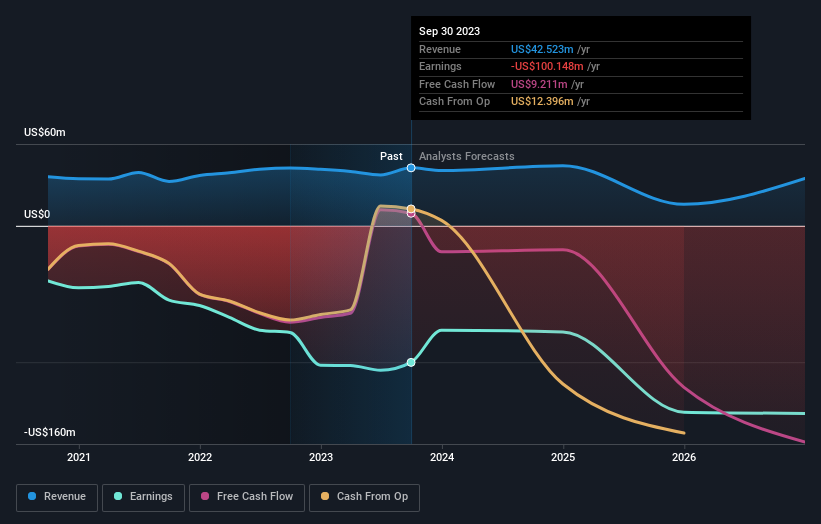

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on EyePoint Pharmaceuticals

A Different Perspective

We're pleased to report that EyePoint Pharmaceuticals shareholders have received a total shareholder return of 700% over one year. That gain is better than the annual TSR over five years, which is 2%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for EyePoint Pharmaceuticals (of which 1 is significant!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.