Beam Global (NASDAQ:BEEM) shares have had a really impressive month, gaining 27% after a shaky period beforehand. But the last month did very little to improve the 57% share price decline over the last year.

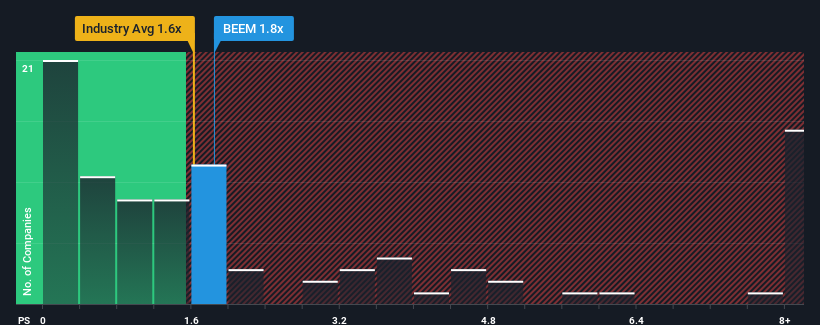

Although its price has surged higher, there still wouldn't be many who think Beam Global's price-to-sales (or "P/S") ratio of 1.8x is worth a mention when the median P/S in the United States' Electrical industry is similar at about 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Beam Global Has Been Performing

With revenue growth that's superior to most other companies of late, Beam Global has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Beam Global's future stacks up against the industry? In that case, our free report is a great place to start.How Is Beam Global's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Beam Global's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 214%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 33% each year as estimated by the five analysts watching the company. With the industry predicted to deliver 45% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Beam Global is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Beam Global's P/S?

Beam Global appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

When you consider that Beam Global's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Having said that, be aware Beam Global is showing 3 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Beam Global, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.