To the annoyance of some shareholders, Cherish Sunshine International Limited (HKG:1094) shares are down a considerable 28% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 41% in that time.

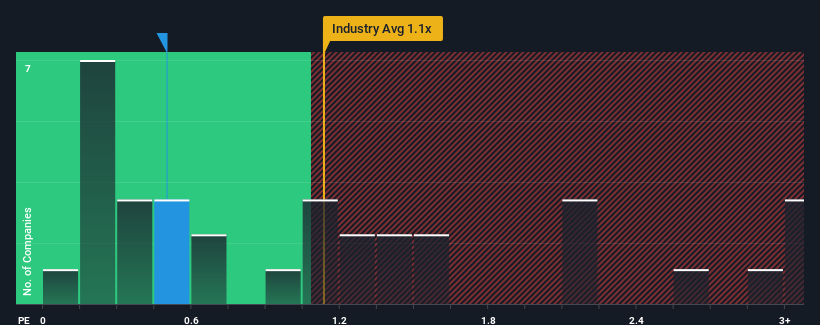

In spite of the heavy fall in price, given about half the companies operating in Hong Kong's IT industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider Cherish Sunshine International as an attractive investment with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Cherish Sunshine International's Recent Performance Look Like?

Recent times have been quite advantageous for Cherish Sunshine International as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. Those who are bullish on Cherish Sunshine International will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Cherish Sunshine International will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Cherish Sunshine International?

Cherish Sunshine International's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 111% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 10% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Cherish Sunshine International's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Cherish Sunshine International's P/S?

The southerly movements of Cherish Sunshine International's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Cherish Sunshine International currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Cherish Sunshine International (2 are a bit concerning!) that you should be aware of before investing here.

If you're unsure about the strength of Cherish Sunshine International's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.