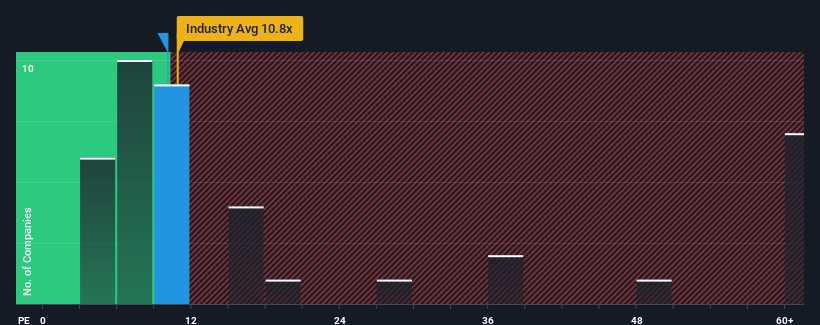

With a price-to-earnings (or "P/E") ratio of 10.1x Shanxi Blue Flame Holding Company Limited (SZSE:000968) may be sending very bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 27x and even P/E's higher than 48x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

There hasn't been much to differentiate Shanxi Blue Flame Holding's and the market's retreating earnings lately. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

How Is Shanxi Blue Flame Holding's Growth Trending?

Shanxi Blue Flame Holding's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 84% overall rise in EPS, in spite of its uninspiring short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 31% during the coming year according to the lone analyst following the company. That's shaping up to be materially lower than the 41% growth forecast for the broader market.

In light of this, it's understandable that Shanxi Blue Flame Holding's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shanxi Blue Flame Holding maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Shanxi Blue Flame Holding, and understanding should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.