Caribou Biosciences, Inc. (NASDAQ:CRBU) shares have continued their recent momentum with a 25% gain in the last month alone. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

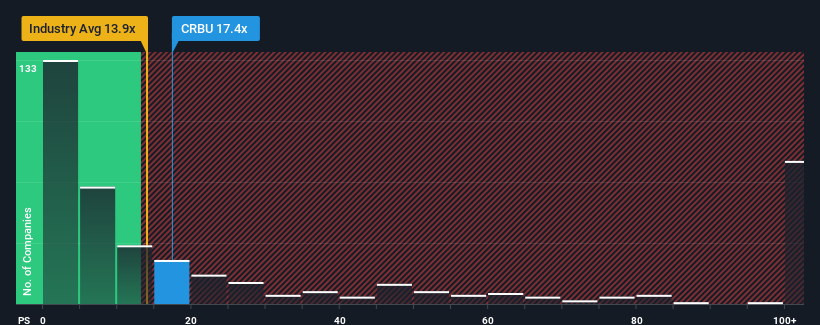

After such a large jump in price, Caribou Biosciences may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 17.4x, since almost half of all companies in the Biotechs in the United States have P/S ratios under 13.9x and even P/S lower than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

What Does Caribou Biosciences' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Caribou Biosciences has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Caribou Biosciences.How Is Caribou Biosciences' Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Caribou Biosciences' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 172%. Pleasingly, revenue has also lifted 180% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 2.8% each year during the coming three years according to the nine analysts following the company. With the industry predicted to deliver 250% growth per annum, that's a disappointing outcome.

With this information, we find it concerning that Caribou Biosciences is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Caribou Biosciences shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

For a company with revenues that are set to decline in the context of a growing industry, Caribou Biosciences' P/S is much higher than we would've anticipated. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 4 warning signs for Caribou Biosciences (1 can't be ignored!) that we have uncovered.

If you're unsure about the strength of Caribou Biosciences' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.