As an investor, mistakes are inevitable. But you have a problem if you face massive losses more than once in a while. So consider, for a moment, the misfortune of Milkyway Chemical Supply Chain Service Co.,Ltd (SHSE:603713) investors who have held the stock for three years as it declined a whopping 74%. That would certainly shake our confidence in the decision to own the stock. The more recent news is of little comfort, with the share price down 70% in a year. Furthermore, it's down 44% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 21% decline in the broader market, throughout the period.

Since Milkyway Chemical Supply Chain ServiceLtd has shed CN¥1.2b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Although the share price is down over three years, Milkyway Chemical Supply Chain ServiceLtd actually managed to grow EPS by 24% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

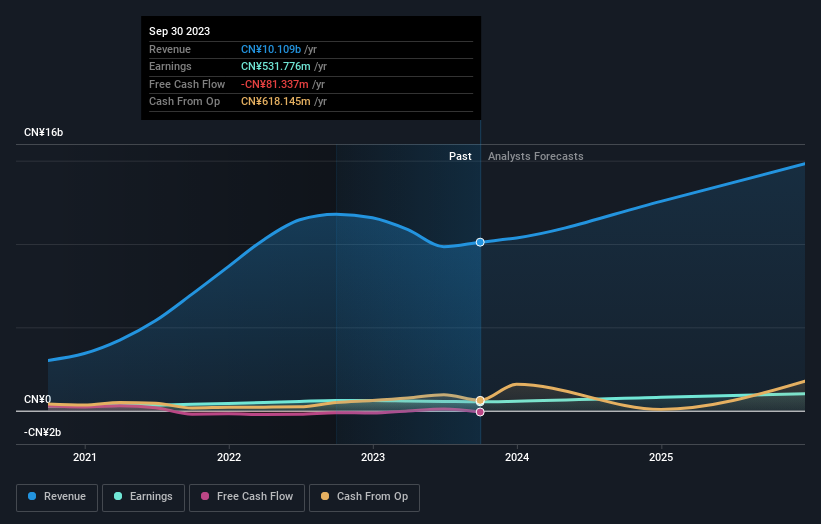

The modest 1.5% dividend yield is unlikely to be guiding the market view of the stock. Revenue is actually up 35% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Milkyway Chemical Supply Chain ServiceLtd more closely, as sometimes stocks fall unfairly. This could present an opportunity.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Milkyway Chemical Supply Chain ServiceLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market lost about 28% in the twelve months, Milkyway Chemical Supply Chain ServiceLtd shareholders did even worse, losing 70% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 1.8% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Milkyway Chemical Supply Chain ServiceLtd better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Milkyway Chemical Supply Chain ServiceLtd you should be aware of, and 1 of them is concerning.

Of course Milkyway Chemical Supply Chain ServiceLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.