Yang Guang Co.,Ltd. (SZSE:000608) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 32% in that time.

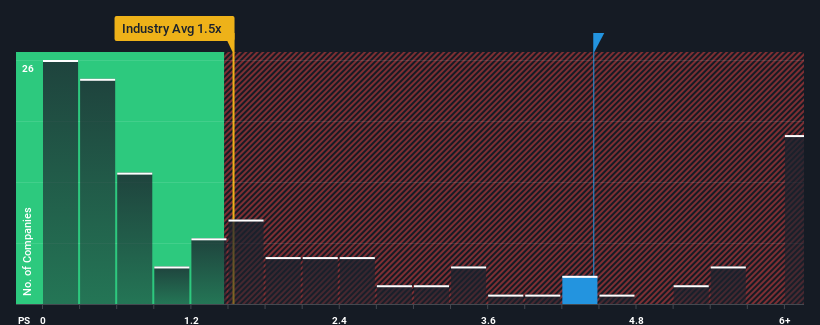

Even after such a large drop in price, given around half the companies in China's Real Estate industry have price-to-sales ratios (or "P/S") below 1.5x, you may still consider Yang GuangLtd as a stock to avoid entirely with its 4.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Has Yang GuangLtd Performed Recently?

As an illustration, revenue has deteriorated at Yang GuangLtd over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Yang GuangLtd will help you shine a light on its historical performance.How Is Yang GuangLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Yang GuangLtd would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 34%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 72% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 9.7% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Yang GuangLtd's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

Even after such a strong price drop, Yang GuangLtd's P/S still exceeds the industry median significantly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Yang GuangLtd revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for Yang GuangLtd (1 doesn't sit too well with us!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.