Everweft lithium becomes a beneficiary in the price war

On the evening of February 5, Everweft Lithium Energy, a leading second-tier power battery manufacturer, announced its 2023 performance forecast. Net profit attributable to shareholders of listed companies maintained positive year-on-year growth. Although not as good as the leading manufacturer Ningde Era, it is still relatively superior to second-tier and third-tier battery companies that lost money throughout the year, such as Funeng Technology.

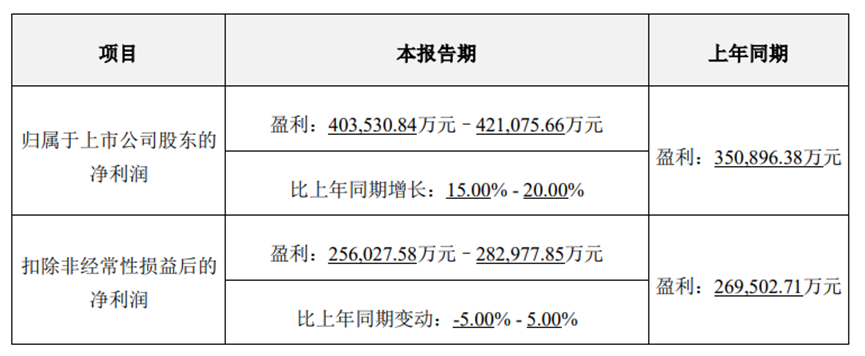

In 2023, Everweft Lithium achieved net profit attributable to shareholders of listed companies of 4,035 billion yuan - 4.211 billion yuan, a year-on-year increase of 15% to 20%; deducted non-net profit of 2.56 billion yuan to 2.83 billion yuan, a year-on-year change of -5%-5%.

In the fourth quarter of 2023, Everweft Lithium achieved net profit attributable to shareholders of listed companies of 611 million yuan to 787 million yuan, a year-on-month decrease of 38%-52%, a year-on-year decrease of 6.6%-27.5%; deducted non-net profit of 405 million yuan to 675 million yuan, a year-on-month decrease of 25% to 55%, a year-on-year change of -21.8%-30%.

1. Market share at home and abroad is growing at the same time, but the impact of the price war will continue to have an impact

In the fierce competition in the power battery market, it is not just tail power battery companies that are under pressure; “cold air” has spread to second- and third-tier power battery manufacturers. Take second-tier power battery manufacturer Funeng Technology as an example. Not only did the domestic market share drop by 0.29 percentage points in 2023, but losses are also expected for the whole year.

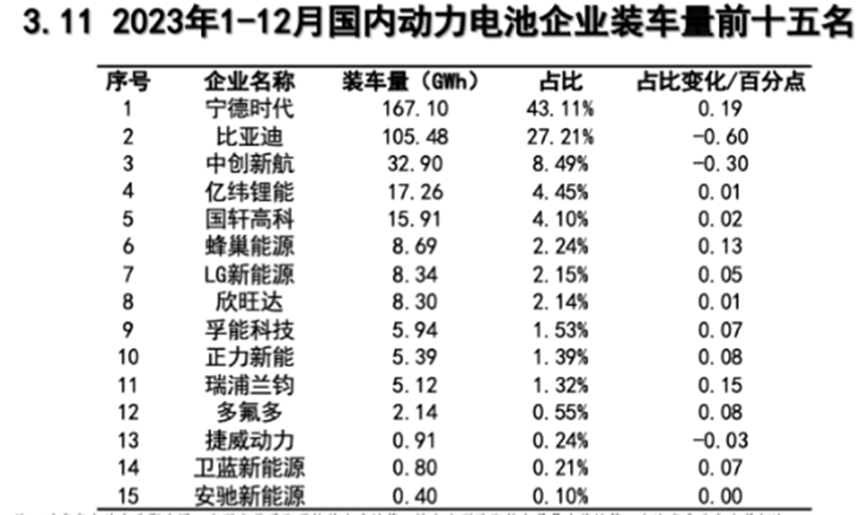

In this context, Everweft Lithium Energy has achieved a simultaneous increase in power battery market share at home and abroad. In 2023, Everweft Lithium Energy's domestic power battery installed capacity reached 17.26 GWH, ranking fourth; with a year-on-year increase of 140%, ranking first in growth rate; its market share increased 2.01 percentage points to 4.45%, second only to BYD.

In terms of the global market, Everweft Lithium Energy entered the top ten global power battery installed capacity list for the first time. From January to November 2023, the global installed capacity reached 13.4 GWh, a year-on-year increase of 131.9%, the highest installed capacity growth rate of the top ten power battery manufacturers, and its market share also increased 0.8 percentage points to 2.1%.

However, it is worth noting that although Everweft Lithium's power battery installed capacity will grow by three digits year on year in 2023, the net profit growth rate is only 15% to 20%. According to Wall Street News and Insight Research, apart from the negative effects caused by the decline in investment returns led by Smore (Everweft Lithium's investment income fell sharply by 48.75% to 448 million yuan in the first three quarters of 2023), the impact of the year-long power battery price war on the profitability of Everweft Lithium Energy cannot be ignored.

Throughout 2023, the prices of square lithium iron phosphate cells (power type) and square ternary lithium batteries (power type) dropped from 0.99 yuan/Wh and 1.1 yuan/Wh at the beginning of the year to 0.44 yuan/Wh and 0.5 yuan/Wh at the end of the year, respectively. The price drops reached 56% and 54%, respectively. The impact of the battery price reduction gradually became apparent

Although the decline in the price of lithium carbonate as a raw material can reduce the cost pressure on 100 million weft lithium energy to a certain extent, it is difficult to make up for the price reduction of 100 million weft lithium energy for terminal new energy vehicle companies. Fortunately, the current battery price is close to 0.4 yuan/Wh. This is also the cost line for many second- and third-tier power battery manufacturers, and there is not much room for subsequent cell price reductions.

2. Large cylindrical batteries are finally loaded and are expected to become the main incremental force of Everweft Lithium Energy in the future

Earlier, new energy vehicle companies such as Tesla and BMW all expressed their preference for 4680 and 4695 large cylindrical batteries. Everweft Lithium Energy is also gradually shifting its focus from the three technology routes of soft pack batteries, square batteries, and cylindrical batteries to research and development of large cylindrical batteries. In terms of production capacity, the planned production capacity of 100 million weft lithium large cylindrical batteries will exceed 100 GWh by 2025.

In 2023, Everweft Lithium Energy's domestic 46 series high specific energy large cylindrical battery production line was successfully built. Up to now, a large cylindrical battery factory with an annual production capacity of 20 GWh of Everweft Lithium has been built at the Jingmen base. The first phase of the second phase of equipment has also begun to enter the market at the end of 2023. More than 5.3 million 46 series large cylindrical batteries have been brought offline, and commercial delivery and application have been officially realized.

Furthermore, on January 31 of this year, Everweft Lithium also officially installed 46 series large cylindrical batteries on the JAC Ruifeng RF8 model, achieving the goal of charging for one quarter hour and a battery life of 100 kilometers.

As of 2023, Everweft Lithium Energy's cylindrical lithium iron phosphate batteries have obtained a total customer demand of about 88 GWh in the next 5 years, and ternary large cylindrical batteries have also obtained a total customer demand of about 392 GWh over the next 5 years.

Everweft Lithium Energy's many years of investment in R&D and production capacity for large cylindrical batteries has finally paid off today. In the future, large cylindrical batteries are expected to become the main incremental force in the installed capacity of Everweft lithium power batteries.