Advanced Fiber Resources (Zhuhai), Ltd. (SZSE:300620) shareholders might be concerned after seeing the share price drop 11% in the last quarter. In contrast, the return over three years has been impressive. The share price marched upwards over that time, and is now 141% higher than it was. To some, the recent share price pullback wouldn't be surprising after such a good run. The thing to consider is whether the underlying business is doing well enough to support the current price.

The past week has proven to be lucrative for Advanced Fiber Resources (Zhuhai) investors, so let's see if fundamentals drove the company's three-year performance.

We don't think that Advanced Fiber Resources (Zhuhai)'s modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last three years Advanced Fiber Resources (Zhuhai) has grown its revenue at 9.9% annually. That's a very respectable growth rate. It's fair to say that the market has acknowledged the growth by pushing the share price up 34% per year. It's hard to value pre-profit businesses, but it seems like the market has become a lot more optimistic about this one! Some investors like to buy in just after a company becomes profitable, since that can be a powerful inflexion point.

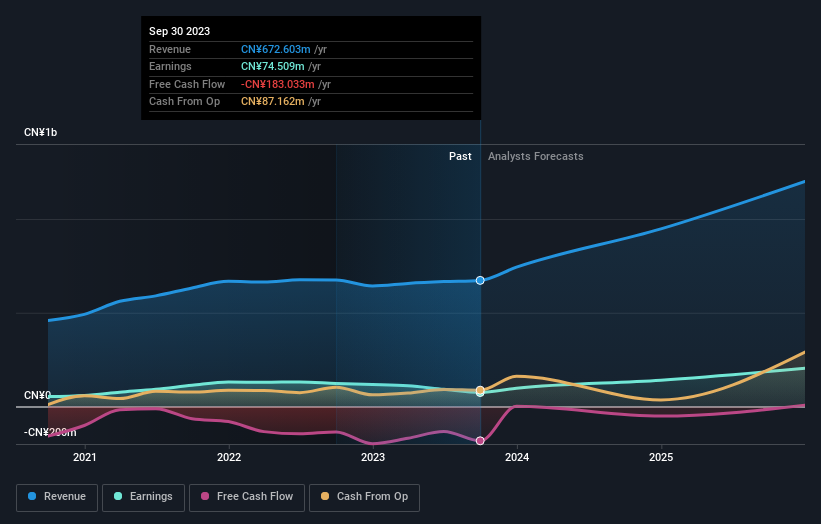

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Advanced Fiber Resources (Zhuhai) stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Advanced Fiber Resources (Zhuhai)'s TSR for the last 3 years was 145%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Advanced Fiber Resources (Zhuhai) shareholders have received a total shareholder return of 28% over the last year. That's including the dividend. That gain is better than the annual TSR over five years, which is 18%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Advanced Fiber Resources (Zhuhai) has 3 warning signs (and 2 which can't be ignored) we think you should know about.

But note: Advanced Fiber Resources (Zhuhai) may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.