You can invest in an index fund if you want to make sure your returns approximately match the overall market. But in any given year a good portion of stocks will fall short of that. The Wuxi Taiji Industry Limited Corporation (SHSE:600667) is such an example; over three years its share price is down 33% versus a marketdecline of 28%. Shareholders have had an even rougher run lately, with the share price down 15% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 13% in the same timeframe.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Wuxi Taiji Industry Limited became profitable within the last five years. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

Revenue is actually up 30% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Wuxi Taiji Industry Limited more closely, as sometimes stocks fall unfairly. This could present an opportunity.

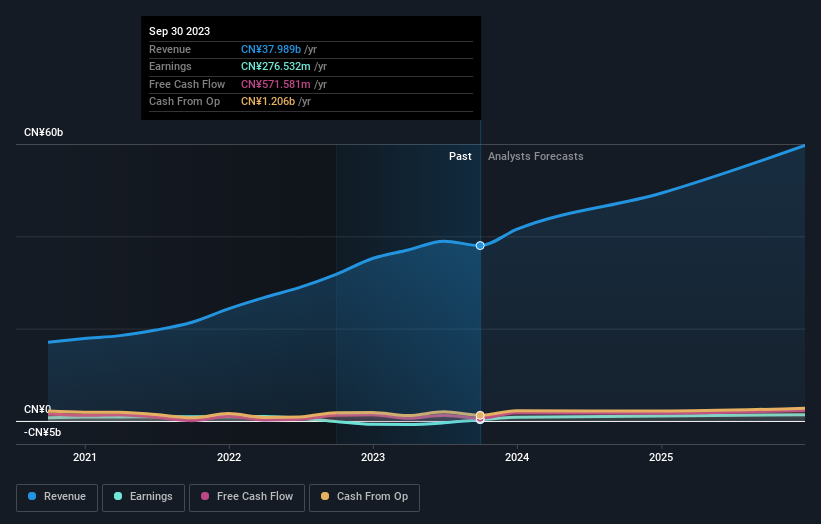

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So we recommend checking out this free report showing consensus forecasts

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Wuxi Taiji Industry Limited's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Wuxi Taiji Industry Limited's TSR of was a loss of 30% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Although it hurts that Wuxi Taiji Industry Limited returned a loss of 0.9% in the last twelve months, the broader market was actually worse, returning a loss of 22%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 0.3% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. Is Wuxi Taiji Industry Limited cheap compared to other companies? These 3 valuation measures might help you decide.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.