Jiangxi Black Cat Carbon Black Inc.,Ltd (SZSE:002068) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

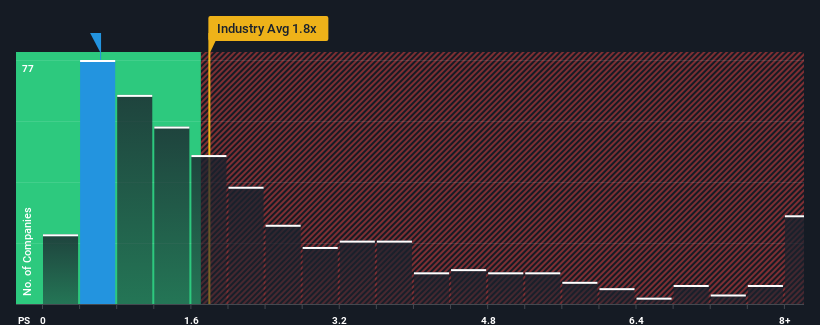

Since its price has dipped substantially, Jiangxi Black Cat Carbon BlackLtd's price-to-sales (or "P/S") ratio of 0.6x might make it look like a buy right now compared to the Chemicals industry in China, where around half of the companies have P/S ratios above 1.8x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Jiangxi Black Cat Carbon BlackLtd's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Jiangxi Black Cat Carbon BlackLtd's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Jiangxi Black Cat Carbon BlackLtd's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Jiangxi Black Cat Carbon BlackLtd's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 77% in total over the last three years. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the dual analysts following the company. That's shaping up to be materially lower than the 26% growth forecast for the broader industry.

With this in consideration, its clear as to why Jiangxi Black Cat Carbon BlackLtd's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Jiangxi Black Cat Carbon BlackLtd's P/S

Jiangxi Black Cat Carbon BlackLtd's recently weak share price has pulled its P/S back below other Chemicals companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Jiangxi Black Cat Carbon BlackLtd maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Having said that, be aware Jiangxi Black Cat Carbon BlackLtd is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Jiangxi Black Cat Carbon BlackLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.